Budget 2024 cheat sheet: What you need to know

SINGAPORE — In a global environment that has “darkened dramatically”, Deputy Prime Minister and Finance Minister Lawrence Wong announced on Friday (Feb 16) that the Government will spend about S$131 billion to “forge a stronger and more united nation”.

This audio is AI-generated.

SINGAPORE — In a global environment that has “darkened dramatically”, Deputy Prime Minister and Finance Minister Lawrence Wong announced on Friday (Feb 16) that the Government will spend about S$131 billion to “forge a stronger and more united nation”.

This year’s Budget, which will support the first instalment of programmes announced in the Forward Singapore report, will be used to equip workers for the long-term and provide more assurance for families and seniors.

It also aims to create a more equal society while tackling immediate challenges that households and businesses face such as inflation.

The S$131.37 billion Budget includes special transfers of around S$850 million worth of Community Development Council (CDC) vouchers and S$810 million in cost-of-living special payments.

Here are some of the key announcements from Budget 2024.

HELP WITH INFLATION, HIGHER GST

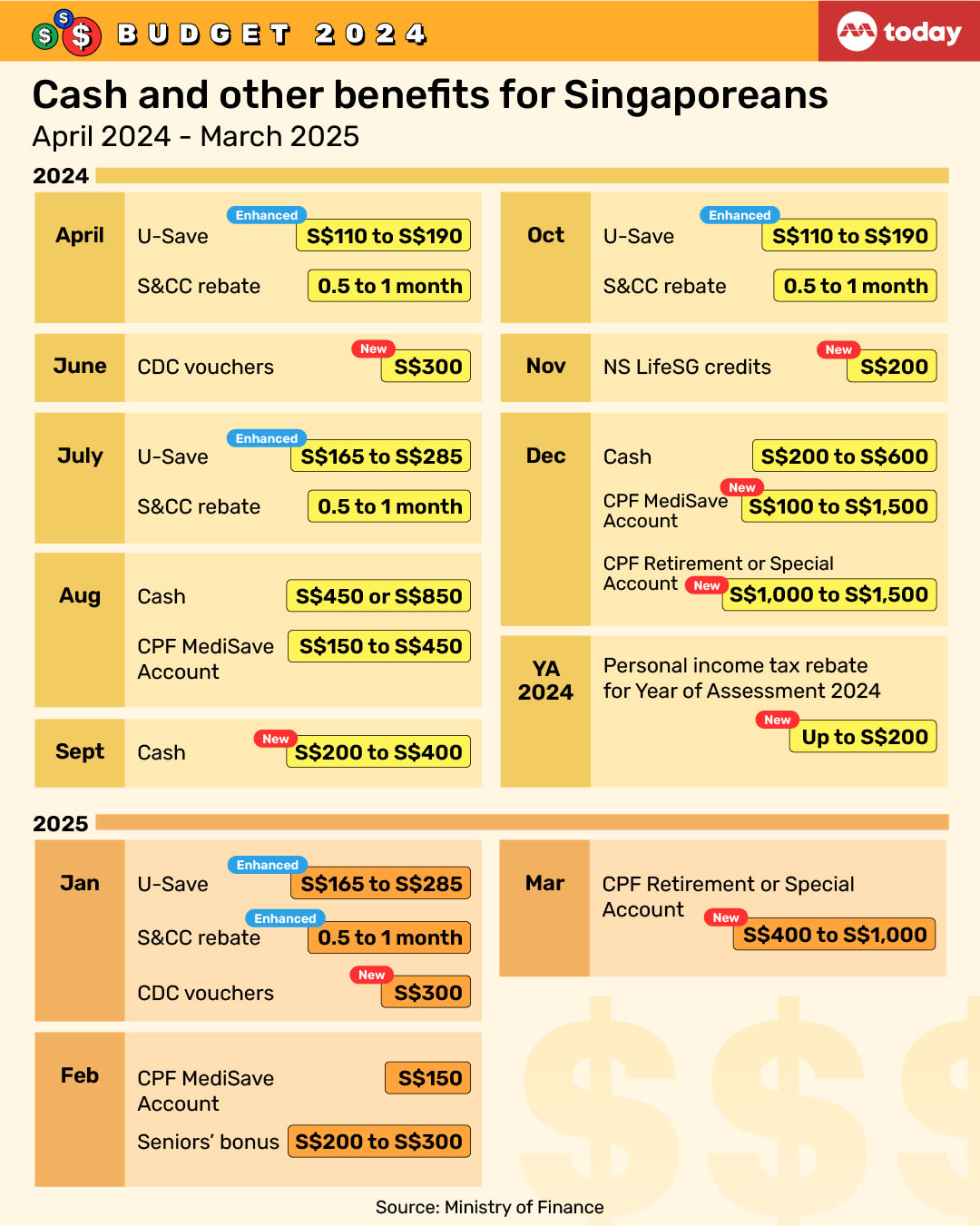

1. COST OF LIVING SPECIAL PAYMENT: All eligible Singaporeans aged 21 and above will receive cash payouts of between S$200 and S$400 in September 2024. These payouts are part of a S$1.9 billion enhancement to the Assurance Package, which was introduced in 2020 to cushion the impact of GST hikes. About 2.5 million Singaporeans will receive the cash payment.

2. VOUCHERS FOR HOUSEHOLDS: All Singapore households will get an extra S$600 in CDC vouchers — half of which will be disbursed at the end of June, while the other half will be given out in January 2025.

Eligible Housing and Development Board (HDB) households where members do not own more than one property will receive 2.5 times the amount of regular GST Voucher – U-Save rebates in this financial year. Eligible households will also get another one-off Service and Conservancy Charges (S&CC) rebate.

3. MEDISAVE BONUS: Singaporeans aged 21 to 50 will receive a one-time Medisave bonus of up to S$300. The amount received will be tiered based on the year of the person's birth, the number of properties the person owns and the annual value of the residence.

4. SERVICEMEN PAYOUT: All past and present national servicemen will receive S$200 in LifeSG credits in November. This will cost the Government S$240 million and benefit 1.2 million national servicemen.

SUPPORT FOR WORKERS

1. SKILLSFUTURE TOP-UPS: Singaporeans aged 40 and above will receive a S$4,000 top-up in SkillsFuture Credit in May this year, and up to S$3,000 in monthly training allowance should they be enrolled in selected full-time courses. Every person can receive up to 24 months of training allowance throughout his or her lifetime.

Those younger than 40 will get the SkillsFuture top-up when they reach 40.

2. TOP-UPS FOR ITE GRADUATES: Institute of Technical Education (ITE) graduates aged 30 and below will get a S$5,000 top-up to their Post-Secondary Education Account if they enrol in a diploma programme. They will also receive a further S$10,000 top-up in their Central Provident Fund (CPF) Ordinary Account upon attaining their diploma.

3. FINANCIAL AID FOR RETRENCHED WORKERS: A temporary financial support scheme for laid-off workers will be announced later this year after the Government works out the parameters of the scheme.

4. HELPING LOWER-WAGE WORKERS: The qualifying income cap for the Workfare Income Supplement scheme will be raised from S$2,500 to S$3,000.

Additionally, the Local Qualifying Salary — which dictates the lowest salary employees here who work at companies that hire foreign workers must receive — will be raised from S$1,400 to S$1,600 this year.

To support employers who raise the wages of lower-wage workers under the Progressive Wage Credit Scheme, the Government will also raise co-funding levels for this year from a maximum of 30 per cent to 50 per cent.

SUPPORT FOR FAMILIES

1. VOUCHER FOR COUPLES RENTING HDB FLATS: Eligible families who rent an HDB flat on the open market under the Parenthood Provisional Housing Scheme (PPHS) will receive a PPHS (Open Market) Voucher to offset rental costs for one year.

The scheme offers subsidised rental housing for married couples who have already booked their Build-to-Order flats but wish to have a place to stay temporarily while waiting for the flats to be built.

2. PRESCHOOL SUBSIDIES: From 2025, monthly full-day childcare fee limits in government-supported preschools will be reduced to $640 for anchor operators and $680 for partner operators. These fee caps will be further reduced in 2026.

Existing preschool subsidies will be made available for children from lower-income families with non-working mothers. This move will benefit up to 17,000 children.

3. TOP-UP FOR EDUSAVE ENDOWMENT FUND: There will be a S$2 billion top-up to the Edusave Endowment Fund, which is used to fund annual contributions to the Edusave accounts of eligible children, grants to educational institutions, as well as scholarships, bursaries and awards.

The top-up is meant to enhance the Edusave awards and support programmes to develop competencies such as communication skills, civic literacy, and inventive thinking.

4. REDUCED FEES AT SPECIAL-ED SCHOOLS: The maximum monthly fees at Special Education schools will be reduced from S$150 to S$90. The fee caps at Special Student Care Centres will also be lowered to reduce families’ out-of-pocket expenses.

SUPPORT FOR SENIORS

1. ENHANCED SILVER SUPPORT SCHEME: The Silver Support Scheme provides quarterly payments to seniors who had low incomes during their working years and have less family support.

The Government will raise the qualifying per capita household income threshold from S$1,800 to S$2,300, and increase the quarterly payments by 20 per cent to keep pace with inflation. The move will benefit around 290,000 Singaporeans aged 65 and above.

There is no need to apply for the scheme, because all Singaporeans aged 65 and above are automatically assessed for eligibility. Those eligible will receive their first enhanced payouts in December this year to cover the first quarter of 2025.

2. ENHANCED MATCHED RETIREMENT SAVINGS SCHEME: The Matched Retirement Savings Scheme helps Singaporeans aged 55 to 70 with less CPF savings to save more by providing dollar-to-dollar matching for cash top-ups to their accounts.

The Government will increase the annual matching from S$600 to S$2,000 and set a lifetime matching limit of S$20,000. The scheme will also be expanded to those above 70 years old from Jan 1, 2025.

The existing tax relief for the cash top-ups that attract the matching grant will be removed.

ATTRACTING INVESTMENTS

1. INVESTMENT IN ARTIFICIAL INTELLIGENCE (AI): More than S$1 billion will be invested into AI computing, talent, and industry development over the next five years. A portion of the investment will be used to secure access to the advanced chips crucial to AI development and deployment.

2. FASTER BROADBAND SPEEDS: Singapore will have mass market access to faster broadband speeds of up to 10 gigabits per second (Gbps) by 2030 to support emerging technology such as AI.

This is 10 times faster than the broadband speed in most homes today.

3. ENHANCING FUNDS FOR BUSINESSES: The National Productivity Fund and Financial Sector Development Fund will both be topped up by S$2 billion this year. Another S$3 billion will be invested in the Research, Innovation and Enterprise 2025 plan.

Additionally, a new Refundable Investment Credit – a tax credit with a refundable cash feature to support high-value and substantive economic activities – will be launched.

CHANGES TO CPF

1. NO MORE CPF SPECIAL ACCOUNT: From 2025, the Central Provident Fund (CPF) Special Account of those aged 55 and above will be automatically closed and the savings — up to the Full Retirement Sum — will be transferred to their Retirement Account. The balance will go into the Ordinary Account.

2. ENHANCED RETIREMENT SUM RAISED: The Government will raise the Enhanced Retirement Sum, which is the maximum amount that people can put into their CPF Retirement Account to receive monthly payouts after they turn 65. It will be raised to four times the Basic Retirement Sum, up from the current three times.

"This will allow more (CPF) members aged 55 and above to fully commit their accumulated CPF savings to receive higher CPF payouts, should they wish to do so," Mr Wong said.

TAX-RELATED CHANGES

1. PERSONAL INCOME TAX REBATE: The Government will provide a personal income tax rebate of 50 per cent for the Year of Assessment 2024. This will be capped at S$200 so that the benefits go mostly to middle-income workers. The rebate will cost the Government S$350 million.

2. ADDITIONAL BUYER’S STAMP DUTY CONCESSION: The Additional Buyer’s Stamp Duty (ABSD) concession, which provides an ABSD refund for Singaporean married couples with an existing residential property on their replacement private property, will be extended to single Singapore citizens aged 55 and above.