S'pore's private property second-most expensive in the world: CBRE report

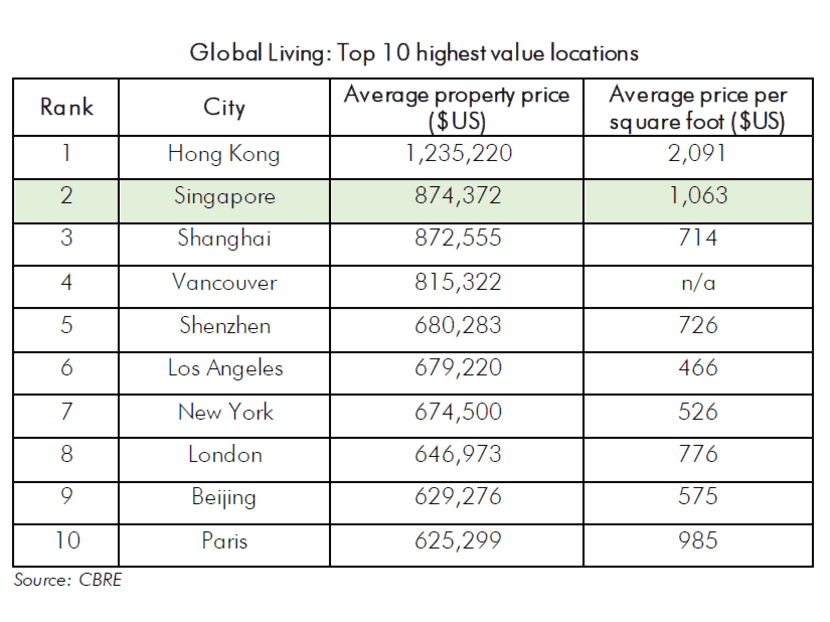

SINGAPORE — Singapore was again the second-most expensive city in the world to buy private property last year.

Singapore’s average property price is US$874,372 (S$1,183,375), with an average price of US$1,063 (S$1,439) per square foot.

SINGAPORE — Singapore was again the second-most expensive city in the world to buy private property last year.

It emerged behind Hong Kong, which remained in first place, in the Global Living report by real estate firm CBRE which compared investment residential properties across 35 global cities.

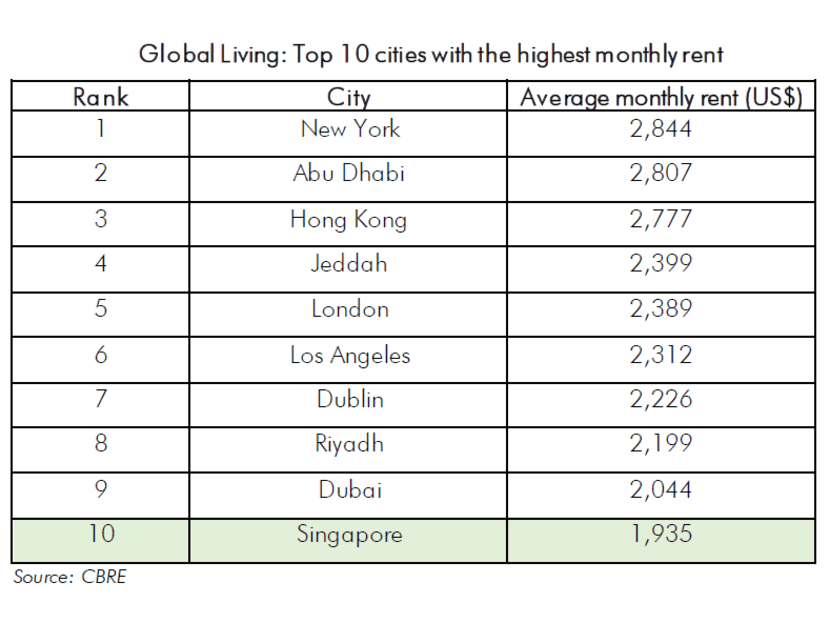

In terms of rentals, however, Singapore was the 10th most expensive.

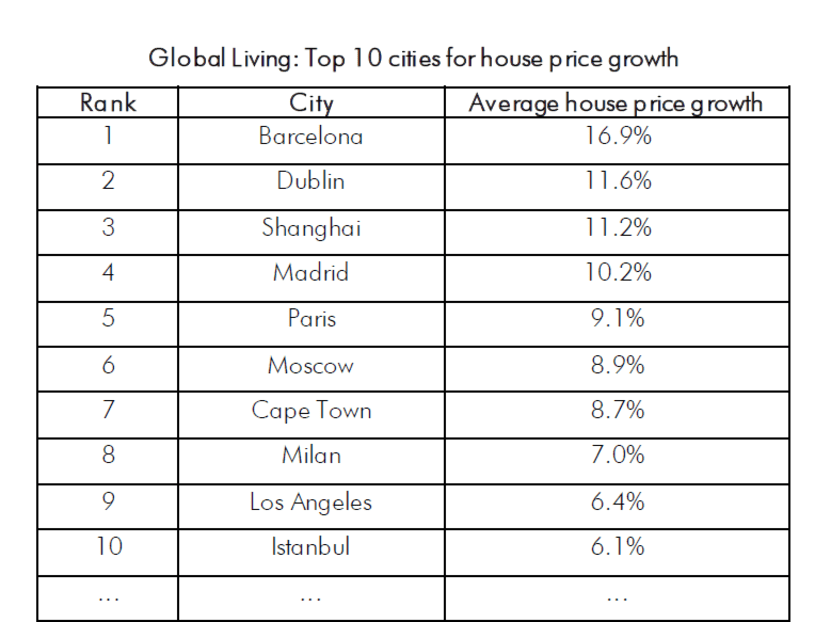

And with property prices inching up just 1.1 per cent last year, the Republic was 27th in growth of house prices.

Values in the report are based on prime residential areas as these are “preferred by expatriates”, said CBRE South-east Asia’s head of research Desmond Sim.

“In Singapore’s case, the prime market refers to the core central region, or districts 9, 10 and 11,” he said.

The three most expensive places to buy private property, all of which are in Asia, remained unchanged from 2017 to 2018.

Singapore’s average property price is US$874,372 (S$1,183,375), with an average price of US$1,063 (S$1,439) per square foot.

For prime property prices, Singapore ranked ninth in the world with prices pegged an an average of US$1,243,640 (S$1,686,002).

“As a financial hub, Singapore is known for its skilled talent, ease of doing business, top-notch infrastructure, as well as economic and political stability,” said CBRE South-east Asia’s head of research Desmond Sim.

The city has thus been an “attractive location” for multinational companies to establish their regional headquarters, in turn influencing the cost of property ownership in the city, he added.

However, property prices here remain “relatively affordable” compared to those in Hong Kong, he said.

The average price growth over 2018 is also “one of the lowest” among cities.

“To prevent cost of living from becoming too prohibitive for citizens, the Singapore Government has since introduced a series of property curbs to cool the housing market,” said Mr Sim.

“As a result, price growth has declined for the second straight quarter in Q1 2019 after five consecutive quarters of strong growth since Q3 2017.”

With increasing supply and weaker sentiment, Mr Sim said prices are likely to moderate or remain flat from this year.

For rentals, Singapore came in 10th with an average monthly rent of US$1,925 (S$2,619), a 46 per cent drop from 2017 when it topped the table with US$3,570 (S$4,833).

Mr Sim said this was due to a confluence of factors linked to the softening of the expat-led rental market last year.

There was an increase in rental supply, as well as a significant drop in demand.

“There was a trend in companies limiting the size of personal packages for these expats, with a cut in budget for their expenses like cars and other spending,” he said.

This led to more expats combining their packages and sharing property to live in, thus pushing down demand.

Despite the high prices of private property, Mr Sim said “Singapore still has mass market and public housing to peg the affordability levels.”

Mr Nicholas Mak, executive director of SLP International Property Consultants, added that CBRE’s report would not be entirely reflective of the housing situation for locals since Housing and Development Board (HDB) flats were not included in the survey of property rates.

HDB resale prices “have been moderately soft for quite a long time since 2013” and continue to be on a gradual downward trend, he said.

Mr Sim said the growth in house prices in Singapore will “continue to be challenged in the future, because of the strong measures to curb foreign demand for property”.

But Singapore will continue to be a safe haven for some foreign buyers.

“More than just capital appreciation, we have strong capital preservation. So the Singapore dollar still holds and is attractive to foreign buyers to come over,” Mr Sim said.

An earlier version of this article said that Singapore’s prime property was second-most expensive in the world, and quoted Mr Desmond Sim saying that the report’s values were based on prime residential areas. This is incorrect. While prime property prices were included in the survey, the findings were not solely based on them. Singapore’s private property was second-most expensive in the world, and ranked ninth for prime property prices alone. We are sorry for the error.