Resilience Budget: Higher tax rebates, deferred tax payments and S$20 billion loan capital set aside to help companies

SINGAPORE — The Government will set aside S$20 billion of loan capital for companies, enhance property tax rebates and defer payments of corporate income tax for three months, in a bid to help businesses ease their cash flow, lower costs and have more access to credit.

To help businesses lower costs, the Government will increase the property tax rebates that were first announced during Budget 2020.

SINGAPORE — The Government will set aside S$20 billion of loan capital for companies, enhance property tax rebates and defer payments of corporate income tax for three months, in a bid to help businesses ease their cash flow, lower costs and have more access to credit.

Deputy Prime Minister Heng Swee Keat announced these measures on Thursday (March 26) in Parliament as part of a second stimulus package — following Budget 2020 unveiled last month — to help businesses tide through the challenges brought about by the Covid-19 pandemic.

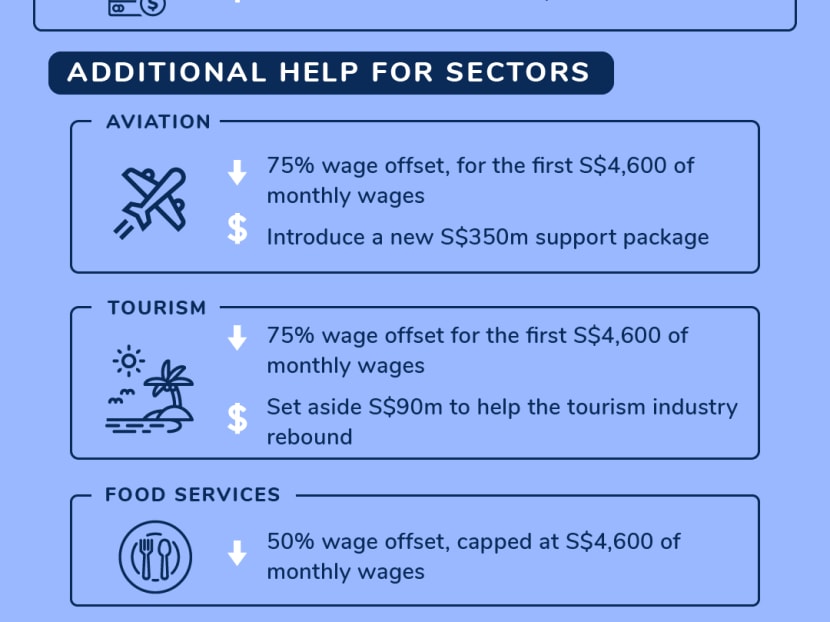

These are on top of initiatives to subsidise wages of workers here such as the Jobs Support Scheme and the enhanced Wage Credit Scheme.

PROPERTY TAX REBATES

To help businesses lower costs, the Government will increase the property tax rebates that were first announced in Budget earlier.

For those in the tourism sector, such as hotels, serviced apartments and exhibition centres, the property tax rebate will be raised from 30 per cent to 100 per cent.

For premises located at Changi Airport, Singapore Cruise Centre, Marina Bay Cruise Centre and Tanah Merah Ferry Terminal, the property tax rebate will go up from 15 per cent to 100 per cent.

Other commercial properties used for retail shops, food-and-beverage outlets, sports and recreation operators, schools and childcare centres, tourist attractions, workers’ dormitory as well as healthcare-related facilities will also get a property tax rebate increase from 15 per cent to 100 per cent.

The two integrated resorts at Marina Bay and Sentosa will have their property tax rebate raised from 10 per cent to 60 per cent.

Non-residential properties, such as offices and industrial properties, will get a 30 per cent property tax rebate. They were not entitled to any property tax rebate in the earlier Budget statement.

“I strongly urge landlords to fully pass on the rebate to tenants, by reducing rentals, to directly ease the cash flow and cost pressures faced by tenants,” Mr Heng said.

“Many businesses have pointed out that it will be a lose-lose situation if landlords do not support their tenants. After all, if tenants fail, the properties will be empty. So my message to landlords is this: Do your part, chip in, and give additional help to tenants who are more badly hit.”

Mr Heng said that the Government will “lead by example” and enhance rental waivers for tenants renting government-managed properties.

Stallholders at hawker centres managed by the National Environment Agency will get three months of rental waiver, up from one month announced previously.

Eligible tenants in other government-managed properties, including those managed by the Housing and Development Board as well as the National Arts Council, will be provided with two months of rental waiver, up from the initial half-month.

Some of the beneficiaries would include social service agencies and charities.

All other non-residential tenants will receive a half-month rent waiver.

All these rental waivers will cost S$334 million in total.

Mr Heng also said all government fees and charges will be frozen by one year, from April 1, 2020 to March 31, 2021.

ACCESS TO LOANS

Financing schemes will be enhanced so that “even the hardest-hit businesses” can continue to have access to credit, Mr Heng said.

Apart from setting aside S$20 billion of loan capital, the loan amount for the trade loan under the Enterprise Financing Scheme will increase from S$5 million to S$10 million. The Government will take up a large part of the risk for the loans, raising its risk share from 70 to 80 per cent.

Subsidies to businesses for loan insurance premiums under the Loan Insurance Scheme will increase from 50 to 80 per cent.

The temporary bridging loan programme first announced for the tourism sector will be expanded to all enterprises, and the maximum supported loan will go up from S$1 million to S$5 million.

Interest rates will continue to be capped at 5 per cent and the Government will also bear 80 per cent of the risk of the loan.

The maximum loan amount for the working capital loan for small- and medium-sized enterprises under the Enterprise Financing Scheme will go up from S$600,000 to S$1 million.

The Government will also work with banks and other financial institutions to defer capital payments for one year on the working capital loan and the temporary bridging loan, if it is requested by businesses.

Mr Heng said that the Monetary Authority of Singapore is working with banks and insurers to see how best to help businesses and individuals facing cash flow challenges with their loan obligations and insurance premium payments.

He added that the Government is looking to see how people can be given relief from their legal obligations that came about due to the Covid-19 crisis.

INCOME TAX DEFERMENT

Mr Heng announced on Thursday, too, that companies and self-employed individuals do not have to pay income tax for three months without having to make any application to defer payment.

For companies, tax payments due in April, May and June will be deferred and collected instead in July, August and September.

For those who are self-employed, the Government will defer their tax payments due in May, June and July, as the payment cycle for personal income tax usually starts in May. The deferred tax payments will be collected in August, September and October instead.