The Big Read: 'Ah Longs' go digital with new tactics and the trouble it spells

SINGAPORE — Mr Alan had no idea that his employee had borrowed from “loan sharks” until he was harassed with almost 120 calls over three days from various unlicensed money lenders.

While harassment from unlicensed moneylenders, or loan sharks, is nothing new, some illegal lenders have adopted new technologically savvy means.

This audio is AI-generated.

- While harassment from unlicensed moneylenders, or loan sharks, is nothing new, some illegal lenders have adopted new technologically savvy means

- Some new tactics include harassing debtors' employers, making bogus cash-on-delivery food orders, and using screenshots from their social media to scare them

- Lawyers told TODAY that more youths are also being recruited online to borrow or become harassers for a “quick buck” online

- Despite strict regulations on moneylending and debt collection as well as tough enforcement, loan shark activities and harassment continue to make the news

- Experts and Members of Parliament see socioeconomic issues as the root of the problem and suggest ways to tackle it

SINGAPORE — Mr Alan had no idea that his employee had borrowed from “loan sharks” until he was harassed with almost 120 calls over three days from various unlicensed money lenders.

The strategic consultant, who spoke on condition of anonymity, discovered that his Singaporean employee had given Mr Alan’s name, personal phone number and the company's main line to the illegal moneylenders, listing Mr Alan as a guarantor.

“During the period where there was constant harassment, if you don’t pick up right away they will call back immediately. They don’t allow your phone to rest, so if other people try to call you they cannot get through,” said Mr Alan, who is in his 50s.

He immediately terminated the man’s contract for placing his office and other colleagues “at risk”. Mr Alan also advised his staff on how to field calls searching for the former employee.

“I was more scared for my staff, who might think, ‘what kind of company is this, what is happening?’”

While this happened in 2017, Mr Alan received a call from a stranger looking for his ex-employee last year.

He told the caller that he did not know who the caller was referring to before hanging up, and did not receive any further calls from purported lenders.

Mr Alan’s brush with “Ah Longs” — a colloquial term derived from the Cantonese phrase for illegal moneylenders — despite him not having borrowed a cent from them is not unique.

In recent years, unlicensed money lenders have used both time-tested and less conventional methods to force their borrowers to pay up — from harassing the latter’s employers to using social media to scare and shame debtors and engaging “runners” to intimidate them.

Mr Sebastian Pereira, a sales manager and delivery rider on Foodpanda, also had a taste of another loan-shark tactic last year.

The 51-year-old said “nothing looked amiss” when he picked up a cash-on-delivery order for fishball noodles in Pasir Ris.

Upon arriving at the drop-off location in Bedok, however, he found more than 10 other delivery riders from various platforms congregating at the void deck.

“When I walked towards them, they asked me, ‘Is it for this address? This is a scam, a fake order. It’s a loan-shark case’,” said Mr Pereira, who reported the incident to the delivery platform and was told to discard the food.

The other riders, from platforms such as Grab and Lalamove, also had cash-on-delivery orders for the same address placed under a similar username, but the resident had not placed any orders.

“It’s another way of harassing the victims, because the loan sharks themselves don’t want to be caught. Especially (for harassment tactics) like paint and graffiti, those people can be caught. But food delivery, you don’t know who they are,” said Mr Pereira.

In April 2020, during the Covid-19 circuit breaker, the police released an advisory stating that unlicensed moneylenders had increasingly been making use of food delivery services to harass debtors, such as by ordering large quantities of food, often late at night.

For Ms Ika Lestari, the aftermath of her former helper borrowing money from unlicensed moneylenders was two months of calls and messages from various numbers, mostly Malaysian, threatening to burn down her house this year.

The intimidation tactics escalated when harassers sent raw pork on two occasions via cash-on-delivery orders through Foodpanda and Grab.

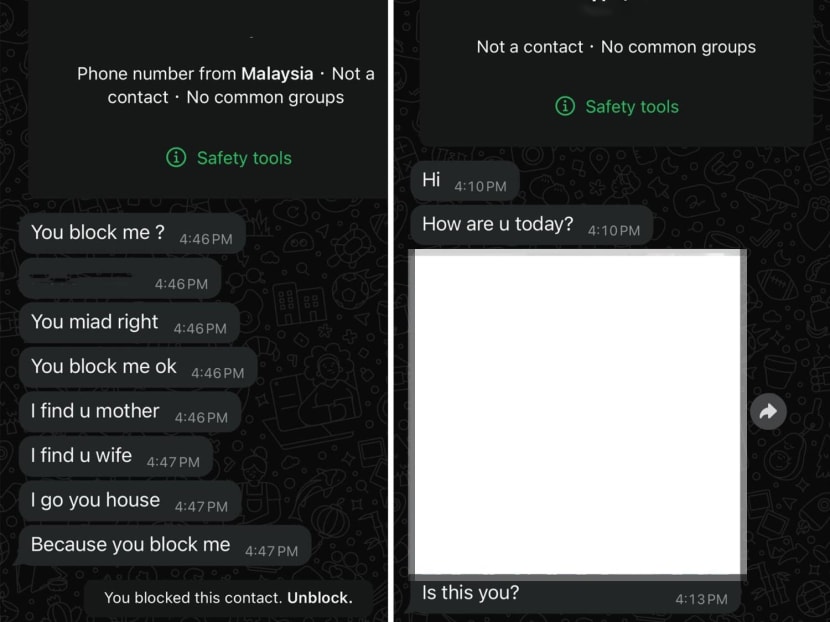

Despite blocking many phone numbers that sent threatening messages, the loan sharks still managed to track her down via social media, the 40-year-old teacher said.

They took screenshots of public photos of her face and sent them to her with messages such as “Is this you?” and issued other threats such as “I go your house because you block me (sic)”.

Ms Ika made four separate police reports during the harassment, which eventually stopped after three months in April this year when she blocked all the contacts and installed a closed-circuit television camera at her main door.

In May, Mr Md Sharif Uddin, a Bangladeshi worker, left Singapore after being fired by his employer amid alleged harassment by loan sharks and a failed last-minute appeal to extend his stay.

Mr Sharif denied ever taking any loan and the police did not find any evidence that he had borrowed from unlicensed moneylenders.

However, the company terminated his employment after the daughter of Mr Sharif’s employer said that she had received debtor’s notes and hell notes addressed to Mr Sharif at her home.

There are no publicly available statistics on cases relating to unlicensed money lender harassment, though such cases make headlines every now and then.

Notably, some lawyers told TODAY that they have seen more cases of teenagers or youths being recruited by these illegal moneylenders as their runners.

The police said on Thursday (June 20) that they too have seen an increase in the proportion of youth arrested for unlicensed money lending activities.

From January to May 2024, 8.6 per cent of unlicensed money lending arrests involved youths between the ages of 14 and 19, a spike from 3.1 per cent for the corresponding period in 2023.

A search of police news releases by TODAY found at least 67 reported cases of individuals being arrested for allegedly helping loan sharks in the past six months.

Many of the cases involved teenagers caught for alleged loanshark harassment, including a 14-year-old who was arrested on June 5, for suspected involvement in setting a fire outside a flat at Yishun Avenue 6.

Since January this year, at least three islandwide operations have been conducted to suppress unlicensed moneylending activities, with over 100 persons being investigated on each occasion for allegedly harassing debtors at their homes, carrying out bank transfers and providing banking information to facilitate unlicensed money lending business.

On June 8, the police said that 128 persons aged between 14 and 73 were being investigated for their suspected involvement in unlicensed moneylending activities, following a five-day islandwide operation in May.

On Friday, Ng Kwong Seng, a Singaporean man who rose through the ranks to become a “towkay” (boss) for an illegal moneylending syndicate based in China, was sentenced to 51 months' jail and a fine of S$495,000.

For 13 years, Ng had worked for the syndicate, which charged Singapore borrowers 20 per cent interest for loans.

With the “Ah Long” menace being a never-ending story, TODAY takes a closer look at how unlicensed moneylender harassment tactics have evolved in this digital age, and why this illicit industry persists.

OLD PROBLEM, NEW TRICKS

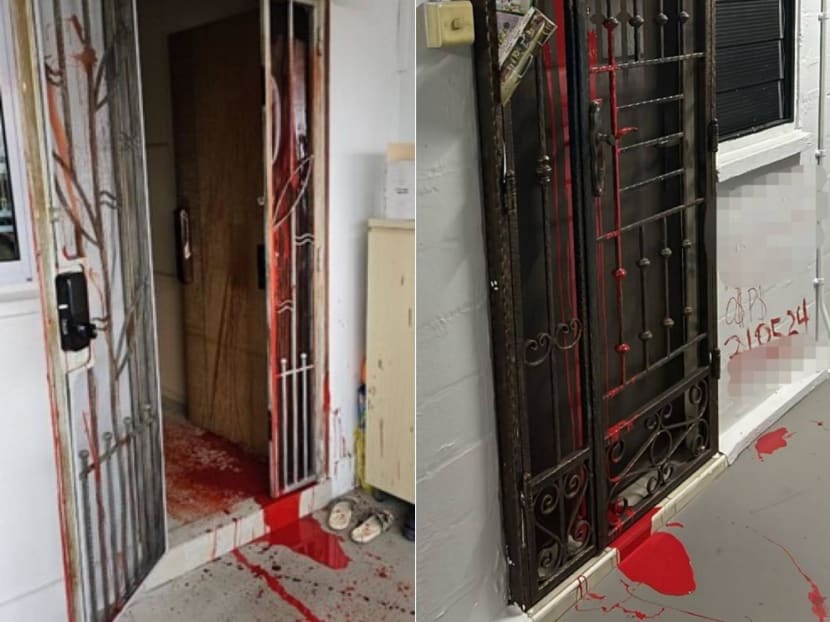

Before the dawn of the digital age, spraying paint and locking gates were among the unlicensed moneylenders’ favourite tools of the trade.

Ms Priya (not her real name), who works in the media industry, recalled a period when her family was harassed by loan sharks every few days between 2003 and 2008 after her father was saddled with unpaid debts.

“Common tactics were spray paint, putting a copy of my father’s identity card and address in all our neighbours’ letterboxes and chain locking our gate,” said the 34-year-old.

Harassers would bang on their door and shout in her family members’ faces to return money when they opened the door.

However, unlicensed money lenders had to reduce such “open harassment” tactics when the authorities installed closed-circuit television cameras in all lifts and at lift landings, said Ms Priya.

They instead adopted “very silent” approaches, such as having a person pass a letter through the door which demanded repayment.

The harassment eventually “tapered off” in 2008, said Ms Priya, who attributed this to a stepped-up police presence in her neighbourhood and her family successfully paying off their loans.

Mr Howard (not his real name), 28, recalled his family being the neighbourhood’s “public enemy” when they faced loan shark harassment.

The intimidation, which continued for over a month in 2010, included continuous calls looking for his father who had borrowed the money, and vulgarities and threats over the phone.

“They spray-painted my father’s and our house details across the block, at the lift lobby, ground floor and car park. We attempted to put a plastic sheet over our door to minimise the mess, however, they went on to splash red paint on our neighbours’ doors,” said Mr Howard.

The harassment stopped after one alleged harasser was caught while carrying paint in Mr Howard's neighbourhood. But having been stigmatised as the “family who borrowed from Ah Long”, Mr Howard’s mother later moved the family out of the area.

Ms Gloria James, head lawyer at Gloria James Civetta and Co, said that unlicensed money lenders typically use intimidation, harassment and threats to collect debts, including threats of violence to the borrower and their loved ones.

She noted that the persons involved in harassing borrowers may not be the actual moneylenders, but other individuals they engage as runners.

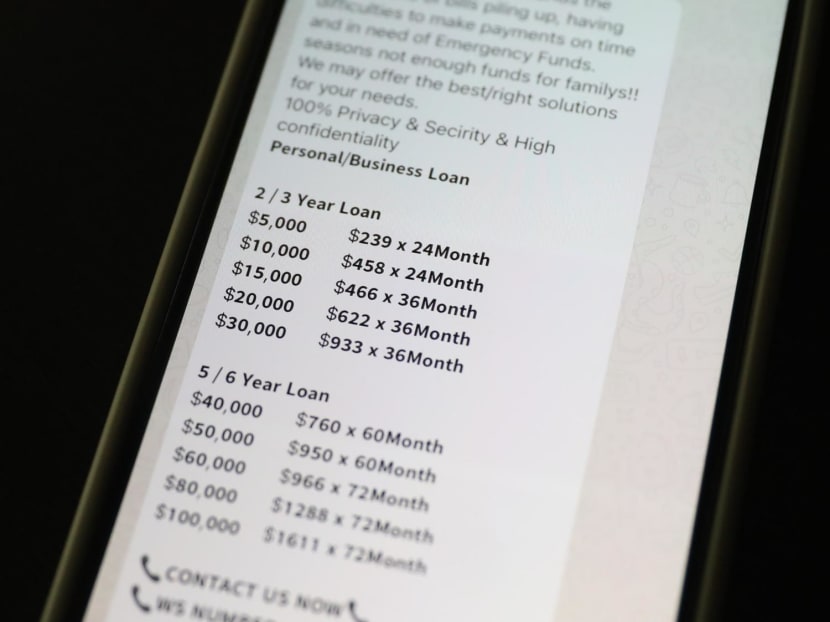

Recent years have also seen the increasing use of social media not only to harass debtors — but also to advertise and contact potential borrowers, such as in unsolicited messages boasting fast approval loans.

“Unlicensed money lenders have increasingly been using online tactics to harass debtors, including posting on social media platforms… this causes embarrassment for the borrowers and it would be difficult to detect given that postings can be made anonymously,” said Ms James.

“They may also contact neighbours, family members, co-workers and employers online in an attempt to cause harassment and to embarrass the borrower.”

She recalled her recent case where an unlicensed moneylender had contacted the borrower’s estranged wife and mother-in-law on Instagram, and sent them threatening messages in an attempt to demand payment.

Another victim of unlicensed money lender harassment, who wanted to be known only as Mr Tan, said his troubles started last month after his former domestic helper had purportedly borrowed around S$500 from an unlicensed money lender she had met on social media platform TikTok.

During the period of harassment, besides calls from unlicensed moneylenders, Mr Tan encountered five to six delivery platform workers from Lalamove sent to collect items from his house for three days.

He ended up installing closed-circuit television cameras outside his home in case the harassers took “more aggressive” actions, said the 45-year-old personal trainer.

A combination of factors finally put a stop to the harassment, including making a police report, unplugging his land line and urging Lalamove to ban the account that was sending orders to his house.

WHY DO 'LOAN SHARKS' STILL ATTRACT BORROWERS?

Despite the plethora of strictly regulated licensed money lending alternatives and the exorbitant interest rates charged by loan sharks, many still resort to borrowing money from illegal moneylenders due to financial and socioeconomic reasons, financial experts told TODAY.

For the borrowers, the perceived immediate access to cash with minimal documentation and credit checks are key factors that draw them to loan sharks.

Associate Professor of Finance Mandy Tham from Singapore Management University (SMU) noted that as legal lending requires the credit assessment of the borrower, it is less accessible to “subprime borrowers” whose credit assessment may not meet the loan requirements.

Subprime refers to a credit classification for borrowers who have a limited credit history, and for loans made to such borrowers who may pose a higher risk of being unable to repay their loan.

“When one could not meet the credit assessment of legal lenders, one has no choice but to borrow from loan sharks as a last resort, especially after exhausting friends and families,” said Assoc Prof Tham.

Those who borrow from loan sharks also tend to be from lower-income backgrounds who may be more “desperate”, and less able to access legal lending options, the experts said.

“With the ease of obtaining a credit card today or a credit line from the bank, only the communities that are struggling turn to such options (illegal moneylenders). It is less of an awareness issue, but more of a lack of options,” said Mr Reginald Koh, founder of financial literacy podcast The Financial Coconut.

“I believe this will never stop. Loan sharks have always been around, the increased discussion today merely reflects harder financial times for our fellow Singaporeans,” he added.

Associate Professor Razwana Begum, head of the public safety and security programme at the Singapore University of Social Sciences, said that gig workers, who may be living “day by day” on an unstable income with no savings may also be at “higher risk” of seeking financial assistance from unlicensed moneylenders.

“Immigrants and foreign workers are also targeted by unlicensed money lenders. Without established credit histories or sufficient knowledge of local financial systems, immigrants might see unlicensed moneylenders as accessible sources of funds,” said Assoc Prof Razwana, who is also a Nominated Member of Parliament.

WHAT AUTHORITIES ARE DOING

Over the years, various measures have been introduced to protect borrowers, including tighter regulation of licensed moneylenders and debt collectors, and harsher punishments for unlicensed moneylenders.

In a written parliamentary reply on trends in illegal moneylending activities in 2020, Minister for Home Affairs and Law K Shanmugam said that there was “no clear trend of increase” in terms of youths arrested for such offences every year.

He added that the police were stepping up efforts to counter these crimes, in light of the economic downturn potentially leading to more people seeking illegal loans.

“On the public education front, police launched the fourth anti-unlicensed money lending campaign in January 2020, with the aim of increasing public awareness, first to not to borrow from unlicensed moneylenders or work for them”

He added that social assistance and credit counselling agencies also provide help for unlicensed money lender cases.

In November 2008, the Moneylenders Act 2008 was passed in Parliament. The Act, which came into effect in March the next year, clarified the money lending activities to be licensed.

Under the updated law, all moneylenders who grant secured and unsecured loans to the public have to be licensed and regulated, adhering to regulations including restrictions on publishing false and misleading marketing material.

It also introduced measures to counter loansharking such as extending the punishments for those who instigate harassment activities to include caning.

Since then, various amendments to the Act have been made, including tightening the laws to tackle loan sharks more effectively.

LAWS FOR MONEYLENDING SECTOR

In 2018, changes to the Moneylenders Act were passed in Parliament.

These include amendments to help prevent over-borrowing, including adding a cap to ensure that those earning less than S$20,000 a year may borrow only up to S$3,000 from all moneylenders combined. Those earning above this amount can borrow up to six times their monthly income.

Regulations related to unlicensed moneylending under the Moneylenders Act 2008 include:

- Individuals engaging in unlicensed money lending can be jailed for up to four years and fined between S$30,000 and S$300,000 upon a first offence

- Individuals found guilty of harassing borrowers in connection to an unlicensed moneylender can be jailed for up to five years and fined up to S$50,000, with a minimum fine of S$5,000. First-time offenders can also face up to six strokes of the cane

As for licensed moneylenders, some of the restrictions they face include:

- Caps on the total maximum amount borrowers may loan depending on their citizenship and annual income range for unsecured loans

- Cap on the maximum interest rate at 4 per cent per month regardless of the borrower’s income and type of loan

- Licensed moneylenders can only advertise through business or consumer directories, their own websites, and advertisements at their premises

- Advertisements in the form of text messages, emails or flyers are not permitted

A few years later in 2022, Parliament passed the Debt Collectors Bill to regulate debt collection activities in Singapore, following a “high number of police reports” on debt collector harassment the previous year.

A statement from the Ministry of Home Affairs then noted a spike in the number of police reports against debt collectors acting in a manner that caused “alarm and nuisance” to members of the public.

The Bill introduced a licensing regime for the debt collection industry, requiring firms to have a licence to operate and have their workers screened and approved by the authorities.

Licensed debt collectors told TODAY that since the introduction of the Debt Collectors Act, which took effect in 2023, companies have adapted to greater scrutiny on tactics that might be perceived as harassment.

Mr Sean Lee, business manager of Assured Debt Recovery, said that debt recovery is more difficult with the tighter regulations, especially when encountering “aggressive” or uncooperative debtors.

Certain debt collection tactics such as hanging banners identifying debtors at their residence are outdated, he said.

However, he emphasised that it is also important for the law to weed out the “black sheep” in the industry who may go “overboard” with their debt collection tactics to embarrass debtors.

Mr Lee’s staff wear uniforms and adhere to industry practices such as wearing body cameras to record the entire debt recovery process, so that debtors are also clear that the staff are legal debt collectors.

Mr Leroy Frank Ratnam, chief executive and commercial adviser at debt collection firm JMS Rogers Global, said the firm follows a “strict protocol” for engagements with debtors.

While its debt recovery tactics have remained largely the same, the company has strengthened its “intelligence divisions” to ensure they have the “most accurate data” on debtors to increase the probability of collections.

“Gone are the days of using the approach of aggression and intimidation. Debts can be collected with the accurate study of the situation and the crafting of the right strategy to approach,” said Mr Ratnam.

EASIER TO RECRUIT RUNNERS, HARD TO TRACK LENDERS

More than expanding the ways unlicensed moneylenders harass debtors, online platforms have also enabled recruitment of those who assist unlicensed moneylender activities, especially young persons.

Lawyers who have acted in proceedings related to unlicensed moneylending noted an increase in young people being recruited to assist unlicensed money lender activities, including harassing borrowers.

Telegram has been a “game changer” in the past five years, as a transnational messaging platform popular among youths where users can be easily recruited for criminal activities, said lawyer Kalidass Murugaiyan, who has worked with young offenders between the age of 16 and 22.

“Around 10 to 15 years ago, (recruitment) used to be on websites. There were popular forums where these (listings) were posted, but now it’s gone even deeper, because it’s on Telegram. If you go to Telegram and type ‘Sell ATM card’, you might get something,” said Mr Kalidass from Kalidass Law Corporation.

Young people can also be “easily manipulated”, as some unlicensed money lenders will “acclimatise” runners by asking them to do less aggressive modes of harassment, such as placing a debtor's note, before asking them if they want to do “something more” for an additional S$100.

Mr Kalidass cited cases where the youths involved were told they only had to place a post-it note at debtors' homes, but were later asked to buy paint and splash it there, which they may feel pressured to do since they were “already in the loop”.

Lawyer Ray Louis also noted an increase in young offenders involved in cases of unlicensed moneylender harassment, who were recruited over Telegram or online marketplace Carousell.

The youths’ parents were not aware of their involvement with loan sharks until it was uncovered by the authorities, as the youngsters’ handphone usage was unsupervised.

“For the young who are naive, it just means going to the debtors' home, doing some stuff and then running away. So they think it's a simple job and they get paid S$50 to S$100,” said Mr Louis from Ray Louis Law Corporation.

Furthermore, young persons may be more easily recruited because they or the loan sharks recruiting them are aware that young offenders, such as those between 16 and 21 years old, are likely to get lighter sentences such as probation if convicted, though it is always possible for them to get a harsher punishment like reformative training.

“In the past, more adults were involved. However, with the penalty of possibly jail and also caning, a lot of adults may not be willing to take the risk,” said Mr Louis.

“My last client was young, (studying) at the Institute of Technical Education and he was accused of harassing debtors. He did get probation, but this exemplifies the trend right now.”

As for why young persons are drawn to working as runners, the police said on Thursday that youths tend to commit such offences for “fast cash”.

For conducting harassment such as splashing paint or placing a bicycle lock at a debtor’s gate, the going rate can be S$300 to S$800 per job, though some are paid less, said officer-in-charge of the Bedok Police Division's Anti-Unlicensed Moneylending Squad, Assistant Superintendent of Police (ASP) Michael Ho in an interview with the media.

He pointed to a March 2020 case where four youths aged between 17 and 18 were caught for vandalising a house with paint and locking a gate with a bicycle lock.

The youths in that case confessed to having committed the acts for “quick cash” and having learned about the job through a Telegram group called “SG Fast Cash”.

They were offered S$100 as a group for this incident of harassment and eventually charged in court and sentenced to 21 months of probation.

When asked if there was a noticeable trend of youths who commit such offences being from lower-income families, ASP Ho said that these youths typically come from a range of backgrounds.

“Some of them come from better off families, but (they commit these offences) because of the attraction (of earning money) and the lifestyle, their daily expenditure, (as) they may spend more as compared to previously,” said Mr Ho.

Lawyer Sanjiv Vaswani said that his firm Vaswani Law Chambers has also seen a “marked increase” in the number of enquiries from young persons charged with being debtors turned runners.

This refers to individuals who cannot secure a credit line with a bank and so turn to online advertisements promising easy cash for a work-from-home opportunity, which can turn out to be “bait advertisements” for unlicensed moneylenders offering quick loans, said the former prosecutor.

“Subsequently when it is time to repay and the borrower can’t keep up with payments, these unlicensed moneylenders will sometimes use these younger borrowers as their runners to harass some of their bigger clients,” he added.

POLICE RESPONSE TO EVOLVING LOAN SHARK TACTICS

The authorities said that they are monitoring the evolving landscape of unlicensed moneylending, and are working with various stakeholders to address new methods of harassment.

Senior Investigation Officer of the Criminal Investigation Department’s Unlicensed Moneylending Strike Force, Inspector Ong Tiam Huat, highlighted a February 2024 case where a woman was charged in court for using her TikTok account to promote and advertise an illegal moneylending business.

“The police work closely with all the relevant stakeholders, including social media platforms to tackle the online unlicensed moneylending activities, and we’ll continue to take tough enforcement action against those involved in loansharking activities,” he added.

While the evolution of the unlicensed moneylending space to the digital realm has made tracking the perpetrators and syndicates more difficult, officer-in-charge of the Criminal Investigation Department’s Unlicensed Moneylending Strike Force, Deputy Superintendent of Police (DSP) Alvin Li, said the police go through training to understand how these platforms work and the measures needed to curb criminal activity.

With the strict laws and enforcement here, unlicensed moneylending syndicates have “shifted overseas” and syndicate members maintain a “high level of secrecy”, DSP Li said.

“It makes it challenging, or even impossible for us to uncover their identities. Witnesses fear reprisal to themselves and family members should the syndicate members come to know that they provided information to the authorities,” he added, stating that some witnesses can turn “hostile” and refuse to cooperate with police investigations.

He shared an example of a “towkay”, or financier of an overseas unlicensed moneylender syndicate, who operated “behind the scenes” and was dealt with under the Criminal Law (Temporary Provisions) Act in 2019 after the police tracked the syndicate for over three years.

The Act is a decades-long law that allows the detention of people linked to certain criminal activities, including secret societies and unlicensed moneylending, without trial.

DSP Li said this syndicate was linked to over 1,800 reported cases of harassment here, but prosecution of the man was “not viable” as borrowers were unable to identify him and syndicate members were afraid of testifying against him.

“We had to work with foreign law enforcement agencies to locate him and process his coordination back to Singapore,” said DSP Li.

“The unlicensed moneylending syndicates will continue to evolve and exploit the easiest ways to harass borrowers and their families. They will stop at nothing. We will continue to monitor the trend, the tactics, and work with the various stakeholders to disrupt their activities, and identify and prosecute these offenders.”

In terms of public education efforts, the police also conduct anti-unlicensed money lending talks during outreach efforts to “vulnerable groups” such as migrant workers, students and volunteers from non-governmental organisations, said Insp Ong.

During school engagements, the authorities will highlight the seriousness of getting involved with unlicensed moneylending activities and the consequences by law of engaging in such actions.

The authorities also engage with young offenders' parents during the course of investigations, and refer them to other resources such as counsellors through the Ministry of Social and Family Development, said ASP Ho of Bedok Police Division.

"We will talk to parents and try to understand more. Let's say if the youth is rebellious or always asking their parents for money, through talking to parents we will ... see how to help them and refer them to the appropriate resources for the future."

GETTING TO THE ROOT CAUSE

Despite the well-documented horror stories about victims of loan sharks, illegal moneylenders will continue to exist in some form simply because there is demand for them, said experts.

Associate Professor of Sociology Alwyn Lim from SMU said: “Illegal money lending indicates to us that in this society, there is much more of a demand for liquidity than actually exists, that is, things seem to need a lot of money.

“As long as the demand for liquidity exceeds the supply, there will be an illegal industry that forms around it. If our society wants to tackle that, we have to get to the roots of what is causing that.”

Mr Josephus Tan, managing director of Invictus Law and a criminal lawyer who has represented clients as young as 14 in such cases, noted that many of his cases were done pro bono for the “down and out” who became involved with loan sharks because of their financial or family circumstances.

He recalled a case of a man who had borrowed money from loan sharks because he had no money to pay for his father’s funeral.

In another case, a man with a failed small business who contracted cancer borrowed money from loan sharks to pay for his family's medical bills. To offset his debts, the loan sharks asked him to hand over his banking information to them.

“People recruited by loan sharks are victims in their own right, either the young and ignorant who want to make a quick buck or those who owe the unlicensed moneylenders and are trapped in the vicious cycle (of assisting lenders),” said Mr Tan.

One way to help people who are more likely to borrow from unlicensed sources is to introduce “targeted, contextualised” saving plans and financial literacy programmes for them, said Assoc Prof Razwana.

She also suggested enhancing “financial inclusion” by increasing access to credit for low-income individuals, such as through microfinance and community banking initiatives.

Mr Louis Chua, a Member of Parliament (MP) for Sengkang Group Representation Constituency, suggested that “ethical lending practices” should be encouraged, apart from raising awareness on the dangers of illicit borrowing.

Strict regulations on all forms of lending, even from licensed moneylenders and banks, to prevent “exorbitant interest rates” and “highly misleading” charges should also be encouraged to protect borrowers, he added.

“Beyond that, we should also establish stronger support systems for those in financial distress, offering a range of services from counselling, to emergency financial assistance and even debt restructuring programmes,” said Mr Chua.

Mr Lim Biow Chuan, MP for Mountbatten Single Member Constituency, pointed to the various agencies that people can turn to.

“Those who are from low-income backgrounds should also know that there are different available to assist them with their finances, for example, from Social Service Offices and Comcare,” he said.

On the issue of young runners, Mr Melvin Yong, MP for Radin Mas Single Member Constituency, said that during his time as a police officer, he had come across many cases of unlicensed money lending and saw the impact it had on those involved, including youths recruited by loan sharks.

This motivated him to create the bi-annual youth engagement programme, Delta League, in 2011, to engage youths through football and keep them “meaningfully occupied” during the school holidays.

While illegal moneylending may seem impossible to eradicate, the question then is whether the same can be said of harassment of borrowers.

Ms James noted that as many unlicensed moneylenders may be based overseas, it has become “trickier” for local authorities to catch them.

Agreeing, Mr Vaswani noted that unlicensed moneylending is a criminal enterprise that is “borderless”, as the masterminds can “easily tap” people in Singapore to conduct harassment or lending of their personal bank accounts no matter where they are based.

“We need to address the root of the problem — which is why do people have to borrow from such sources in the first place? Are people doing so to feed an addiction?

“Or is it to feed their family, in which case the other question to ask is were there no other alternatives? Theoretically, if you strip away the need to borrow from such sources and you will slowly dismantle the unlicensed moneylending industry,” he said.

Lawyers also noted that victims of loan-shark harassment are often caught in a “double bind”, given that borrowing from such lenders is also illegal.

“They might fear getting in trouble themselves if they report the activity. As a result, even if they do come forward, they might be hesitant to provide the full details of the situation, hindering prosecution efforts,” said Ms James.

“This lack of cooperation, stemming from a well-founded fear of violence and potential legal repercussions, makes it significantly harder to build strong cases against the lenders.”

Still, lawyers said that cracking down on runners and illegal local lenders can curb the harassment problem.

“Law enforcement can still put pressure on the unlicensed moneylender and their operations by taking strict action against the runners and local lenders, as well as seizing assets,” said Ms James.

Mr Vaswani emphasised that the ubiquity of police cameras in housing estates has also gone a long way in the identification and tracing of suspects involved in loan shark harassment, and the freezing of bank accounts used for unlicensed moneylending activities can greatly hamper illegal moneylending operations.

At the end of the day, reducing inequality is key to ending the “Ah Long” problem, said Assoc Prof Razwana.

“As long as inequality exists, we will not be able to completely eradicate unlicensed money lenders. However, we could try to minimise the dependency and make it harder for them to operate.”