The Big Read in short: Singapore’s telco wars — a race to the bottom?

Each week, TODAY’s long-running Big Read series delves into the trends and issues that matter. This week, we look at the impact of the fourth telco’s entry and the state of the industry. This is a shortened version of the full feature.

There are now nine mobile virtual network operators (MVNOs) which are selling mobile plans, slugging it out in a price war to seize market share.

Each week, TODAY’s long-running Big Read series delves into the trends and issues that matter. This week, we look at the impact of the fourth telco’s entry and the state of the industry. This is a shortened version of the full feature, which can be found here.

- The price and data war, sparked by TPG Telecom’s entry as Singapore’s fourth telco, has not stopped

- It has been a year since TPG launched its commercial plans that boast high data allowances at cheap prices

- A wide field of players offering alternatives to the big telcos has led to lower prices across the board

- Some experts have questioned whether the competition based purely on price is healthy and sustainable

- They note that a “reset” to the price competition may come soon as 5G is rolled out here

SINGAPORE — Today, the average person pays between 20 and 50 cents per gigabyte for the most basic mobile plans, which is up to 25 times more cost-effective than what it was five years ago.

This steep plunge in prices was not due to any technological marvel that occurred in the past five years.

Instead, the authorities in 2016 had sought to shake up Singapore’s telco industry that was made up of three 800-pound gorillas — Singtel, StarHub and M1 — by introducing a fourth player into the picture. Australia’s TPG Telecom was granted a licence, and mobile plans prices have fallen ever since.

It has also been a year since TPG launched its paid commercial services in March 2020, kicking off the Infocomm Media Development Authority’s (IMDA) vision of a liberalised and competitive consumer mobile industry.

Mr Richard Tan, TPG Telecom’s chief executive, said: “TPG is the first real competitor to enter the market. Real, in the sense that we obtained spectrum, we've built a completely brand new network, we've introduced efficiencies into the business not seen before.

“And as such, we were able to bring products and services which benefited the market.”

There are now nine mobile virtual network operators (MVNOs) which are selling mobile plans, slugging it out in a price war to seize market share.

But as companies inevitably bow out amid this war of attrition in the years ahead, there are signs that this era of cheap mobile plans may not last, several experts told TODAY.

Some also questioned whether market liberalisation had only resulted in a cost-cutting price war that hurt the industry’s ability to innovate.

Associate Professor Nitin Pangarkar, from the National University of Singapore (NUS) Business School, said: “You can’t have affordable low prices and also have innovation and quality customer service. Something has got to give.”

HOW TELCO INDUSTRY OPENED UP OVER 20 YEARS

The telecommunications industry in the 90s was a monopoly held by Singtel, whose unrivalled position propelled it to become one of Singapore’s largest companies.

The authorities sought to liberalise the industry then in order to fulfill Singapore’s ambitions to become Asia's largest infocommunications hub. Hence, Singtel’s licence as the sole provider of mobile services in Singapore lapsed 21 years ago on April 1, 2000. Licences were granted to rivals M1 in 1997, and StarHub in 2000.

It remained the case for several years. Associate Professor Lawrence Loh, associate professor of strategy and policy at NUS Business School, described this as an oligopoly consisting solely of three local players.

The strategy then was to lock customers into contracts and grow the average revenue per user over time, as there wasn’t much of an incentive to improve, added Prof Pangarkar.

“In such a market structure, businesses tend to have a tacit agreement among themselves, which is to make hay while the sun is shining.”

So in 2016, when the authorities wanted to facilitate the entry of a fourth telco to drive greater competition and innovation in the sector, the move was met with protests from the incumbents.

Singtel, for example, warned that the entry of a new operator would drive the focus of the industry competition to price alone.

Responding to TODAY’s queries, Singtel’s CEO of consumer Singapore Dr Anna Yip reiterated Singtel’s stand that a fourth telco was not a necessity for the industry to improve.

Despite this, the authorities went ahead and held a new entrant spectrum auction.

An IMDA spokesman said it wants to facilitate a vibrant telecommunications landscape in Singapore undergirded by fair competition. So in 2016, it set out an “exceptional arrangement” to lower entry barriers for the new entrant, setting aside preferential spectrum resources only available to new entrants.

The spokesman said in each instance when a new telco is introduced in the past, IMDA has observed benefits to consumers such as lower prices, better value offerings, enhanced service quality and more innovative services.

“Today, the mobile market is highly competitive. To succeed, operators, as commercial businesses, will need to understand market conditions, and offer services that meet consumer needs, while adhering to regulatory requirements that protect consumers’ interests,” said the spokesman.

PRICE AND DATA WAR

The two final bidders in the spectrum auction were TPG and homegrown favourite MyRepublic, which was already a disruptor in the consumer broadband segment. Unlimited data at affordable prices was to be its trump card.

In an interview then, MyRepublic CEO Malcolm Rodrigues nevertheless said that his company would have no interest in being the fourth operator if the market was only about a price war.

In the end, however, MyRepublic’s S$102.5 million bid lost out narrowly to TPG’s S$105 million offer.

Paying more would mean that MyRepublic would not be able stay true to the vision it had as a fourth telco, the company said then.

With MyRepublic’s dreams dashed, it fell upon TPG to take on the behemoths.

Assoc Prof Pangarkar said: “The fourth telco had its own agenda. It didn’t mind rocking the boat, and so that was the thinking behind the liberalisation of the market.”

But before TPG could establish a foothold, the incumbent telcos allowed the entry of MVNOs such as Circles.Life, Zero1 and RedOne, which triggered a price war that continues till today.

These low-cost outfits lease network capacity from Singtel, StarHub and M1, and thus do not have to build or maintain the cell network infrastructure.

They would undercut the prices of the incoming telco, which would have to build a whole new network from scratch.

THE NEWCOMER’S JOURNEY

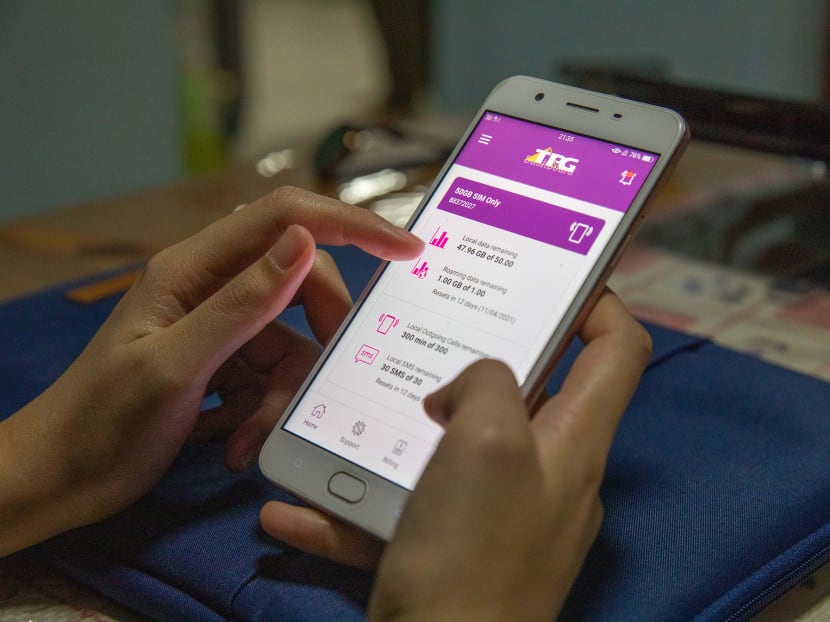

Despite the competition from other telcos and MVNOs, TPG generated headlines when its SIM-only plan offer — S$10 for 50 gigabytes — was launched on March 31, 2020. It has remained as the best deal on paper.

TPG said its price advantage came from the fact that it only had to support 4G technology, at a time when our competitors had to do both 3G and 4G.

“It’s the leap-frogging that we were able to do. We think we came in at a good point in the inflection of technology,” said TPG’s chief technology officer Benjamin Tan..

Still, the journey has not been smooth-sailing, said Mr Richard Tan. There were difficulties in building a new network in Singapore, which involved the tedious and complicated matter of installing base stations in underground areas, MRT tunnels and military camps.

It did not help that TPG’s commercial launch coincided with the Covid-19 pandemic that began early last year, which partly affected the mandatory MRT tunnel trials needed to test TPG’s signal underground.

There were also regulatory hurdles that prevented TPG from completing its works in underground road and rail tunnels by end 2021, said Mr Richard Tan.

“It was a huge challenge getting our signal into the tunnels because it required the cooperation of our competitors who technically own the system. There's a lot of work that was done there… If you ask me, it would have been good if we had completed all of our tunnel coverage before the commercial launch,” he added.

When it receives feedback regarding consumer issues or anti-competitive conduct, IMDA said it will conduct a thorough investigation. Licensees in breach of its competition rules will face enforcement action, it added.

Mr Sam Fenwick, senior analyst at consumer mobile analytics firm Opensignal, said that since the start of 2019, TPG and the MVNOs have gained users from churn at the expense of Singtel, StarHub and M1.

But TPG also started to lose some of its users after its commercial launch, which Opensignal said was due to consumers who ditched their free TPG trial plans and did not continue with the telco.

When asked about a 400,000 subscriber target in Singapore in order for the company to reach break even point, Mr Richard Tan said he is not able to reveal any figures about subscriber counts.

“We are working hard to achieve it,” he said.

SERVICE QUALITY AND INNOVATION

One thing that the newcomer telco and the MVNOs have in common is a lean digital business model, which allows them to save on rental and staff costs, and thus offer cheaper mobile plans.

MyRepublic Singapore managing director Lawrence Chan said the competition has been healthy as it has forced operators to relook their services and push for more innovation and efficiency in order to thrive.

“Telcos are much more driven now to seek automated solutions to maintain margins,” said Mr Chan.

M1’s CEO Manjot Singh Mann said that in February, his telco announced its digital transformation plans as part of its goal to become Singapore’s first digital network operator.

With M1’s new digital platform and artificial intelligence, customers can easily access self-service options and solve problems with a click of a button, said Mr Mann.

Likewise, Mr Johan Buse, StarHub’s chief of consumer business, said that his telco has also worked to provide a digital-first approach for service.

But when it comes to the automated aspect of customer service, some experts said that certain cost-saving measures may have gone a bit too far.

Assoc Prof Pangarkar said: “People like low prices, but they also expect to have some level of personal service from their telcos.”

Other mobile users interviewed also had similar gripes about customer service, and service-related complaints have plagued the crowded industry of telcos and MVNOs in recent years.

TPG came under fire last year for poor customer service. It did not have a hotline that its customers, especially elderly users on its seniors SIM-only plan, could turn to for technical support.

TPG executives said the telco now has an in-house customer service team to respond to feedback, on top of its website of frequently asked questions and email support.

This growing reliance on digital solutions as a cost-saving measure may irk some and may not be what IMDA had in mind when it embarked on market liberalisation, experts and industry players said.

These solutions are only considered as a form of innovation if they improve customer experiences.

In its response, IMDA said it requires all operators including new entrants to expeditiously resolve any issues relating to consumer protection, such as those regarding customer service quality.

“Our objective is to safeguard consumers’ interests,” said the regulator.

Assoc Prof Loh said: “Liberalising a market increases competition which normally leads to more innovation. However, it is not always the case that a competitive market structure provides better incentives for innovation.

While telcos may have resorted to price competition as a “sure-fire” way to seize customers and gain market share, “cut-throat price competition is not sustainable”, he added.

StarHub’s Mr Buse added: “We believe that a greater degree of sustainable competition will allow more investment to promote innovation that will benefit the industry and customers.

“A singular focus on price competition will adversely impact such innovation and investments,” he said.

Dr Yip from Singtel put it in more direct terms, stating that having a fourth player in Singapore’s telco industry is not sustainable.

“We do not believe it’s sustainable to have a fourth player in any market, let alone a small market like Singapore,” said Dr Yip.

WHAT DOES THE FUTURE HOLD?

The industry is now at a transitioning point to the use of 5G networks, which are expected to become the next frontier in telephony.

Last year, IMDA awarded the rollout of 5G network infrastructure to Singtel and a joint venture corporation consisting of StarHub and M1.

TPG lost the bid, and will only be able to lease 5G capacity from the two operators. The two chosen operators have to provide coverage for half of Singapore by the end of 2022, and provide nationwide coverage by end-2025.

But the loss of the 5G infrastructure to the incumbent telcos has led some to question TPG’s long-term survival — leasing from the incumbents could mean that the fourth telco’s future mobile prices would be at the mercy of the other three.

The arrival of 5G would most likely “reset” the ongoing price competition, said analysts. That means that the price war that has benefited consumers all this while will probably come to an end, with prices expected to rise again when 5G plans offered by the incumbent telcos become prevalent.

Already, there are initial signs of price hikes.

As of last November, the 5G version of Singtel’s five gigabyte a month plan cost 21 per cent more than the same in 4G. StarHub’s 5G plans also had similar increases.