New scam targeting bank customers has cost victims S$65,000 so far: Police

SINGAPORE — Scammers targeting bank customers here have fleeced victims of at least S$65,000, the Singapore Police Force (SPF) warned on Monday (Nov 25).

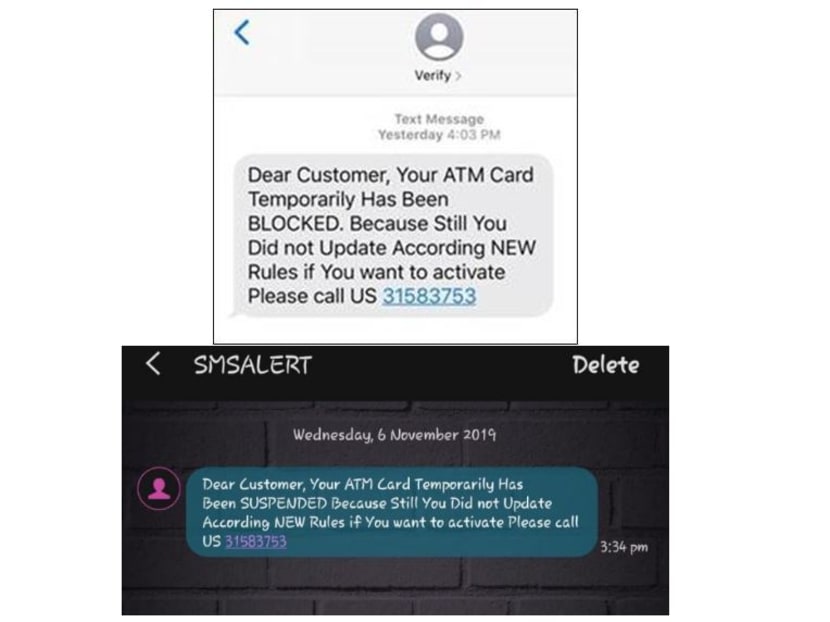

Victims of the scam would receive an SMS message, which claimed that either their ATM card has been blocked or deactivated, or that their bank account has been locked, the police said.

SINGAPORE — Scammers targeting bank customers here have fleeced victims of at least S$65,000, the Singapore Police Force (SPF) warned on Monday (Nov 25).

In an advisory, the police said that they have received at least 12 reports of a new variant of a scam trying to trick bank customers since the start of the month.

Victims of the scam would receive an SMS message, which claimed that either their ATM card has been blocked or deactivated, or that their bank account has been locked, the police said.

The message also informed the victims to call a specified number to reactivate their ATM card or bank account.

During the telephone conversation, the police said that the scammers would claim to be the staff of the bank and would ask for the victims’ personal particulars, internet banking details and their one-time password (OTP).

“The victims subsequently discovered that unauthorised transactions were made from their bank accounts,” the police said.

*TODAY's WhatsApp news service will cease from November 30, 2019.

The police advised the public to adopt the following crime prevention measures:

- Beware of unsolicited messages or calls from persons impersonating staff from banks. Scammers may use caller ID spoofing technology to mask their actual phone number and display the bank’s number instead.

- Do not disclose your internet banking details such as account user name, personal identification number (PIN) or OTP to anyone through phone, email or SMS.

- Do not respond to digital token authentication requests via phone calls if you did not initiate any internet banking transaction. Do not authorise any suspicious authentication request.

- If you receive a suspicious call purportedly from your bank, hang up and call the hotline published on the bank’s website to verify the authenticity of the request. Do not call the number provided by the caller.

Those who wish to provide information on such scams can call the police hotline at 1800-255-0000 or submit a report online at www.police.gov.sg/iwitness.