China’s hotpot king Zhang Yong shoves aside real estate magnates to become Singapore’s richest man

HONG KONG — Mr Zhang Yong, mainland China’s “hotpot king,” has displaced a couple of property developers as Singapore’s richest man according to Forbes Asia’s latest listing, as a doubling in the stock price of Haidilao International Holdings bolstered his wealth.

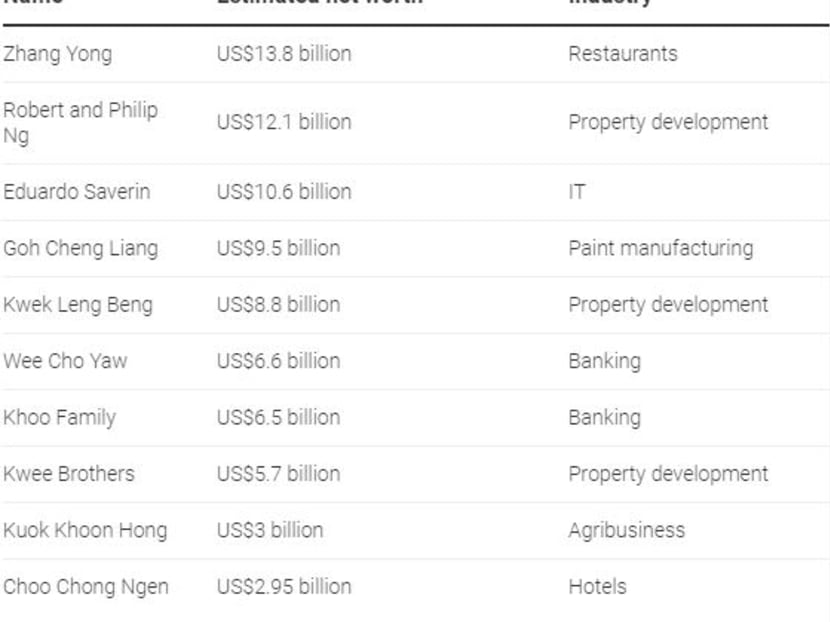

Mr Zhang Yong's debut at the top of Singapore’s rich list displaces Mr Philip Ng and Mr Robert Ng, who own property developer Far East Organisation and Hong Kong’s Sino Land, for the No 1 spot.

HONG KONG — Mr Zhang Yong, mainland China’s “hotpot king,” has displaced a couple of property developers as Singapore’s richest man according to Forbes Asia’s latest listing, as a doubling in the stock price of Haidilao International Holdings bolstered his wealth.

Mr Zhang, who was on the China rich list last year, has since become a naturalised Singaporean citizen. His debut at the top of Singapore’s rich list displaces Mr Philip Ng and Mr Robert Ng, who own property developer Far East Organisation and Hong Kong’s Sino Land, for the No 1 spot.

The Ng brothers, with a combined wealth estimated at US$12.1 billion (S$16.8 billion), had been Singapore’s wealthiest people every year this decade, according to Forbes Asia.

Haidilao’s HK$7.6 billion initial public offering (IPO) last year turned Mr Zhang, 48, into a billionaire, with his wealth estimated by Forbes at US$13.8 billion. The stock had more than doubled since its IPO last September, giving the Beijing-based company HK$199 billion (US$25 billion) in capitalisation.

China-born Forrest Li – founder of Shopee and Garena, the latter which created e-game Free Fire – has seen his wealth balloon to US$1.57 billion from last year’s US$738 million. Li is on the list after his naturalisation as a Singapore citizen.

The combined wealth of Singapore’s 50 richest tycoons increased by more than 12 per cent to US$130 billion from last year, Forbes Asia said.

To make the list of the top 50 required a net worth of at least US$560 million. For now, Hong Kong remains the overwhelming leader in wealthy inhabitants, home to 87 dollar billionaires with US$259 billion in combined wealth, according to the 2019 Billionaire census by Wealth-X.

Singapore was home to 39 billionaires with a total wealth of US$84 billion, according to the same survey.

The presence of Mr Zhang, Mr Li and dozens of other wealthy China-born billionaires on Singapore’s wealth list underscores Lion City’s rise as the preferred destination in the exodus of mainland tycoons.

For Hong Kong, the previous go-to destination for Chinese émigré, Singapore has become a stiff competitor as safe haven, while the Chinese special administration region goes through 12 consecutive weeks of unprecedented civic unrest and street rallies.

“People are obviously very conscious of what’s going on, and are watching the developments carefully,” said Mr John Ashwood, Hong Kong-based managing director of Zedra, a global trust and fund services company. “The political and social issues are causes for concern for setting up Hong Kong-domiciled structures and booking or holding assets in Hong Kong.”

Hong Kong and Singapore had been competing to host family offices and trusts, structures that the world’s wealthiest people use to manage their personal wealth.

A consortium of private banks created the Private Wealth Management Association in 2013 to lobby Hong Kong’s government on behalf of the wealth management industry. The industry employs 42,000 people, according to an estimate by the Securities and Futures Commission (SFC) in its 2019 Asset and Wealth Management Activities Survey.

Jobs would ultimately follow the money, if wealth from Hong Kong moves to Singapore, industry experts said.

One director of a multifamily office in Hong Kong said that because of the families’ heavy weighting in real estate, operations would remain in Hong Kong. However, protests had caused family members to reassess plans for long term residency in Hong Kong, he said. SOUTH CHINA MORNING POST