Insurers to offer new integrated shield plan from May 1

SINGAPORE — A new private medical insurance plan that offers identical benefits across insurers for stays in Class B1 wards in public hospitals will be available from May 1.

SINGAPORE — A new private medical insurance plan that offers identical benefits across insurers for stays in Class B1 wards in public hospitals will be available from May 1.

This Standard Integrated Shield Plan (IP), set up by the Ministry of Health (MOH) together with private insurers, comes nearly two years after a committee that worked out the details of MediShield Life pushed for it.

IPs are offered by private insurers, providing benefits over and above the coverage offered by MediShield Life, which provides coverage for large hospital bills in Class B2 or C wards in public hospitals. Insurers hitherto offered their own plans that came with varying benefits, causing some confusion.

The Standard IP to be offered by five private insurers here — AIA, Aviva, Great Eastern Life, Prudential and NTUC Income — come with standardised benefits, making it easier for consumers to compare premiums across insurers.

Nearly two in three (or 64 per cent) Singaporeans have IPs, of whom 19 per cent have policies that provide coverage for Class B1 wards in public hospitals.

Standardised benefits under this new IP, which will be regulated by the MOH, include claim limits that are designed to fully cover nine out of 10 Class B1 bills in public hospitals. The new plan will provide coverage for hospital stays and selected outpatient treatments, such as chemotherapy and kidney dialysis.

There will also be co-payment features to manage healthcare costs.

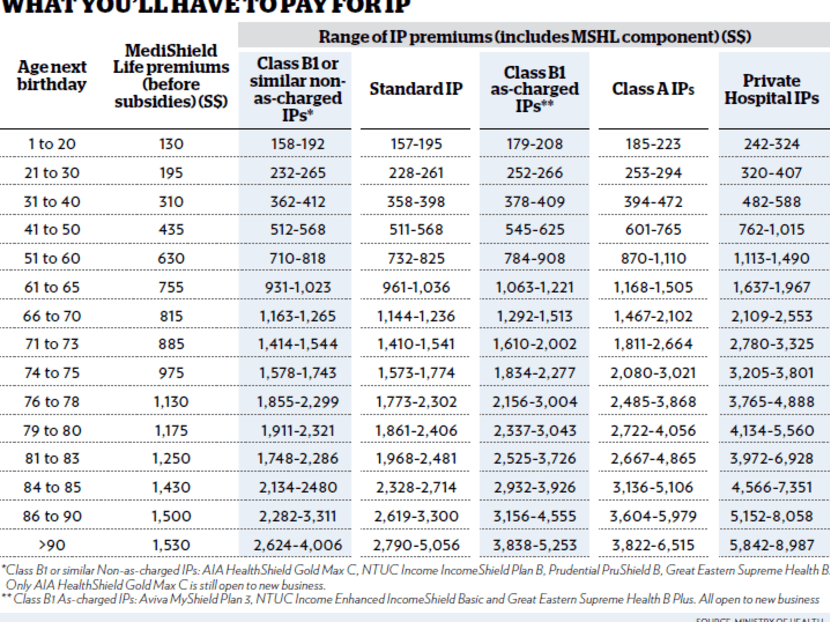

The premiums for the Standard IPs will cost more than that for MediShield Life, but less than that for IPs covering Class A and private hospital stays. They also cost less than “as charged” IPs — no claim limits — pegged to Class B1 hospital stays on the market now.

For instance, premiums for Standard IPs will be in the range of S$358 to S$398 for those aged 31 to 40 years old. In contrast, premiums for as-charged IPs for those within this age bracket will cost S$378 to S$409 for Class B1, S$394 to S$472 for Class A, and S$482 to S$588 for Private Hospital.

Medisave can be used to fully pay for all insurers’ Standard IP premiums until one turns 74. After that, one may have to fork out cash for the premiums.

Premiums will vary across the five insurers as the amounts are determined based on each firm’s commercial considerations and risk assessment frameworks, said the MOH on Tuesday (March 15).

But for the first two years, the firms will keep the premiums for the additional private insurance component of the Standard IP fixed.

Those looking to downgrade from their Class A or Private Hospital IPs can do so with their current insurer without additional underwriting. But the insurers have the discretion to assess, approve with or without exclusions, or reject new applicants based on their own risk assessment frameworks, said MOH.

In response to queries, insurers told TODAY that it is difficult to predict the take-up rates for the Standard IPs and will need time to assess its demand. But they noted that as IPs are term products that are renewable yearly, premiums are not guaranteed and different insurers may raise premiums differently over time.

Dr Chia Shi-Lu, who chairs the Government Parliamentary Committee for Health, said the Standard IP is a more affordable option for the elderly who are existing IP policy-holders and are facing increasingly costly premiums with age.

It also serves as a check against higher-priced plans, he added, noting that people will start questioning if they really want to fork out additional premiums for the higher-tiered plans.

Senior research fellow at the Institute of Policy Studies Christopher Gee said the new plan setting out the premium range brings some consistency. “It addresses the complaint previously that there was far too much choice, that I can’t compare apples with apples,” he said.

Health economist Phua Kai Hong of the Lee Kuan Yew School of Public Policy said the Standard IP plugs the gap of people overbuying insurance due to lack of knowledge about policy plans, such as purchasing Class A coverage when they are contented with Class B1 facilities.