Hong Kong’s tycoons are handing over power in troubled times

HONG KONG - For decades, aspiring Hong Kongers dreamt of emulating the rags-to-riches rise of Li Ka-shing, the wealthiest man in a city built by commerce, improvisation and not a little luck. But when the 89-year-old billionaire announced his retirement in March, his right-hand man Canning Fok was one of many warning that his like may never be seen again in the semi-autonomous Chinese territory.

Hong Kong tycoon Li Ka-shing listens to his son Victor Li during a news conference in Hong Kong in March.

HONG KONG - For decades, aspiring Hong Kongers dreamt of emulating the rags-to-riches rise of Li Ka-shing, the wealthiest man in a city built by commerce, improvisation and not a little luck.

But when the 89-year-old billionaire announced his retirement in March, his right-hand man Canning Fok was one of many warning that his like may never be seen again in the semi-autonomous Chinese territory.

“If I was young, I wouldn’t work in Hong Kong,” said the managing director of Mr Li’s main holding company, CK Hutchison, and one of the city’s best-paid executives, earning US$27 million (S$36.2 million) last year.

“I wouldn’t spend HK$10m (S$1.71 million) on a 300 square foot apartment, I’d go over there [to mainland China] and spend HK$2 million and put HK$8 million into a start-up.”

Like the other tycoons who dominate Hong Kong, Mr Li made much of his money through property development, recycling the profits into a wide range of businesses ranging from ports to retail, telecommunications to energy.

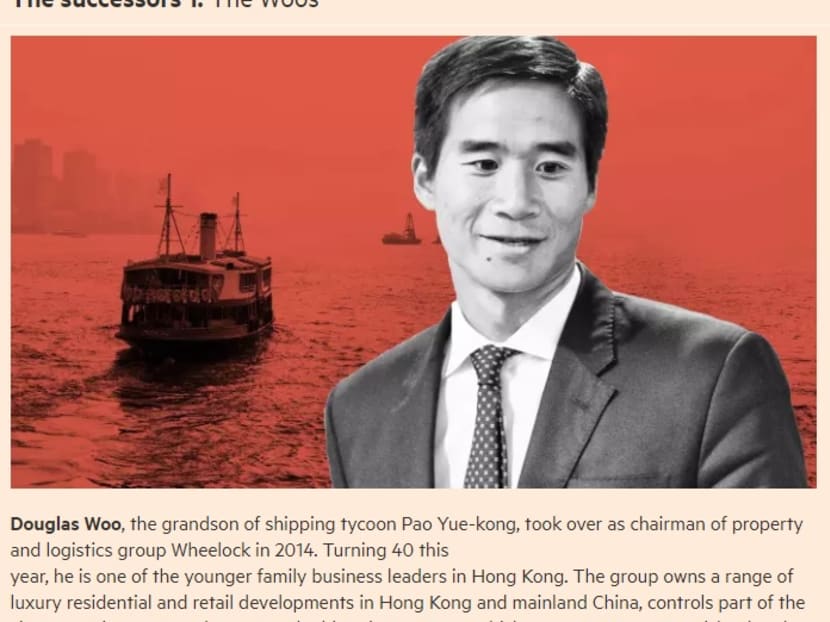

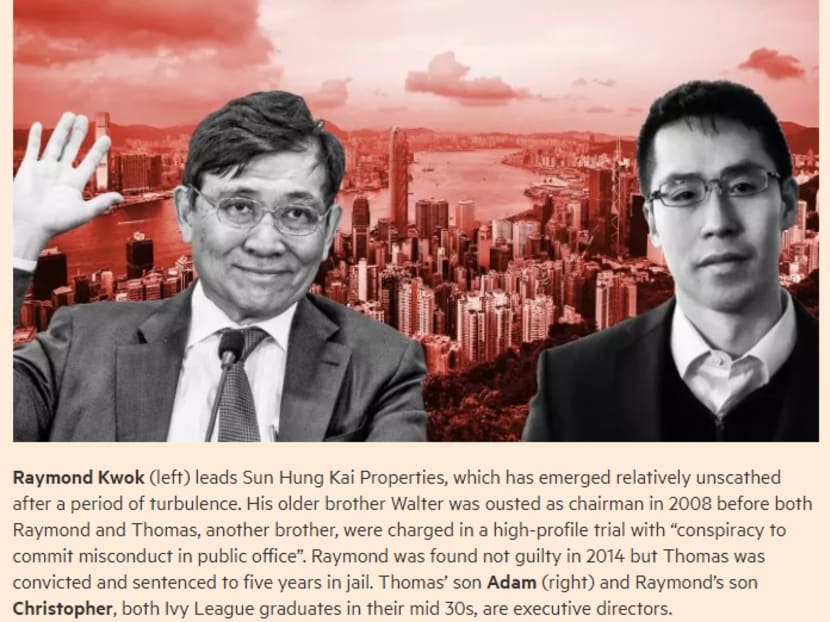

But the decades-long property boom that helped turn the likes of Li Ka-shing, Lee Shau-kee, the majority owner of Henderson Land, and the Kwok, Cheng and Woo families into billionaires has left Hong Kong saddled with the world’s most unaffordable housing prices — and much of the economy controlled by a handful of closely connected business groups.

Many young people are unable to buy, or even rent, a home of their own, and are deterred from starting a business by equally astronomical commercial rents.

Kenneth Tong, a 33-year-old academic researcher who lives with his parents, compares his generation’s predicament to playing a game of Monopoly that has been going on for 50 years, with all the properties already taken and only the prospect of paying ruinous rents.

“If you continue to play the game, the disparity between the rich and poor will be wider . . . and more and more people will live in abysmal conditions,” says Mr Tong, who runs a campaign called No Flat Slave.

“The tycoons are heartlessly rich. They used the power they attained to alter policies and strengthen their status.”

Family businesses dominate economies across Asia but no place is as synonymous with its tycoons — nor its tycoons as synonymous with it — as Hong Kong.

Mr Li’s retirement, passing the baton to his elder son Victor Li, is the most high-profile handover of a wider transition of power in Hong Kong, as the second and third generation of Ivy League and business school-trained offspring take over from their pioneering, self-made fathers and grandfathers.

It symbolises the end of an era in more ways than one.

The first generation of billionaires like Mr Li were trusted advisers to Communist leaders such as Deng Xiaoping as they sought expertise and capital during the “reform and opening up” of China’s economy in the 1980s and 1990s.

In today’s far richer, more powerful China, President Xi Jinping has little need to take advice from second-generation Hong Kong tycoons.

In fact, the roles have been reversed. Hong Kong’s government looks to Chinese tech entrepreneurs such as Jack Ma of Alibaba and Pony Ma of Tencent, who both have luxury homes in the city, for help in re-energising an economy that many Hong Kongers feel does not work for them any more.

“The dominance of several tycoons over generations has impeded economic development here because of their anti-competitive practices and rent-seeking behaviour,” says David Webb, a corporate governance campaigner and former director of the Hong Kong stock exchange.

“That . . . has resulted in less economic dynamism.”

The primary challenge for every senior Hong Kong tycoon is how to transfer their business empire and wealth to the next generation.

With multiple heirs, siblings and, sometimes, wives, it is not an easy task, especially in a culture where billionaires are reluctant to discuss succession openly.

“Many Asian founders never retire, they just die at a desk,” says Joseph Fan, a professor of finance at the Chinese University of Hong Kong.

Family businesses listed on the stock market in Hong Kong, Singapore and Taiwan lose, on average, 60 per cent of their value during the five years before and three years after their founder steps down, according to Prof Fan’s research.

He says this transition discount is driven by the difficulty of passing on “intangible critical assets” such as the founder’s relationships and values, as well as the fear of festering family feuds.

A key characteristic of ethnic Chinese family businesses that survive more than a century is their ability to “prune ownership” to head off such disputes, says Roger King, who runs the family business studies centre at Hong Kong University of Science and Technology.

On a scale of smoothness, Li Ka-shing’s handover to Victor Li would come near the top, while the formal retirement of Stanley Ho, another Hong Kong tycoon who is known as the “godfather” of the booming casino industry in neighbouring Macau, would be closer to the bottom.

Mr Victor Li, 53, has spent 30 years learning the ropes from his father, before formally becoming chairman of CK Hutchison and CK Asset, the family’s property group, this month.

Rather than see his two sons tussle for influence, Mr Li Ka-shing backed his younger son Richard in a separate business venture and today he runs PCCW, a telecoms and media group.

By keeping his family small, Mr Li Ka-shing made life much more straightforward.

Mr Ho, who stood down as chairman of his casino company SJM Holdings in April at the age of 96, has had a much tougher task, with 17 known, living children by four different partners.

A messy legal dispute over who controls the family’s shares in his gambling group was eventually resolved in 2011.

But Mr Ho, who stepped back from active involvement several years ago due to ill health, has never identified a clear successor.

He is being replaced by three co-chairmen, including Angela Leong, his fourth partner, and Daisy Ho, a daughter by his second partner. Meanwhile Ina Chan, his third partner, was also appointed as an executive director.

Vitaly Umansky, an analyst at Bernstein, an equity research group, says this sort of messy structure creates an “enormous discount for the company” in investors’ eyes. “There’s a giant hodge-podge of conflicts of interest at the board, shareholder and management level,” he says.

“Many US and European investors would never invest in a company like SJM for that reason.”

While ageing tycoons struggle to get their house in order, many young Hong Kongers wonder if they will ever be able to buy one.

The densely populated city of seven million people has the world’s most unaffordable residential property, measured as a proportion of median income, according to Demographia, an urban planning consultancy.

In response to soaring prices, limited land supply and stagnating wages for many graduates, developers have been racing to build ever smaller micro-flats, some no bigger than a parking space.

More than 200,000 Hong Kongers live in often-squalid cubbyholes known as “subdivided homes”, which are typically about 10 square metres but rent for about US$570 per month.

The average living space per person in Hong Kong is just 16 sq m, compared with 20 sq m in Tokyo, which is also infamous for its tiny apartments, and 28 sq m in Shenzhen, China’s tech metropolis just over the border from Hong Kong, according to research by Our Hong Kong Foundation, a think-tank backed by many of the city’s tycoons.

Stephen Wong, a former investment banker and head of public policy at the think-tank, says the housing situation has reached “crisis” point.

“We’re going to be short by another 70,000 private flats over the next 10 years,” he says.

“People have lost hope.”

Tycoons get much of the blame for the situation — and a large share of the resulting profits.

Five of the best-known tycoon families — the Lis, the Lees, the Woos, the Chengs and the Kwoks — took home more than US$3 billion in dividends, which are not taxable in Hong Kong, from their main listed companies alone last year, according to FT calculations.

But economists and politicians disagree about the causes of the crisis, with some blaming developers for hoarding land, some blaming the public for resisting the development of greenfield sites and others blaming the influx of around one million mainland migrants since the United Kingdom handed back control to China in 1997. Quantitative easing, which has pumped cheap money into the global economy since the financial crisis, has helped drive prices even higher.

Mr Wong understands why residents resent developers, given that property prices have, over the past decade, grown faster than gross domestic product and way ahead of wages.

“People see that a landlord is better off than a business owner, who is better off than a wage earner,” he says.

“What kind of society is that?”

Even some tycoons are balking at soaring prices.

Lau Ming-wai, chairman of property group Chinese Estates, says his company has not bought land at government auctions in Hong Kong for five years because “we see better risk-return in other investments”.

Mr Lau, 37, who took over when his father stepped down after being convicted of bribery and money laundering in Macau in 2014, advises the Hong Kong government on youth policy.

He compares the situation to the UK and other developed economies struggling with a “toxic mix” of high property prices and declining social mobility.

The difference is that Hong Kong has no hinterland and the city’s residents cannot elect their own leaders, leading to a sense of “pent-up anger”.

He adds: “You can see and feel the resentment and frustration.”

President Xi Jinping ’s concentration of power — and Beijing’s growing influence in Hong Kong — has killed off hope for democratic reform, and eroded the autonomy and civic freedoms that helped make the city an international gateway for China.

Economically Hong Kong is much less important to Beijing than it was 20 years ago.

On the eve of the handover, the city’s GDP was nearly a fifth of China’s, but today it represents just 3 per cent, only slightly more than the neighbouring cities of Shenzhen and Guangzhou.

The Chinese economy is not just much bigger, it is far more technologically advanced, led by the likes of Alibaba, Baidu and Tencent, whose innovative businesses make the Hong Kong tycoons’ traditional empires look like relics from an earlier era.

The shift in influence has seen Chinese investors buying up some of Hong Kong’s most prominent buildings and most storied assets.

Alibaba acquired the South China Morning Post, the city’s main English language newspaper, in 2015.

Cosco, the state-owned shipping group, is in the process of taking over Orient Overseas, the shipping company controlled by the family of former Hong Kong leader Tung Chee-hwa, for US$6 billion.

While some tycoons worry about Beijing’s interventions in Hong Kong’s legal system, few are willing to stand up for the territory’s autonomy.

When asked at his final press conference in March what he thought of Mr Xi’s decision to end term limits, allowing him to be leader for life, Mr Li, who has expressed support for democracy in the past, replied: “If I had a chance to re-elect him, I would have voted for him.”

Anson Chan, who worked with many of the tycoons when she was deputy leader of Hong Kong before and after the handover, argues that this willingness to put profit before principle is as big a threat to the city as the housing crisis.

“At some stage business people here need to ask themselves if they have a bottom line and are they prepared to defend it,” she says.

“We have to keep Hong Kong’s unique strengths or it will become marginalised.” THE FINANCIAL TIMES