Police warn of stock market manipulation scams resurfacing; more than S$1.45m lost in recent spate of cases

SINGAPORE — The police have warned the public to be wary of stock market manipulation scams where victims are fooled into buying a listed company’s stock at artificially high prices.

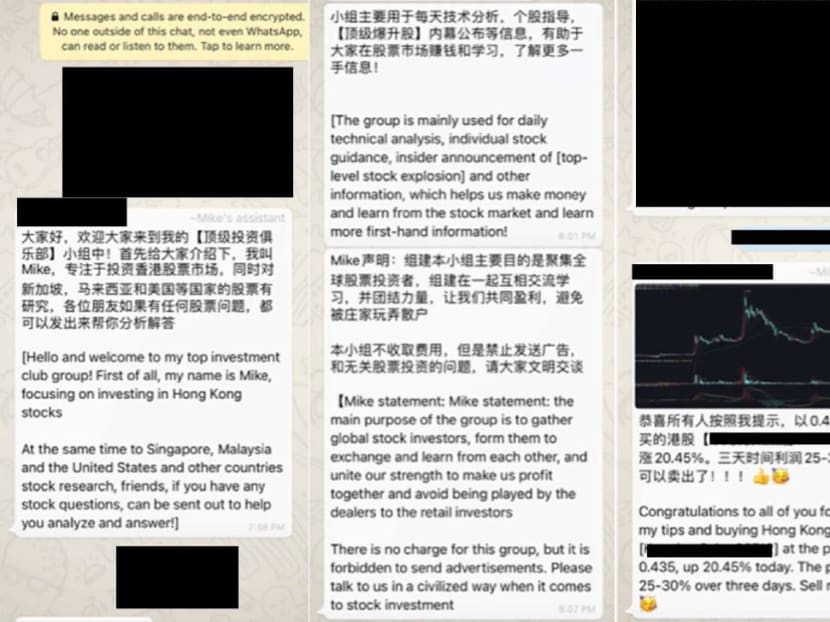

An example of a chat group set up by scammers, where they identify themselves to their victims as either investment gurus or share trading experts.

SINGAPORE — The police have warned the public to be wary of stock market manipulation scams where victims are fooled into buying a listed company’s stock at artificially high prices.

In a statement on Wednesday (Aug 11), the police said such “pump and dump” schemes were resurfacing here, highlighting a recent spate of cases involving seven victims who had bought more than 49,000 shares in a United States-listed company based on the recommendations of a so-called expert.

Within two days, the share price plunged by almost 80 per cent, and the victims lost a total of more than US$1.07 million (S$1.45 million).

Fraudsters behind such schemes attempt to artificially inflate the market price of a stock by “spreading false positive news about the company, or creating an appearance of trading activity in order to induce others to buy the shares”, the police said.

The fraudsters would then sell their shares in the company while the price is high, before stopping the manipulation. The resulting price plunge causes losses for the victims.

In most instances, victims were approached by strangers offering stock recommendations on social media, or invited to join online chat groups on platforms such as WhatsApp and WeChat to discuss coordinated share purchases.

The victims were then persuaded to purchase shares listed on either the Hong Kong or US stock exchanges.

The police said the fraudsters have two modes of operating.

The first involves using an attractive woman’s photo as a profile on either social media or instant messaging accounts as a means to initiate conversations with victims.

There is often no mention of shares in the first few conversations, until the fraudster has gained the trust of the victim.

Once trust was established, the fraudsters would say that they had insider information on certain overseas listed companies and then encourage the victims to buy shares in these companies with the promise of quick profits.

Another method involves inviting multiple victims to a chat group where the scammers claim they are either investment gurus or share trading experts.

To gain the victims’ trust, these fraudsters may first provide recommendations on certain shares which turn out to be correct.

Once trust was established, the fraudsters would then recommend another company whose share price will purportedly increase significantly in the near future, and encourage the victims in the chat group to purchase its shares immediately.

In both methods, the police said the fraudsters asked the victims to send a screenshot of their trading account transactions to show that they had indeed bought the shares.

The police believe that these fraudsters are remunerated by the scams’ masterminds based on the number of victims persuaded to buy shares, and screenshots are needed to claim their rewards.

The police had in May 2019 warned of similar “pump and dump” scams involving companies listed on the Hong Kong Stock Exchange.

Singapore Exchange Regulation had also issued an advisory in December 2020 on such activities and then followed up with a joint advisory two months later with the Monetary Authority of Singapore.

For more information on scams, members of the public can visit www.scamalert.sg or call the anti-scam hotline at 1800-722-6688.