OCBC digital banking, payment services restored after 2.5-hour disruption due to 'technical issues'

SINGAPORE — Some customers were unable to use OCBC's app and PayNow service on Tuesday (Nov 7), with the bank citing "intermittent slowness".

SINGAPORE — Fund transfers and PayNow services on OCBC's app and internet banking platform have been restored after a two-and-a-half hour outage on Tuesday (Nov 7).

In response to queries, OCBC said it faced "technical issues" at around noon.

"These services were restored at about 2.30pm. We apologise for the inconvenience caused and thank our customers for their patience," said OCBC.

The bank earlier cited "intermittent technical issues" in a Facebook post about the disruption to its digital services.

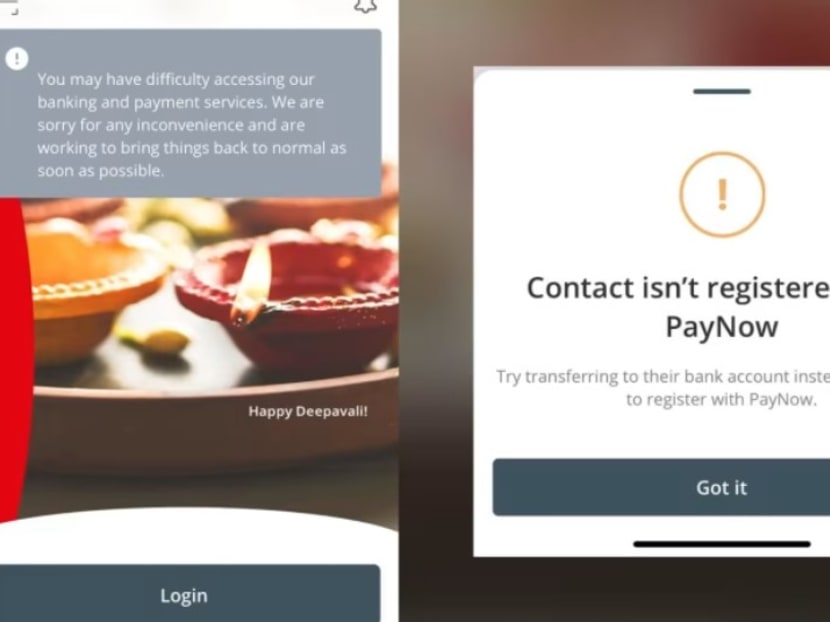

OCBC also acknowledged the issue on its app in a notice on its login page.

"You may have difficulty accessing our banking and payment services. We are sorry for any inconvenience and are working to bring things back to normal as soon as possible," it said.

For some users who attempted to make a PayNow transfer, they were unable to select a recipient to proceed with the payment with a notification saying that their chosen contact was not registered with the service.

"We sincerely apologise for any inconvenience caused. There appears to be an intermittent slowness, please try accessing it again at a later time, thank you," the bank said in response to some complaints on its Facebook page.

For some users who attempted to make a PayNow transfer, they were unable to select a recipient to proceed with the payment with a notification saying that their chosen contact was not registered with the service.

"OCBC digital banking seems to be down again? Can’t open the app and Pay Anyone now decommissioned," said Facebook user Joe Sin, in reference to the bank's recently discontinued standalone payments app.

Facebook user Gary Liew said the SMS one-time passcode (OTP) was not working for him.

The lunchtime service disruption on Tuesday was the latest in a string of separate digital banking disruptions or service outages this year.

Connectivity issues caused NETS-related services to go down briefly on Nov 3, with some users having problems with their payments not reflecting or being charged multiple times.

DBS and Citibank were hit by an hours-long outage on Oct 14, affecting online banking and payment services. It was said in parliament that these disruptions prevented about 2.5 million payment and ATM transactions from being completed.

DBS itself has suffered multiple service disruptions this year, with a day-long service outage in March and digital banking services and ATMs also going down in May.

OCBC suffered a morning outage on Aug 28 due to a “technical problem”. The affected services included its internet and mobile banking platforms, PayNow, ATMs, cards and Velocity, the bank's digital business banking platform. with CNA

For more reports like this, visit cna.asia.