Solidarity Budget: Govt widens criteria to allow more freelancers to automatically qualify for income relief

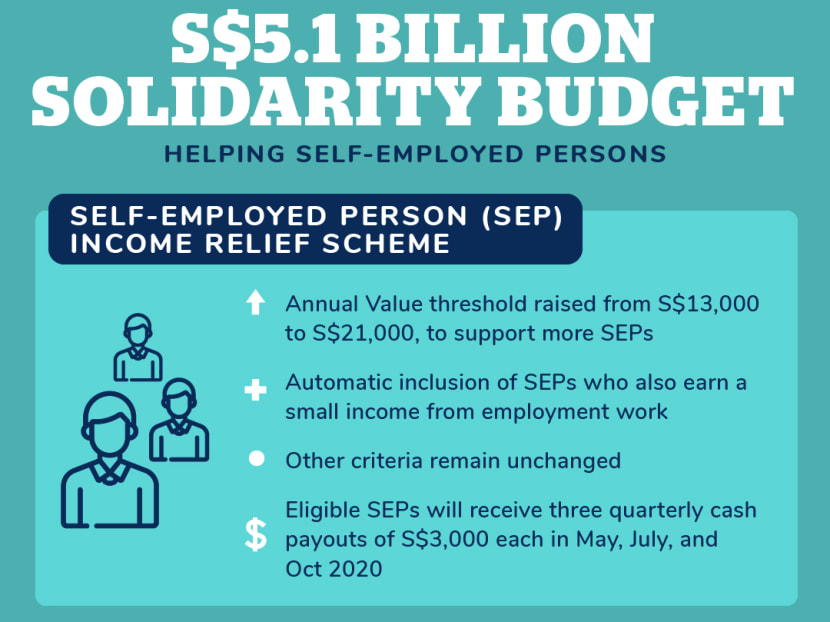

SINGAPORE — Enhancements have been made to the Self-Employed Person Income Relief Scheme (Sirs) to widen the qualifying criteria and support more freelancers affected financially by the Covid-19 pandemic.

The Self-Employed Person Income Relief Scheme is aimed at helping self-employed individuals, such as taxi drivers, private-hire car drivers and real estate agents, tide over the Covid-19 pandemic.

SINGAPORE — Enhancements have been made to the Self-Employed Person Income Relief Scheme (Sirs) to widen the qualifying criteria and support more freelancers affected financially by the Covid-19 pandemic.

The scheme will now automatically include freelancers earning a small income from employment work, Deputy Prime Minister Heng Swee Keat announced on Monday (April 6). It is part of the Solidarity Budget, which is a third package of relief measures made in response to tightened regulations to curb the spread of Covid-19.

Manpower Minister Josephine Teo, elaborating on the enhancement in Parliament, said that it would cover freelancers who earn up to S$2,300, which is the current Workfare income ceiling. The Workfare scheme, by supplementing eligible workers' income and retirement savings through cash payments and Central Provident Fund contributions, helps those earning up to S$2,300 a month.

Mrs Teo also said that as a qualifying criterion for Sirs, the annual value of property threshold will be raised from S$13,000 to up to S$21,000 to include freelancers living in condominiums and other private properties. This will include most condominiums outside prime areas, she added.

The enhancements will mean that around 100,000 self-employed persons — up from 88,000 — will automatically be eligible for the scheme and will receive three payments of S$3,000 starting from May.

Freelancers aged 37 and above, who declared a positive net trade income will be automatically notified and receive their first payout at the end of May.

All other criteria remain unchanged.

Sirs was first announced by Mr Heng, also Finance Minister, on March 26 as part of Singapore's Resilience Budget. It is aimed at helping self-employed individuals, such as taxi drivers, private-hire car drivers and real estate agents, tide over the Covid-19 pandemic.

Mr Heng said that since the scheme was announced, the Government has received feedback from various self-employed persons whose livelihoods have been affected. During this circuit-breaker period from April 7 to May 4 when many workplaces and all schools are closed, he acknowledged that more people will see a further drop in income.

“In these extraordinary times, many such self-employed persons are hard-hit. I hope that by our helping them, they, too, can help others in their networks, and their workers, and we keep the spirit of enterprise alive,” he added.

Mrs Teo said that the pandemic appears to be more cruel than the severe acute respiratory syndrome (Sars) outbreak and even the global financial crisis.

"No one can, at this point, seriously imagine a V-shaped recovery any time soon, if at all. After all, entire cities and nations have had to make drastic changes to the way people live," she said.

The Ministry of Manpower's priority, she said, was protecting the livelihoods of workers.

"Even as we close workplaces temporarily, we want to ensure that workers can still put food on the table and meet financial obligations," she said.

While acknowledging that employers were making many adjustments, Mrs Teo said that they should still do their part.

"Given the generous Jobs Support Scheme funding, employers should aim to pass the government support to their workers," she added.

Under the enhanced Jobs Support Scheme, the Government will pay for 75 per cent of the wages of every Singaporean worker in employment, up to the first S$4,600 of their monthly salary, for the month of April.

This is an increase from the 25 per cent of wage support that Mr Heng announced during the Resilience Budget on March 26.