The Big Read in short: What a K-shaped recovery means for Budget 2021

Each week, TODAY’s long-running Big Read series delves into the trends and issues that matter. This week, we look at what’s in store for Budget 2021 and how it will be shaped by an expected K-shaped recovery for Singapore’s economy. This is a shortened version of the full feature.

With sectors such as manufacturing, finance as well as information and communications technology (ICT) chugging along steadily — even as sectors such as aviation and tourism have yet to detect any light at the end of the tunnel — support measures in Budget 2021 will largely be very targeted, said economists and observers interviewed by TODAY.

Each week, TODAY’s long-running Big Read series delves into the trends and issues that matter. This week, we look at what’s in store for Budget 2021 and how it will be shaped by an expected K-shaped recovery for Singapore’s economy. This is a shortened version of the full feature, which can be found here.

- With the Covid-19 pandemic having an uneven impact on Singapore’s economy and people, observers say the recovery path would be quite different from past crises

- Budget 2021 would have to address the unique challenges of what economists term a K-shaped recovery

- Support measures in this year’s Budget is likely to be targeted, with help focused on hard-hit sectors like aviation and tourism

- With the economy still weak, Budget 2021 is expected to be an expansionary one, which means the new term of the Government will start its first fiscal year with a deficit

- Observers expect any hike in GST to take place only from 2022

SINGAPORE — After working as a tour guide for 10 years, Ms Jessie Seah’s professional life took a drastic turn when the Covid-19 pandemic hit Singapore’s shores last year.

Unable to serve tourists anymore due to global travel restrictions that have halted most forms of tourism, Ms Seah, 48, has been working as a safe distancing ambassador in the past year.

“At first, of course it hit me. I thought ‘wow I am not going to be in tourism for the next few years?’ It saddens me emotionally, mentally,” she said.

Apart from the psychological impact, Ms Seah’s income has also been reduced by 30 per cent.

Fortunately, the impact of Covid-19 on livelihoods has been less devastating on some other Singaporeans, such as Mr Johnston Seah (no relation to Ms Seah). As far as Mr Seah is concerned, his job security is not under threat and apart from the nationwide rules to curb the spread of the pandemic, it has been more or less business as usual for him.

Mr Seah, 32, works in the finance department in a food and beverage (F&B) manufacturing plant. While his company’s sales have been affected, it was still able to provide financial help to its staff.

The crisis also accelerated his company’s plans to digitise its work processes, which enabled him to work from home.

“At the start of Covid, my wife was in the second half of her pregnancy. Being able to work from home was favourable for my family’s situation. Work wise, I didn’t feel that things have changed a lot,” he said.

The dissimilar experiences of Mr Seah and Ms Seah reflect how the coronavirus has had an uneven impact on Singapore’s economy and its people, even though they have been living through the same pandemic in the same country with the same set of restrictions.

Measures to curb the spread of the disease — which included a two-month circuit breaker that halted almost all economic activities and the subsequent gradual relaxation of safe distancing requirements — have impacted various sectors quite differently.

And this uneven spread of Covid-induced misery would have been very much on the minds of policymakers as they crafted Budget 2021, which will be delivered by Deputy Prime Minister and Finance Minister Heng Swee Keat on Tuesday (Feb 16) in Parliament.

It is also this unevenness which has led some observers to believe that this year’s Budget will be different from previous ones, given how the recovery path from this unprecedented crisis — which some have termed as a “K-shaped recovery” — will be different from past crises.

“It is like you are trying to drive a car with one or two of your wheels still punctured. This makes this year’s Budget a little bit interesting. Although you can say it is a recovery year, it is not a typical recovery year,” said Ms Selena Ling, head of treasury research and strategy at OCBC Bank.

With sectors such as manufacturing, finance as well as information and communications technology (ICT) chugging along steadily — even as sectors such as aviation and tourism have yet to detect any light at the end of the tunnel — support measures in Budget 2021 will largely be very targeted, said economists and observers interviewed by TODAY.

A DIFFERENT TYPE OF RECOVERY

More than a year after Covid-19 surfaced, there is a general consensus among economists that Singapore has moved past its worst days.

While Singapore is gradually moving out of the woods and entering a recovery phase, observers whom TODAY spoke to remained cautious about the pace and form of recovery this year.

Some sectors, such as construction, are poised for recovery given that restrictions on the movement of foreign workers living in dormitories are gradually easing and projects have largely resumed, though at lower capacities.

Other sectors, including finance, ICT and manufacturing, even recorded growth in Singapore’s worst- performing year.

Then, there are travel-related sectors, including aviation and tourism, which would likely remain in a “coma state”, said Ms Ling, since international borders remain closed as the coronavirus continues to spread unabated in many parts of the world.

The implications arising from a K-shaped recovery — whereby one part of the economy recovers while another segment suffers — are what Budget 2021 will seek to address, said some observers.

NO ‘BIG BAZOOKA’ BUT TARGETED SUPPORT

This year’s Budget will not see the same “big fiscal bazooka” that the authorities unveiled in 2020, said those interviewed.

A total of S$92.9 billion was doled out last year across four Budget speeches and two ministerial statements delivered in Parliament by DPM Heng. Out of this, S$52 billion was drawn from Singapore’s past reserves.

Observers agreed that the various schemes would taper off or even expire for industries that are recovering or doing well amid the pandemic.

However, they noted the need for continued support for the hard-hit aviation and tourism sectors to maintain Singapore’s status as a connectivity hub.

Companies from the aviation and tourism sectors told TODAY that they hope to see existing support measures continue in 2021, beyond the current expiry date of March 31.

These include the wage subsidies through the Job Support Scheme (JSS), property tax rebates, rental rebates, waivers on foreign worker levies, subsidies and salary support for reskilling programmes, rebates on landing and parking charges for aircraft.

Dr Kevin Cheong, executive director of 4D Adventureland, said that his Sentosa attraction is not able to make ends meet despite efforts to boost domestic tourism with the SingapoRediscover Vouchers.

Mr Musdalifah Abdullah, chief financial officer at airport services provider dnata, said that he is concerned about the potential impact on the aviation sector if the Government’s assistance stops after March.

“Without having a government-to-government agreement and having travel bubbles that work, I think we may be a forgotten sector. The ministers are telling good news, saying there is job recovery, the market is increasing, there are investments and all that. But to be honest, the aviation sector is excluded from all of that,” said Mr Musdalifah.

Beyond the short- and medium-term, industry insiders worry how this crisis might bring about more long-term challenges — such as the structural decline in the aviation and tourism sectors as the pipeline supply of talent shrinks over the next few years.

Some have warned that hospitality courses offered by polytechnics and institutes of technical education may see smaller intakes, as prospects for the industry remain gloomy.

Mr Gary Ho, 46, was in the midst of his doctoral programme on aviation when Covid-19 hit last year. The Temasek Polytechnic senior lecturer in aviation management said that Budget 2021 should provide training subsidies for aviation professionals to upgrade their skills so that the industry would be more than ready when the recovery comes.

TARGETED HELP FOR INDIVIDUALS

The uneven impact of the pandemic is not only felt across different economic sectors. It is also the same story for different income groups.

Research has shown that lower-income earners have been more severely affected by the Covid-19 disruptions, compared to their middle- and higher-income counterparts.

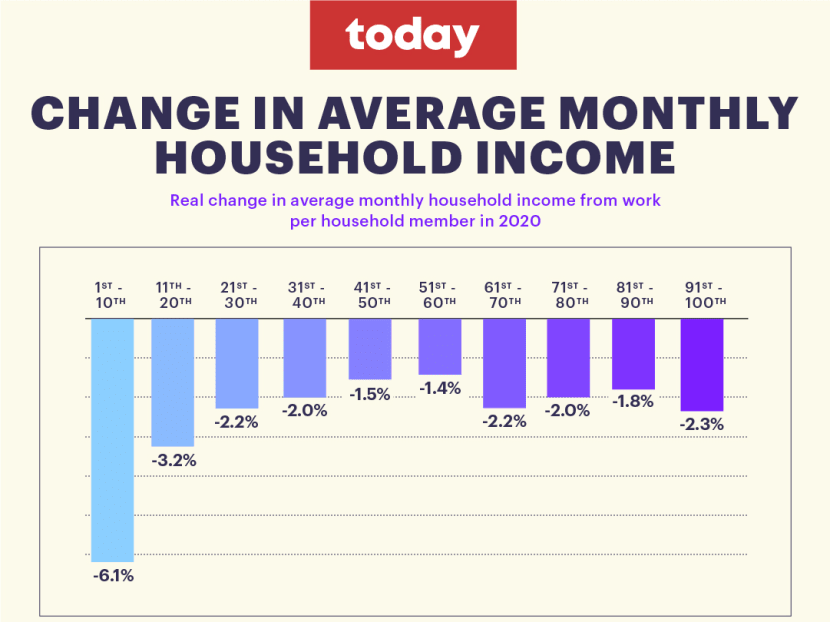

A recent report on household income by the Department of Statistics showed that the bottom 10 per cent of households in Singapore saw their average monthly income per member shrink by S$37 last year, or 6.1 per cent of their total earnings from work, making them the hardest-hit group in the pandemic.

At the other end of the spectrum, those in the top 10 per cent income group earned S$337 less each month last year, or 2.3 per cent of their earnings from work.

DBS’ Mr Seah believes that Budget 2021 could provide incentives for companies to hire low-wage workers.

For example, the current Jobs Growth Initiative, which provides higher salary subsidies for companies which hire older Singaporeans, could be extended to cover low-wage workers as well.

Companies that relied on low-wage foreign workers to perform essential services could be encouraged to offer higher wages and hire locals instead.

TIMING OF GST HIKE

Apart from the Government’s plans to steer Singapore on the road to recovery, all eyes will also be on any announcement on the timing of the Goods and Services Tax (GST) hike.

At Budget 2020 delivered in February last year, DPM Heng assured the public that the impending GST hike would not take place in 2021 but stressed that it could not be postponed indefinitely.

He first announced the intended GST hike from 7 to 9 per cent in Budget 2018, and said then that the increase would take place some time between 2021 and 2025.

Observers believe that the economic momentum is expected to be more stable next year, which gives the Government a possible opportunity to implement the GST hike.

“The policy preference would be to introduce it as soon as possible, but not in a situation when the economy is still weak and where people are still out of jobs,” said Mr Seah, the DBS economist.

Analysts agreed that the timing of the hike would largely depend on the pace of recovery and the national vaccination programme, which started recently.

Associate Professor Eugene Tan, who teaches law at the Singapore Management University (SMU), said the right time for a GST hike will be when it is the least detrimental economically and politically.

With the pandemic taking up so much of the Government’s fiscal resources, he added that there may be pressure to implement the hike sooner rather than later as social spending would increase significantly to deal with Covid-19-related challenges.

NOT WASTING A CRISIS

Even as the Covid-19 pandemic has severely disrupted Singapore’s economy, new opportunities have sprung up for companies in sectors such as healthcare, e-commerce and logistics.

And the Government has constantly reiterated the importance of seizing these opportunities to digitise and transform so that these companies are better placed for future growth.

The impetus to continue business transformation would still feature strongly in Budget 2021, said DBS’ Mr Seah.

The crisis, in fact, has provided the Government with an opportunity to achieve its medium-term policy objective of getting companies to digitise their operations and hire more locals across the skills ladder through job redesign, with the number of foreign workers significantly down.

Another area that Singapore can capitalise on is to ensure that its economic recovery is taking place in a sustainable manner, or what some people call a “green recovery”.

While initiatives to get companies and individuals to go green had been introduced in every Budget in the last few years, Budget 2020 marked the first time that climate change was featured prominently in the Government’s fiscal plans.

On Feb 1, Sustainability and the Environment Minister Grace Fu announced that a whole-of-nation movement — called the Singapore Green Plan 2030 — would be launched to advance the sustainability agenda. Its details were unveiled earlier this week.

Ms Fu had added that DPM Heng will speak more on the sustainability agenda during the Budget debates.

With empirical evidence showing that a slowdown in economic activities forced upon by the pandemic had produced better ecological outcomes, observers said that there is a heightened sense of urgency within the Government to ensure that sustainability and decarbonisation efforts not only continue but are carried out more forcefully.

So how would a green recovery look like?

Assistant Professor Simon Schillebeeckx, who teaches strategic management at SMU, suggested a few examples, including reducing or eliminating investments in non-profitable sectors that are not sustainable, removing subsidies from sectors that would no longer be around in 20 years, and equipping people and companies to digitise.

Instead of investing money in emissions-based production such as the building of more roads or buildings, Mr Marc Allen, technical director at energy and climate change consultancy Engeco, suggested that investing in infrastructure for electric vehicles, or in renewable energy in neighbouring countries before importing it into Singapore, could be some options the Government could consider.

With Singapore heading towards a recovery fraught with uncertainties, Budget 2021 is likely to offer some pointers towards achieving more longer-term objectives relating to economic transformation and sustainability in a world irrevocably altered by the crisis of a generation.

“This is the litmus test for Budget 2021, if we are to not just build back but build back better and stronger. Sustainability in public spending will be very much on display and interrogated in Budget 2021.

“It will test the Government’s resourcefulness, ingenuity, and determination to have a Budget that will be fit for purpose and yet demonstrate fiscal prudence and sustainability,” said SMU’s Assoc Prof Tan.