Property cooling measures: Govt announces tighter loan rules, private home owners can't buy HDB resale flats for 15 months

SINGAPORE — In a bid to moderate demand for public housing, the authorities have announced that private property owners will now have to serve a temporary wait-out period of 15 months after selling their homes before they are allowed to buy a non-subsidised resale flat.

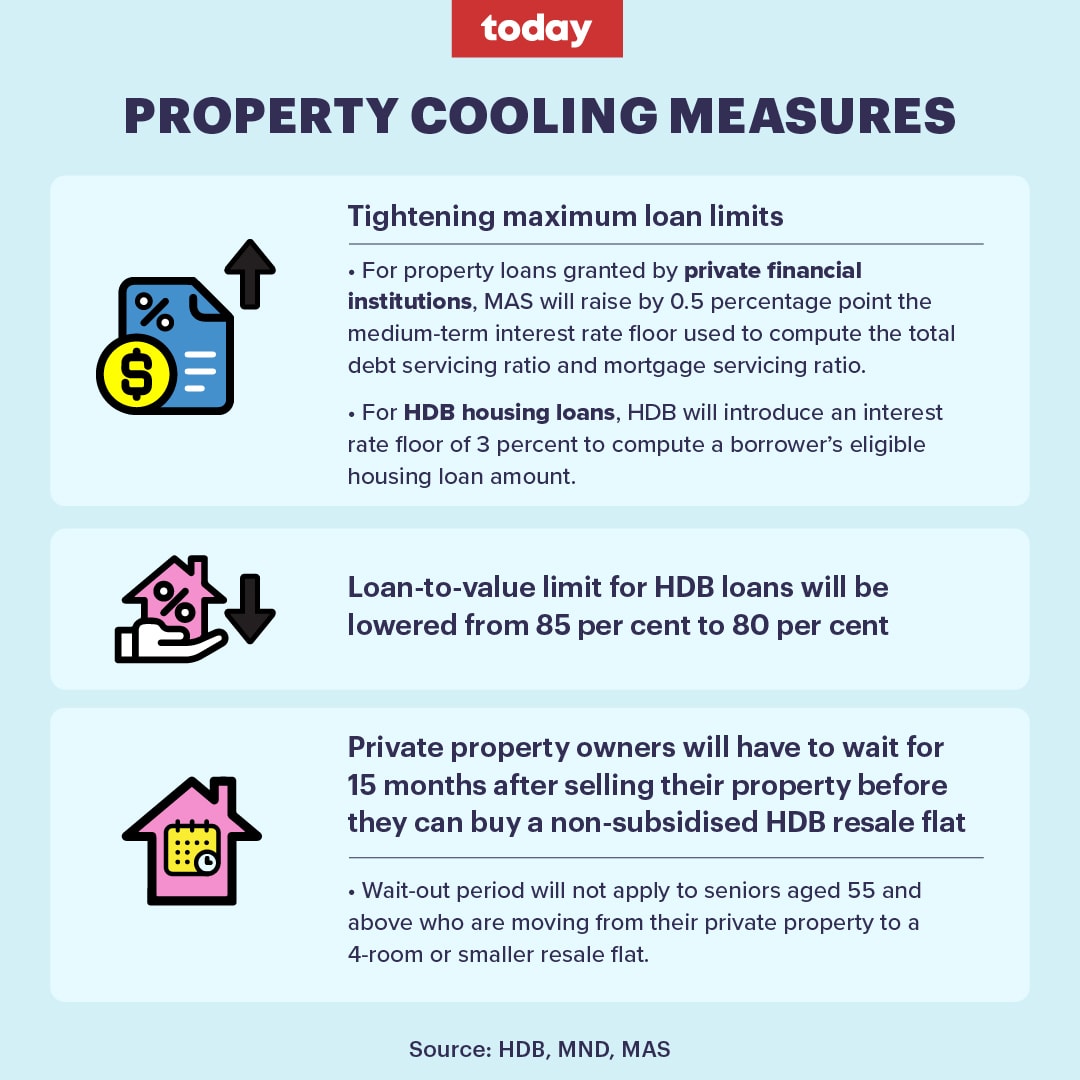

- Private property owners will now have to wait for 15 months after selling their property before they can buy a non-subsidised HDB resale flat

- The Government said this is a temporary measure to moderate demand and ensure that resale flats remain affordable for buyers

- The maximum loan amount limits for housing loans will also be tightened

- This will help buyers borrow money prudently and avoid future difficulties in repaying home loans

- The loan-to-value limit for HDB loans will also be lowered from 85 per cent to 80 per cent

SINGAPORE — In a bid to moderate demand for public housing, the authorities have announced that private property owners will now have to serve a temporary wait-out period of 15 months after selling their homes before they are allowed to buy a non-subsidised resale flat.

In addition, new rules have also been announced to tighten maximum loan amount limits, in order to promote prudent borrowing by property buyers as interest rates rise.

The loan-to-value limit for loans taken with the Housing and Development Board (HDB) will also be lowered from 85 per cent to 80 per cent. This means that the maximum loan amount HDB will lend to flat buyers will be 80 per cent of the property purchase price.

These new measures were announced by the Monetary Authority of Singapore, Ministry of National Development (MND) and HDB in a joint statement late on Thursday (Sept 29) night, about 20 minutes before they took effect at midnight.

WAITING PERIOD

The authorities said that since the Government rolled out a broad package of measures in December last year, the HDB Resale Price Index has gone up by more than 5 per cent as at the end of June this year, which reflected a broad-based increase in public housing demand.

As a means to tackle this “clear upward momentum in HDB resale prices”, the Government will introduce a wait-out period of 15 months for both current and former private residential property owners to buy a non-subsidised HDB resale flat.

Before the announcement, both current and former private property owners were allowed to buy a non-subsidised HDB resale flat on the open market, with the requirement that they dispose of their private properties within six months of the HDB flat purchase.

The statement added that the new restriction is a temporary measure to moderate demand, and ensure that resale flats remain affordable for buyers, especially for first-timers.

It will be reviewed depending on overall demand and market changes.

However, the wait-out period for private property owners who are first-timers and wish to apply for the Central Provident Fund (CPF) Housing Grant and Enhanced CPF Housing Grant for their resale flat purchase remains unchanged at 30 months.

Buyers aged 55 and above, along with their spouses, will not be affected by the new wait-out period if they are moving from their private property to a four-room or smaller resale flat.

Furthermore, both current and former private property owners who fall into this age category may continue to buy a two-room flexi flat on short lease and community care apartment — if they are aged 65 and above — from HDB.

As for current and former private property owners, regardless of age, who are facing extenuating circumstances such as financial difficulties, they may approach HDB for assistance and to have their situations assessed on a case-by-case basis.

BORROWERS' ABILITY TO REPAY LOANS

The authorities said that they will also tighten the maximum loan amount limits, in light of market interest rates that have "risen significantly" and "are likely to increase further in future".

This, it said, will affect borrowing costs for home purchases, and it would be tightening the maximum loan amount limits for housing loans to “ensure prudent borrowing and avoid future difficulties in servicing home loans”.

This means that the authorities will assume higher interest rates when assessing borrowers' repayment ability.

This will be done in two ways.

First, for property loans granted by private financial institutions, MAS will raise by 0.5 percentage point the medium-term interest rate floor used to compute the total debt servicing ratio and mortgage servicing ratio.

The agencies' statement said that this will apply to loans for the purchase of properties where the option to purchase agreement is granted on or after Sept 30 this year.

In the event that there is no option to purchase, the date of the sale and purchase agreement is similarly on or after Sept 30 this year.

The actual interest rates charged for mortgages will continue to be determined by the private financial institutions.

Total debt servicing ratio refers to the maximum proportion of an individual’s gross monthly income that can go towards repaying all monthly debt obligations. This is currently set at 55 per cent of the borrower's monthly income.

Mortgage servicing ratio, applicable to loans for HDB flat purchases, is the portion of a borrower’s gross monthly income that goes towards repaying all property loans.

It is capped at 30 per cent of a borrower's monthly income.

As for housing loans granted by HDB, HDB will introduce an interest rate floor of 3 per cent for computing the eligible loan amount.

This interest rate floor will apply to fresh applications for an HDB loan eligibility letter received on or after midnight on Sept 30 this year.

It will not affect the actual HDB concessionary interest rate, which will remain unchanged at 2.6 per cent a year.

LOWER LOAN-TO-VALUE LIMIT

As for the loan-to-value limit for HDB housing loans, the revised 80 per cent limit will apply to new flat applications for sales exercises launched and complete resale applications that are received by HDB on or after Sept 30.

The revised limit does not apply to loans granted by private financial institutions, which remains at 75 per cent.

This new ruling is not expected to affect first-time and lower-income flat buyers significantly, since they may get significant housing grants of up to S$80,000 when buying a subsidised flat directly from HDB, or up to $160,000 when buying a resale flat, the authorities said.

Such buyers may also tap their CPF savings to pay for the flat purchase, thereby reducing the loan amount they may need to take.

HDB resale flat prices have been rising for 26 straight months as of August, with prices up by 10.8 per cent year-on-year, and rising 0.4 per cent in August.

TODAY previously reported that resale HDB flats have been going for S$1 million with increasing frequency.

Interest rates in Singapore, which are closely linked to global interest rates, are rising as well due to the United States Federal Reserve aggressively increasing interest rates to tackle inflation.

In their statement, MAS, MND and HDB said that the Singapore Government is committed to keeping public housing inclusive, affordable and accessible to Singaporeans.

"We will continue to monitor the property market and adjust our policies to ensure that they remain relevant," they said.

"We urge households to exercise prudence before taking up any new loans, and be sure of their debt-servicing ability before making long-term financial commitments."

Their press statement can be found here.