Closure of CPF Special Account not aimed at 'saving interest monies' for Government: Tan See Leng

SINGAPORE — The closure of the Central Provident Fund (CPF) Special Account is not aimed at helping the Government to save on higher interest it pays out to such account holders, said Minister for Manpower Tan See Leng in Parliament on Wednesday (28 Feb).

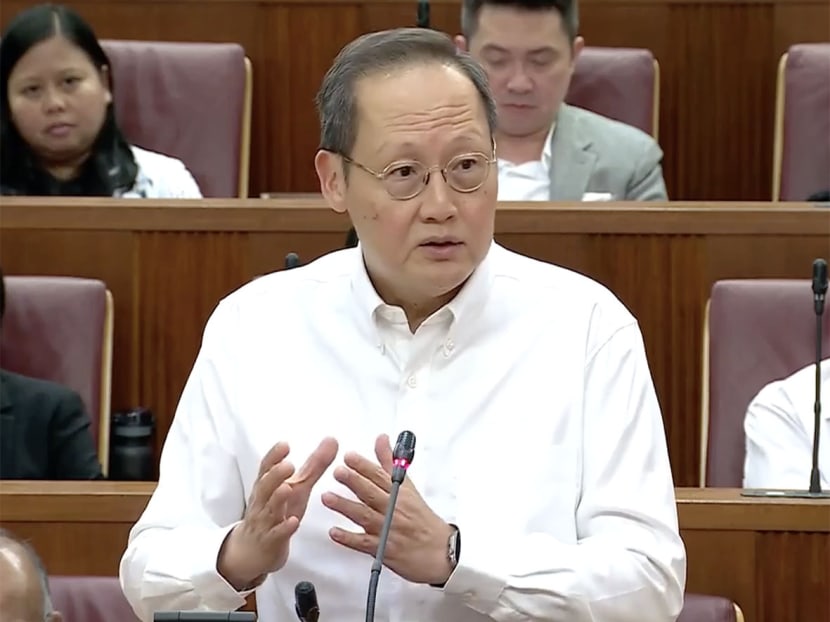

Manpower Minister Tan See Leng speaking in Parliament on Feb 28, 2024.

This audio is AI-generated.

- Closing the CPF Special Account is not aimed at helping the Government save higher interest paid to the account holders

- Minister for Manpower Tan See Leng said this in reply to opposition party member Leong Mun Wai in Parliament

- Mr Leong had asked how much more the Government is now paying to CPF members due to the difference in interest rates between the Special Account and the Ordinary Account

SINGAPORE — The closure of the Central Provident Fund (CPF) Special Account is not aimed at helping the Government to save on higher interest that it pays to account holders, Minister for Manpower Tan See Leng said.

Dr Tan, who is also the Second Minister for Trade and Industry, was responding in Parliament on Wednesday (28 Feb) to Mr Leong Mun Wai of Progress Singapore Party, at the conclusion on a debate on Budget 2024.

After Deputy Prime Minister Lawrence Wong had delivered a round-up speech following three days of debate, Mr Leong rose to ask several questions.

One question was on how much more the Government is now paying to CPF members because of the difference in interest rates between the Special Account and the Ordinary Account.

Mr Wong, who is also Finance Minister, said that he did not have the details on the additional amount that the Government is paying and that this can be addressed at the upcoming debate on the Ministry of Manpower's budget.

He reiterated the Government's rationale for closing the Special Account when members turn 55, adding that with the other CPF changes announced, Singaporeans can benefit from higher retirement payouts through CPF Life, which many observers have said is the best annuity product in the market today.

Dr Tan then rose to address Mr Leong's point.

“I think it's important members of the House understand that the closure of the Special Account is not aimed at saving interest monies,” he said, adding that he will provide a fuller explanation during his ministry's budget debate.

The CPF Board is a statutory board under the ministry.

Singaporeans aged 55 and above have two CPF accounts that hold savings intended for retirement payouts: Special Account and Retirement Account.

Both earn the same interest rate, which is now 4.08 per cent, higher than the 2.5 per cent for Ordinary Account.

Mr Wong had announced in his Budget 2024 speech on Feb 16 that from 2025, the Special Account of those aged 55 and above will be automatically closed, and the money in there, up to the Full Retirement Sum, will be transferred to their Retirement Account.

The balance will then go into their Ordinary Account.

Concurrently, the Government will raise the Enhanced Retirement Sum, which is the maximum amount that people can put into the Retirement Account to receive monthly payouts after they turn 65.

The Enhanced Retirement Sum will be raised to four times the Basic Retirement Sum, up from the current three times.

The change to the Special Account is part of the Government’s move “to rationalise the CPF system”, Mr Wong said on Feb 16.

The Ministry of Finance has explained that for now, like Ordinary Account savings, some money in the Special Account can be withdrawn from age 55. However, this goes against the principle where only money that cannot be withdrawn from CPF earn higher long-term interest rate.

Making a similar point in his response to Mr Leong on Wednesday, Dr Tan said: “I don't think that there's any system in the world, any financial institution in the world, any bank in the world, that will pay a long-term assured fixed deposit interest rate but to allow you the flexibility to withdraw like an ATM.”

The CPF Board has said that with the increase in the Enhanced Retirement Sum, more than 99 per cent of the roughly 1.4 million CPF members above the age of 55 can transfer all their Special Account savings to their Retirement Account, a point reiterated by Dr Tan on Wednesday.

He also said that those who want flexibility after they turn 55 can still leave their savings in the Ordinary Account, which they can also use for investment purposes if they like.

“So (the CPF changes are) not about saving money (for the Government). It is not about locking up money,” Dr Tan continued.

“In fact, if anything at all... the CPF Board doesn't have any option for members (at the age of 70) to continue to accumulate. If there's such a word, at 70, everyone has to 'de-cumulate'. I hope that clarifies.”

He is referring to the oldest age that the CPF Board allows members to start their CPF Life monthly payouts. The CPF website states that this is “to facilitate effective decumulation of CPF savings during (a) member’s lifetime’’.