New CPF Life plan with payouts increasing over time proposed

SINGAPORE — A new annuity plan that increases payouts as one ages has been proposed as an additional option under the Central Provident Fund (CPF) Life scheme, which some members felt was lacking in covering inflation.

SINGAPORE — A new annuity plan that increases payouts as one ages has been proposed as an additional option under the Central Provident Fund (CPF) Life scheme, which some members felt was lacking in covering inflation.

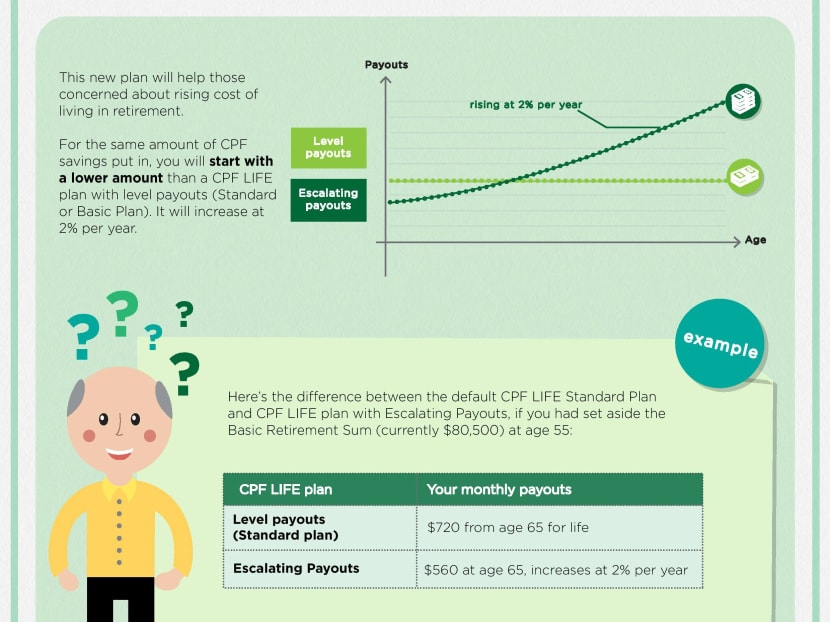

By increasing payouts at a fixed rate of 2 per cent every year for the rest of a CPF member’s life, the advisory panel behind the idea said it would maintain purchasing power — going by 20- and 30-year average inflation rates here. But the caveat is that starting payouts would be about 20 per cent lower than the existing default CPF Life plan.

CPF Life is an annuity scheme that provides lifelong monthly payouts from age 65. The two existing plans — Standard, which is the default; and Basic — give payouts that remain constant. Standard gives higher monthly payouts and a lower bequest and vice versa for Basic.

Members can avoid the lower initial payouts by either topping up their CPF Life premiums, or by delaying the age they start receiving the payouts, up till age 70.

(click on image to expand)

Coming up with an escalating payout structure to help CPF members keep up with rising costs of living was one of the four areas a 13-member advisory panel was tasked to look into. The panel had given its recommendations for two areas previously and yesterday unveiled their proposals for the remaining areas.

The panel had deliberated over the possibility of a plan that was fully indexed to inflation but it concluded that such a structure could mean “less certainty to members on their future stream of payouts as the quantum of annual increases would fluctuate from year to year”.

Some members might also not be able to accept a lower payout when there is deflation or when costs of living go down, they added.

Conversely, a fixed increment rate for payouts would give members more certainty without compromising the objective of maintaining purchasing power, the panel said.

It added that it came up with the 2 per cent increment rate because it was in line with the historical 20- and 30-year average inflation rate, which gives a better estimate of long-term inflation trends. There was no major difference across various inflation measures — core, headline and headline excluding owner-occupied accommodation.

Recognising that the long-term inflation rate could change in the future, the panel said the payout escalation rate and payouts for future cohorts can be reviewed periodically.

The panel was asked if their proposed plan adequately addresses the issue of inflation protection, given that those who need help with inflation would have to accept a lower starting payout and wait about 25 years before they pocket a cumulative payout equivalent to those who took up the Standard plan.

In response, panel member Colin Pakshong, who is an independent actuarial consultant, said it was “constrained by simple mathematics”.

CPF members will have to decide themselves if they can accept the trade-off, he added, noting that it was not within the panel’s purview to suggest if the Government, in lieu of the smaller starting sums, should step in with subsidies.

Commenting on the proposal, SIM University economist Walter Theseira agreed with the approach, saying: “Pegging payouts to inflation means increased risk or variability, which someone has to pay for.

Either the CPF member pays for it through lower initial payouts, or the public has to pay for it through promising a subsidy.”

He added: “Basically, the problem is there’s no free lunch with retirement savings, you can’t make money out of nothing.”

Associate Professor Chia Ngee Choon from the National University of Singapore also noted that inflation-indexed products are typically more costly, with research showing that in the case of annuity plans, premiums are 30 per cent higher.

“By fixing a 2 per cent increment, it would help address inflation risk while not increasing premiums,” he added.

Mosque manager Salamah Abdoll, 55, said she did not mind the lower starting payouts as she intends to work for “as long as (she) can”.

Since she might have to deal with medical bills and heftier expenses when she gets older, the bigger payouts then would come in handy, the mother of four added. ADDITIONAL REPORTING BY VALERIE KOH