Proportion of BTOs sold within a year of meeting minimum occupation period doubled between 2016 and 2020: HDB

SINGAPORE — The proportion of Build-to-Order (BTO) flats sold within a year of meeting their minimum occupation period (MOP) has doubled between 2016 and last year, according to statistics provided by the Housing and Development Board (HDB).

- The proportion of BTO flats sold within a year of meeting MOP was 13.4 per cent, double the figure from 2016

- Property analysts said the trend showed S’poreans’ desire to upgrade to private property

- However, they warned that buying a BTO to profit from it could cause a housing bubble

- HDB said that the five-year MOP ensures buyers do not quickly resell them for profit

SINGAPORE — The proportion of Build-to-Order (BTO) flats sold within a year of meeting their minimum occupation period (MOP) has doubled between 2016 and last year, according to statistics provided by the Housing and Development Board (HDB).

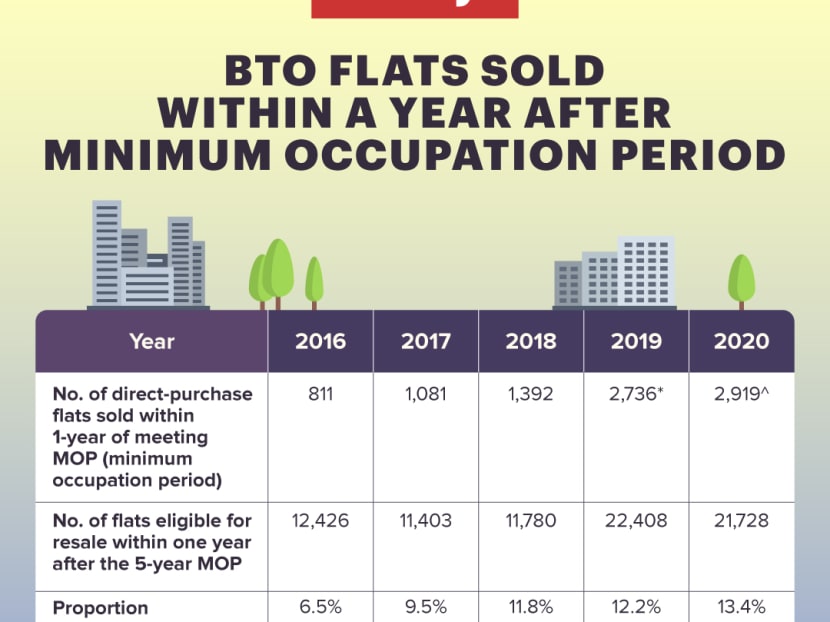

Responding to TODAY’s queries, the housing agency said that the proportion of such flats being sold rose steadily over the years, from 6.5 per cent in 2016 to 9.5 per cent in 2017.

In 2018, it was 11.8 per cent and in 2019, 12.2 per cent, before climbing to 13.4 per cent last year.

The percentage for last year’s sales includes flats which commenced their MOP in 2015 and were sold on the open market as of Aug 31 this year.

Popular among first-time home buyers, BTO flats are new housing projects that are highly-subsidised by the Government. Owners of such flats are required to physically occupy their flats for five years, also known as MOP, before they can sell their flats in the open market.

Property analysts whom TODAY approached said that the trend of selling BTOs once they meet their MOP “reaffirmed” the notion that Singaporeans continue to desire living in private property.

It could also be driven by a demand for newer flats with longer leases amid rising HDB resale prices, they added.

However, some cautioned against market speculation as this could lead to housing prices rising further.

AN INVESTMENT FOR SOME, A HOME FOR OTHERS

As part of TODAY’s Adulting 101 column in July, TODAY’s correspondent Ng Jun Sen wrote about how he undecided over whether to view his BTO purchase as an investment opportunity or a home to sink his roots in.

Homeowners and buyers whom TODAY approached for this article also shared different considerations for purchasing their BTOs.

While some did so with the aim of securing a windfall upon its sale, others saw their BTOs as a place to live in for the long term.

Media executive Sophie Tan Su Ying, for instance, applied for a BTO flat with her partner in Toa Payoh last year with the intention of selling it as soon as it completes its MOP.

Ms Tan, 25, said she knows that the flat, which costs more than S$500,000, can be sold off for a higher price.

To ensure that the flat is attractive to future buyers, she and her partner deliberately picked a flat on the 26th floor. They also plan to keep renovations to a minimum.

Ms Tan said that she viewed her BTO as an investment rather than a long-term home.

“We always hear our parents say that our first flat is not going to be the final one and you are constantly going to be upgrading, so I guess that’s why that mindset is in me, too,” she said.

However, not all homeowners buy their BTO flats with the intention to profit from their sale.

Madam Nor Suhailah Abdul Rauf, 33, a part-time teacher, had moved into her BTO in Punggol which cost more than S$420,000 in 2016.

Unable to secure a spot for her daughter at a childcare centre in Punggol, Mdm Suhailah had to enroll her daughter, now aged six, in a preschool near her parents’ home in Eunos.

With her daughter entering Primary 1 next year, Mdm Suhailah and her husband decided that it would be better to sell the flat this year and move closer to her daughter’s future primary school in Bedok South.

They were able to sell their flat for S$680,000 and move into a condominium in Bedok South earlier this year.

“We plan to live here (in Bedok South) for a good 10 years or until my children move out,” Mdm Suhailah said.

Several BTO applicants also said they have no intention of selling off their flats at the five-year mark and plan to live there for the long term.

Mr Chan Yu Siang, a 25-year-old software engineer who applied for a four-room flat costing over S$600,000 last November in Bishan, said that he intends to stay beyond the MOP as it is difficult to find a home that is conveniently located near amenities such as an MRT station, sports facilities and shopping malls.

Ms Fiona Teo, 25, who does editorial work, said that she has no intention of selling her BTO flat in Woodlands, which she applied for in May this year, as she did not want to go through the hassle and mental stress of looking for a new home again.

WHY ARE PEOPLE SELLING THEIR FLATS SO SOON?

Property analysts offered several reasons as to why more homeowners were selling their BTOs within a year of the MOP.

Mr Ismail Gafoor, the chief executive officer of PropNex Realty, said that it shows a continued desire among the new generation of homeowners to upgrade to private property.

Noting that the trend coincides with a rising number of Singaporeans living in private homes in recent years, Ms Christine Sun, the senior vice president of research and analytics at OrangeTee, said that couples who wanted to upgrade would sell their BTOs earlier as they believed it would fetch a higher value with a longer lease.

Analysts said that amid rising HDB resale prices, the trend could also be driven by demand for newer flats with longer leases.

“Even if they live in it for 10 years, the remaining lease will still be quite long when they decide to sell it,” said Mr Nicholas Mak, the head of research and consultancy at ERA Realty.

Analysts did not rule out personal reasons for homeowners to sell within a year of MOP, such as moving to live closer to their parents, workplaces or children’s schools.

‘FLIPPING’ COULD LEAD TO HOUSING BUBBLE

Property analysts said that BTOs in central or mature estates, as well as those located near amenities such as MRT stations, tend to cost more, but also fetch better resale prices upon reaching their MOP.

Analysis of resale prices this year by PropNex showed that flats in mature estates such as Bukit Merah and Queenstown which reached their MOP this year had better average resale prices. The average resale price for a four-room flat in Bukit Merah was S$855,511 while the price for a similar unit in Queenstown was S$839,711.

Resale prices were lower in non-mature estates. For instance, the average resale price of a four-room flat in Punggol which reached MOP this year was S$502,437 while a similar flat in Chua Chu Kang sold for S$466,032.

However, analysts pointed out that while BTOs are profitable as they are highly-subsidised, it does not mean that homeowners always see the profits from their sales.

This is because the sale proceeds usually go into upgrading their property and renovation costs for their next home.

Some analysts such as Mr Lee Sze Teck, the senior director of research at Huttons Asia, also cautioned against buying a BTO with the intention to “flip” it for a profit as this may drive resale prices up and cause a housing bubble.

“If it is the aim of BTO buyers to flip their flat upon reaching the MOP, it is an unhealthy trend and the authorities should look into this,” he added.

In response to queries from TODAY, HDB said that the MOP ensures that flat owners purchase BTOs with the intent of living in the flat rather than quickly reselling flats for profit.

“It deters speculative purchase of HDB flats and helps to keep these flats affordable for those with genuine housing needs,” said the agency.

TREND EXPECTED TO CONTINUE AMID BTO DELAYS

Analysts said that delays to the construction of BTOs due to the Covid-19 pandemic will continue to drive up demand for flats which have just completed their MOP.

The demand for such flats would be driven by people who want a new flat but are unsure of when they will be able to secure a BTO, said Mr Mak.

Rising HDB resale prices will also drive the trend, said Mr Ismail of PropNex Realty. He expects the proportion of those selling their homes within a year of reaching MOP to hit 15 per cent this year.