Budget 2023: In ‘new era’ of great power contestation, Singapore unveils S$104.2b spending to reposition economy, buttress households

SINGAPORE — To reposition Singapore for a “new era” of global development, the Government will spend around S$104.2 billion to grow the economy, equip workers and build up the country’s collective resilience, while making immediate moves to help families and vulnerable Singaporeans cope with high inflation.

- Deputy Prime Minister Lawrence Wong unveiled a S$104.2 billion Budget in 2023

- The spending is aimed at growing the economy and equipping workers in the midst of a volatile world, as well as to build up the country’s collective resilience

- Part of the measures will also help Singapore households cope with high inflation

- Total spending in Budget 2023 fell slightly from the S$106.95 billion spent by the Government in 2022

- An overall deficit of S$0.4 billion is expected for Budget 2023 and there is no need to draw from past reserves, he said

SINGAPORE — To reposition Singapore for a “new era” of global development, the Government will spend around S$104.2 billion to grow the economy, equip workers and build up the country’s collective resilience, while making immediate moves to help families and vulnerable Singaporeans cope with high inflation.

Delivering the Budget 2023 speech in Parliament on Tuesday (Feb 14), Deputy Prime Minister and Finance Minister Lawrence Wong said that the world’s economy is expected to enter a stage of greater contestation and fragmentation, with nations thinking less about mutual benefit and interdependence and more about national gain and security.

“An era of zero-sum thinking has begun,” he said, adding that such a world will be less hospitable to small economies such as Singapore.

“We therefore cannot assume that we can continue to be successful by doing the same things as we have in the past. We will need to adjust to this new era, reposition our economy and refresh our social compact for the future.”

In a wide-ranging Budget speech, which was themed "moving forward in a new era" and lasted almost two hours, Mr Wong noted how China and the United States are jostling for leadership in key technologies, thereby setting off a trend of greater economic nationalism and protectionism around the world.

Governments are increasingly imposing sanctions, investment prohibitions and export controls, as well as implementing aggressive tax breaks and subsidies to anchor strategic industries within their countries, he said.

As a result, businesses are reorganising themselves to account for “once-unimaginable” risks, with more multinational enterprises seeking to relocate to places where they are less likely to get caught in “geostrategic crossfires”.

At the same time, the scope for tax competition is expected to get tougher due to the global Base Erosion and Profit Shifting initiative, which limits the level of tax incentives that Singapore can use to attract foreign investments.

Singapore will need to adapt quickly to these changes, Mr Wong stressed.

While countries such as the US are rolling out vast subsidies to build strategic industries, it is not possible for Singapore to outbid these countries to lure multinational firms here, Mr Wong added.

“Neither can we afford to be complacent and simply take our competitive position for granted. We will therefore have to work harder to enhance our overall productivity and workforce quality to stay competitive in this new environment.”

ATTRACTING INVESTMENTS

To this end, the Government will set aside S$4 billion for the National Productivity Fund, as well as expand the fund’s scope to cover investment promotion and use it as a way to anchor quality investments in Singapore.

A new Enterprise Innovation Scheme will allow businesses to qualify for greater tax deductions of 400 per cent for spending on activities related to innovation that include:

- Research and development

- Registration of intellectual property

- Acquiring and licensing intellectual property

- Innovation carried out with polytechnics and Institutes of Technical Education

- SkillsFuture-approved training courses that are aligned to the Skills Framework

For now, businesses have tax deductions of up to 250 per cent on some of these activities.

Under the new scheme, even those that have yet to turn profitable and so are not able to maximise the benefits of tax deductions may convert 20 per cent of their total qualifying expenditure into a cash payout of up to S$20,000.

The Government will also add S$150 million to the SME Co-Investment Fund to invest in promising small- and medium-sized enterprises, and will enhance the Singapore Global Enterprises initiative by S$1 billion.

EQUIPPING WORKERS

Apart from attracting investments, Mr Wong said Singaporeans should ultimately benefit in the form of wage growth and job opportunities, which is why the Government has invested in SkillsFuture.

But more still needs to be done to "shift our efforts into higher gear" amid a volatile environment, besides having more skills training that can vary in quality, he added.

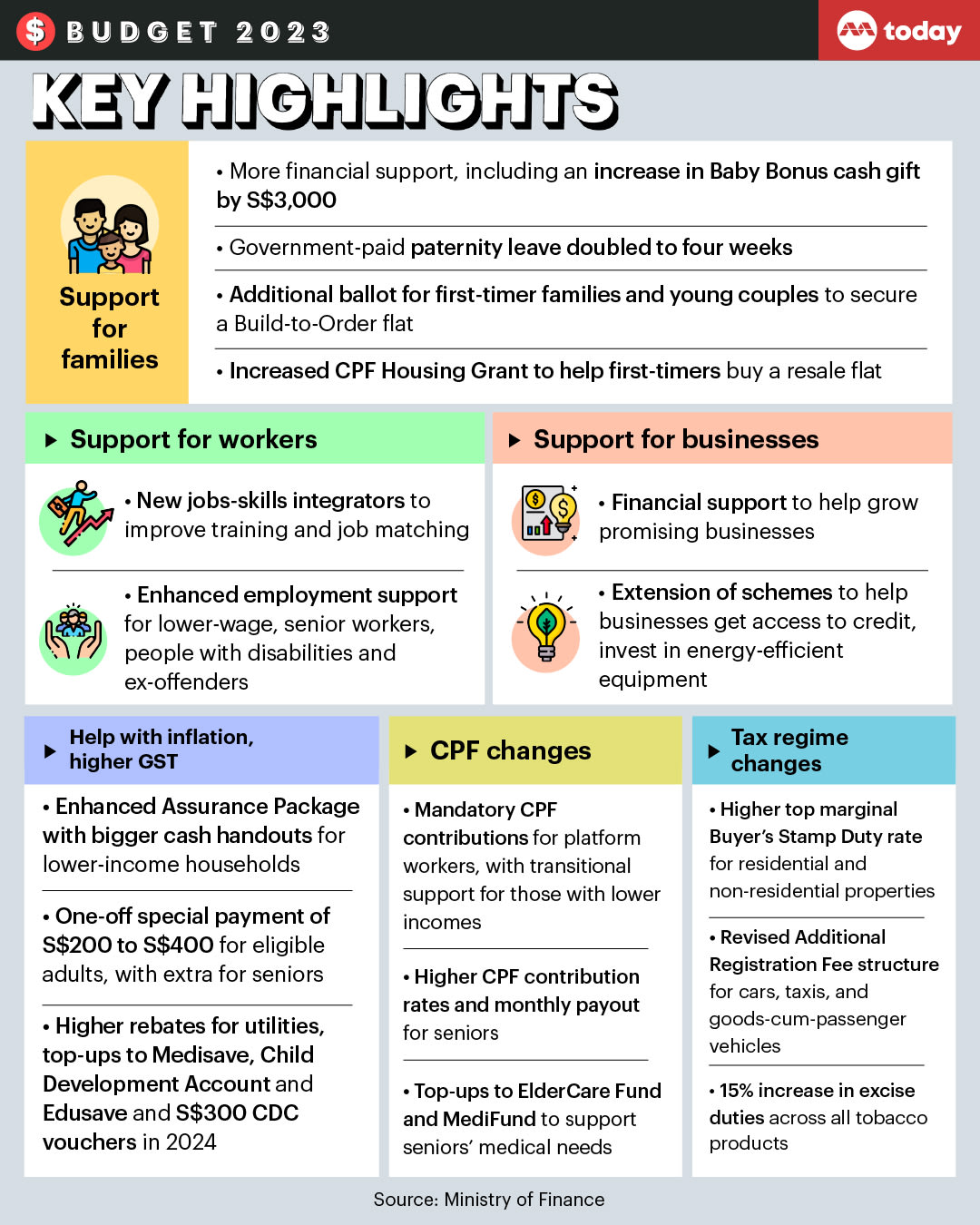

Hence, there is a need for jobs-skills integrators — intermediaries who work with industry, training and employment facilitation partners. Mr Wong said they will be piloted in the precision engineering, retail and wholesale trade sectors to ensure that training translates to better employment and earnings.

Other moves announced for Budget 2023 included:

- Extensions of the Senior Employment Credit and the Part-time Re-employment Grant until 2025

- A S$2.4 billion top-up to the Progressive Wage Credit Scheme

- The Enabling Employment Credit will be enhanced to encourage firms to hire persons with disabilities and a new Uplifting Employment Credit will be introduced for employers to do the same for ex-offenders

DEALING WITH HIGH INFLATION

To help Singaporeans cope with inflation and cushion the impact of the rising Goods and Services Tax (GST) rates, Budget 2023 will set aside an additional S$3 billion for the Assurance Package — including a S$1.4 billion top-up Mr Wong had announced in November 2022 — bringing the total package to S$9.6 billion.

Among the measures is a one-off Cost-of-Living Special Payment expected to benefit around 2.5 million adult Singaporeans.

The Government will also extend the Energy Efficiency Grant and current enhancements to the Enterprise Financing Scheme for another year until March 2024 to support businesses facing tighter financial conditions and high energy prices.

STRENGTHENING THE SOCIAL COMPACT

Calling families the “bedrock” of Singapore’s society, Mr Wong said that the Government will do more to support parents with the costs of raising children, help manage their various commitments, as well as to support their housing aspirations.

Referring to the Forward Singapore exercise he launched in 2022, Mr Wong said the engagements have so far turned up several "pressing issues".

These issues include the long wait times for new flats and rising resale home prices, which Mr Wong said are key concerns for young Singaporeans.

"We also want to help parents better balance their work and family commitments, and look after their children," he said.

To address this, Mr Wong said the Government will move sooner on specific measures to support young married couples.

- The Baby Bonus Cash Gift will be raised by S$3,000 for all eligible Singaporean children born from Feb 14, 2023, and the disbursement period will be lengthened

- Children born from Feb 14 will also receive higher government contributions to their Child Development Account to offset preschool and healthcare expenses

- Government-paid paternity leave will be doubled from two weeks to four weeks for children born on or after Jan 1, 2024. Unpaid infant care leave will also be doubled to 12 days a year.

For first-time applicants of Build-to-Order (BTO) flats, the Housing and Development Board will give them further ballot chances for their flat applications:

- First-timer families with children, as well as young married couples aged 40 and below who are buying their first home, will get an extra ballot

- This will take effect some time this year and more details will be announced by the Ministry of National Development later

- With immediate effect, the CPF Housing Grant will be increased by S$30,000 for eligible first-timer families buying four-room or smaller resale flats, and by S$10,000 for those getting five-room or larger flats

Low-income households as well as seniors will also get targeted support in Budget 2023 through top-ups of S$300 million to the ComCare Endowment Fund, S$500 million to the ElderCare Fund and S$1.5 billion to the MediFund.

For lower-income platform workers, the Government will also introduce a Central Provident Fund (CPF) Transition Support for these workers who will see an increase in CPF contribution rates.

The Government accepted last November recommendations to gradually align CPF contribution rates by platform workers with regular employees over a five-year period.

FORTIFYING RESERVES

In his Budget 2023 speech, Mr Wong stressed the importance of resilience in a world characterised by uncertainty and volatility.

Giving the example of the “several hundreds of billions of dollars” needed to rebuild Ukraine as a result of the ongoing war, he said that the best safeguard in such crises is still Singapore’s accumulated past reserves.

Related to this, Mr Wong announced changes to the tax system, including higher marginal Buyer's Stamp Duty rates for higher-valued residential and non-residential properties.

The additional registration fee for vehicles will also be made more progressive to better differentiate high-end cars and luxury cars.

Tobacco excise duties across all tobacco products will go up by 15 per cent immediately.

For Budget 2023, Mr Wong said that an overall deficit of S$0.4 billion, or 0.1 per cent of gross domestic product, is expected. There is no need for any draw on past reserves in this year’s Budget.

The Contingencies Fund, which was raised in 2020 from S$3 billion to S$16 billion to help Singapore respond quickly to urgent and unforeseen cashflow needs during the Covid-19 pandemic, will now be reduced to S$6 billion.

Total government expenditure for the year is estimated to hit S$104.15 billion, a slight decrease from the S$106.95 billion Budget in 2022, based on revised figures. Government spending for Budget 2021 was S$98.41 billion.

Over the three-year course of the pandemic, Mr Wong said that the Government has drawn around S$40 billion from past reserves, lower than the initial draw of S$52 billion that was approved by President Halimah Yacob.

In the 2022 financial year, the Government drew only S$3.1 billion from past reserves, out of the S$6 billion that was originally set aside.

"It reflects our prudent approach in using our reserves — drawing on them judiciously, only when there are compelling reasons to do so," Mr Wong said.