TLDR: Cryptocurrency crash offers industry the reality check it needs (The Big Read in short)

SINGAPORE — Cryptocurrency prices may have fallen from its peak, but Mr Ken Tan has not stopped pumping money into the digital coin XRP over the course of this year.

Despite the cryptocurrency crash this year, investors interviewed said they are not quitting the market yet.

Each week, TODAY’s long-running Big Read series delves into trends and issues that matter. This week, we look at how some Singaporean investors have been hit by the sharp drops in the values of cryptocurrencies. This is a shortened version of the full feature, which can be found here.

SINGAPORE — Cryptocurrency prices may have fallen from its peak, but Mr Ken Tan has not stopped pumping money into the digital coin XRP over the course of this year.

Thus far, the 36-year-old businessman has poured about S$100,000 into cryptocurrencies, including the S$15,000 that he invested in November last year when prices skyrocketed.

While initially making a S$100,000 profit last year, Mr Tan did not cash out during the cryptocurrency bull run and his portfolio has now dwindled to over S$30,000, resulting in a paper loss of about S$70,000 when prices fell.

“Of course I look back, I regret it, but there is no way for me to undo that,” he added.

Mr Tan is among many who are suffering significant paper losses since the cryptocurrency market turned south in January.

As of Friday (Dec 7), one Bitcoin — the most-well-known cryptocurrency — is valued at US$3,428. That’s an 80 per cent drop from its peak of close to US$20,000 last December.

Besides Bitcoin, other popular cryptocurrencies such as XRP and Ethereum also saw a similar crash. Almost US$700 billion has been wiped off from global cryptocurrency markets since their peak.

WHAT GOES UP MUST COME DOWN

Observers have cited several factors that could have contributed to the downward pressure on cryptocurrency prices:

- Goldman Sachs scrapping plans to open cryptocurrency trading desk

- Greater regulatory scrutiny

- Hacks in cryptocurrency exchanges

Some analysts expect the downtrend in cryptocurrencies to continue. Santa Clara University professor of finance Atulya Sarin said in financial news site MarketWatch that Bitcoin will be “worthless” when its price falls below the cost of mining it, leading miners to exit.

Mining is a peer-to-peer computer process, where miners solve mathematical problems to verify the transactions or payments, from one user to another on a decentralised network, to obtain Bitcoins.

In Singapore, some miners have indeed shut down their mining rigs along with the fall in cryptocurrency prices.

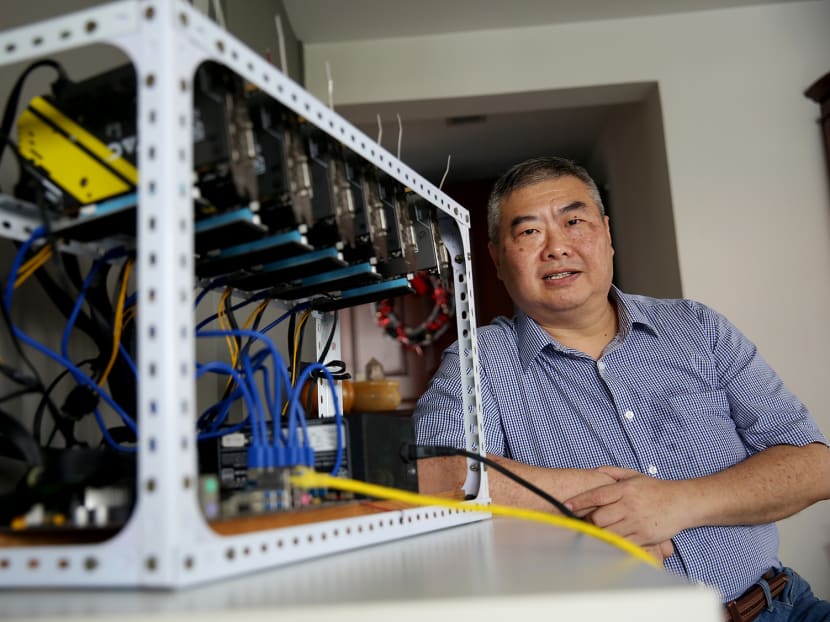

Mr Ian Chan, 52, used to make about S$270 on average a month for each rig — after taking into account electricity costs — when he started mining a digital currency called ZCash in June last year.

He decided to power down his rigs in September when his returns started turning negative in July, losing about S$8 to S$10 per rig each month.

END OF A VIRTUAL CRAZE?

It is not just cryptocurrency investors who have been hit by the drop in prices. Cryptocurrency-related businesses are also affected.

- Trading activity in cryptocurrency exchanges has shrunk

- No more orders of mining rigs at Sim Lim Square

- Companies hosting mining rigs have lost significant revenue

- No more snaking queues at Bitcoin automated teller machines

- People putting in smaller amounts of money to buy Bitcoin

Singapore University of Social Sciences Professor David Lee said that the cryptocurrency industry is also re-focusing on the technology underpinning cryptocurrencies, i.e. blockchain.

Bitcoin was the first application of blockchain technology — an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way.

“(We should not) focus on the price. It’s always a cycle… People need to refocus on how much can this technology do, and the answer is a lot,” Professor Lee added.

The chief executive officer of cryptocurrency advisory firm XSQ, Mr Lim Hong Zhuang, said: “Revenues of blockchain companies have fallen, and many once speculative investors or businesses that were started during the hype have also seen closure with people exiting the industry.”

“We are seeing the real technology companies survive and building up their products at the moment”, he added.

While the chairman for Singapore’s Cryptocurrency and Blockchain Industry Association, Mr Anson Zeall, agrees, he said that there are still “bad actors” that the industry needs to “weed off”.

AN UNCERTAIN FUTURE AWAITS

Despite the cryptocurrency crash this year, the investors interviewed by TODAY said they are not quitting the market yet.

The reason for their optimism? Their belief in the blockchain technology.

The blockchain economy, represented by its various cryptocurrencies, is seeing:

- Increasing adoption by traditional financial institutions

- More relevant real-life applications, such as ticketing systems, retirement plans

- Greater support by regulators

While touted to have huge potential, the industry players cautioned that:

- The failure rate of blockchain firms is still high given the nascent stage of development of the technology

- Tokens from failed startups are still being traded in the market

Mr Zeall said: “There will be people that try to trick (investors) in by moving the (prices) of (those) coins but actually there is no (business) activity. … If no one is running the coin, from that sense it’s worthless because no one is supporting it”.

Chairman of the Token Economy Association, Mr Chia Hock Lai, said a prudent approach for interested investors would be to stick to the top five cryptocurrencies.

“Invest no more than 5 per cent of their total investment portfolio. Most importantly, never buy more than what they can afford to lose,” he added.

Mr Zeall was a lot more absolute. “The whole point is… don’t speculate.”