Overall retail sales in Singapore plummet 13.3% in March, biggest slump since 1998

SINGAPORE — Overall retail sales in Singapore continued to drop, falling by 13.3 per cent in March from the same month last year and making this one of the worst declines since 1998. Just the month before, the year-on-year drop for February was 8.6 per cent.

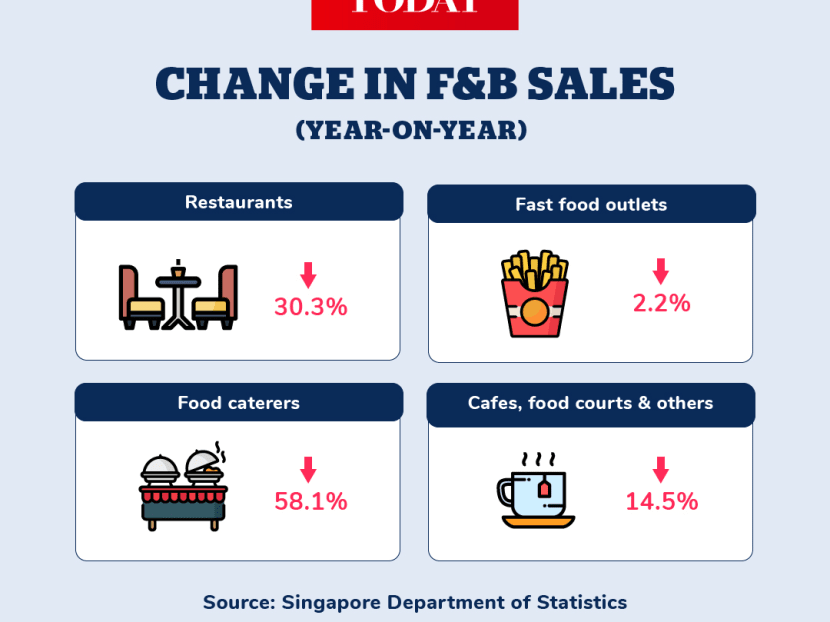

Apart from food caterers and restaurants doing badly in sales, cafes, food courts and other eating places also saw sales drop 14.5 per cent this March compared with last March.

SINGAPORE — Overall retail sales in Singapore continued to drop, falling by 13.3 per cent in March from the same month last year and making this one of the worst declines since 1998. Just the month before, the year-on-year drop for February was 8.6 per cent.

During the Asian Financial Crisis, there was a 16.9 per cent year-on-year drop in retail sales in September 1998.

Commenting on the latest figures released by the Department of Statistics Singapore on Tuesday (May 5), Mr Barnabas Gan, an economist with United Overseas Bank (UOB), said: “It may get worse than the Asian Financial Crisis... No one knows how protracted and severe the Covid-19 pandemic is going to be, and exactly what degree of long-term impact it will have on the economy.”

The Department of Statistics said the decline is due to weaker domestic consumption and fewer tourist arrivals. Travel and stay-home restrictions as well as limits on business activities have been in force in recent months and as part of the circuit breaker due to the pandemic.

Excluding motor vehicles, retail sales fell 9.7 per cent this March compared with last March.

Significantly, total food-and-beverage (F&B) sales tumbled by 23.7 per cent in March compared with the same period last year, with food caterers seeing a slash of 58.1 per cent and restaurants, 30.3 per cent.

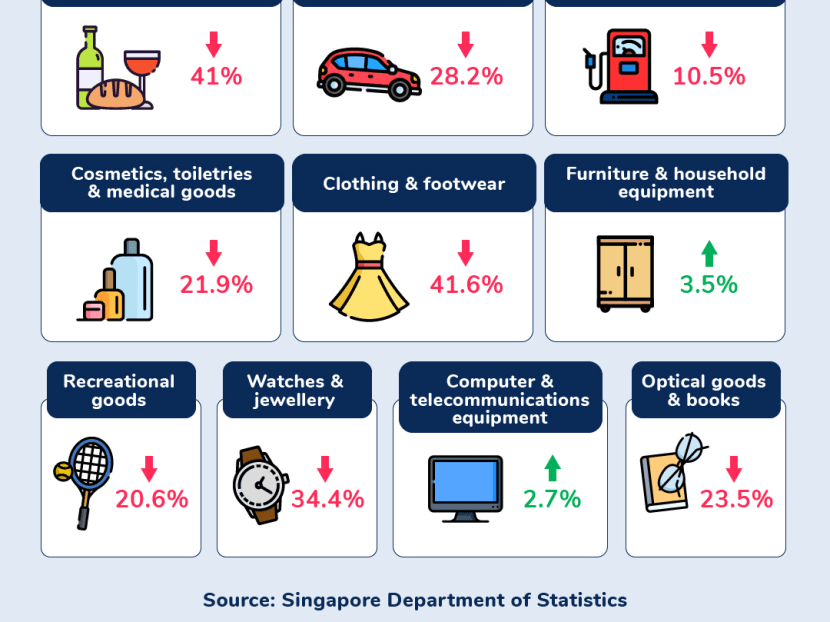

The retailers that saw some of the largest declines in sales for March were:

Wearing apparel and footwear: 41.6 per cent drop compared with March last year; 6.7 per cent compared with February this year.

Food and alcohol: 41 per cent drop compared with March last year; 21.6 per cent compared with February this year.

Department stores: 38.6 per cent drop compared with March last year; 7.2 per cent compared with February this year.

Watches and jewellery: 34.4 per cent drop compared with March last year; 10.3 per cent compared with February this year.

Motor vehicles: 28.2 per cent drop compared with March last year; 16.4 per cent compared with February this year

Although all F&B sales shrank, some segments were hit harder than others. Apart from food caterers and restaurants doing badly, cafes, food courts and other eating places saw sales drop 14.5 per cent this March compared with last March. For fast-food outlets, sales slipped 2.2 per cent for the same period.

However, as it was in February, supermarkets and hypermarkets were among the few retailers that enjoyed gains in March, with sales rising by 35.9 per cent compared with last March.

Economists told TODAY that these figures are just a “telltale sign” of sharper declines for the retail industry in April and May, as they begin to reflect the effects of the circuit breaker introduced on April 7.

Mr Gan said the decline in department store sales was led by a drop in demand for discretionary goods such as footwear, watches and jewellery in favour of essential items such as groceries.

Mr Irvin Seah, an economist with DBS bank, also said that this trend could continue well after stay-home measures are eased.

“Even after the circuit breaker is lifted, people will be worried about job security, so there will be some delay in the purchase of big-ticket items like automobiles,” he said.

Mr Seah added that this gap between demand for essential goods and that of discretionary items would likely become more distinct in the coming months, as consumers look to curb their spending further.

He observed a likely connection between March’s increase in supermarket sales and the decline in spending at F&B outlets.

“Essentially, when people stop going out to the restaurants to dine, they have to buy more groceries to cook at home.”

Ms Selena Ling, head of treasury research and strategy at OCBC bank, said that the higher supermarket sales could also be due to shoppers stockpiling groceries and household items in anticipation of the containment measures.

She also attributed the increase in electronics and furniture sales to work-from-home arrangements and more Singaporeans planning to stay indoors in March.

“The increase in furniture sales could be from both electrical goods such as mini-fridges and freezers, and home-office furniture such as work tables or office chairs.

“Electronic sales were also probably boosted by a spike in consumer demand for computers, laptops, monitors and headsets for work-from-home arrangements, and Nintendo Switch sales for recreational pastimes,” she added.

Mr Song Seng Wun, an economist with CIMB Private Banking, said that overall retail and F&B sales will decline sharply in the next few months, but online sales will make up a larger proportion of total spending in April and May as businesses shift towards e-commerce.

“It’s all about survival. The shops are closed, so the only way to generate revenue growth is to go online,” he said.

The estimated total retail sales value in March was about S$3.3 billion, with online retail sales making up an estimated 8.5 per cent.

Computer and telecommunications equipment took the highest share of online sales, making up 41.2 per cent of the total earnings for that industry. Furniture and household equipment made up 16.5 per cent, while supermarkets and hypermarkets made up 7.5 per cent of the total sales of their industries.