Covid-19: Proposed law to give relief to individuals, firms who can't fulfil contracts — including couples who postpone weddings

SINGAPORE — Couples who have had to postpone their weddings because of the Covid-19 outbreak will soon not have to worry about forfeiting their deposits. The Government intends to fast track a set of proposed laws that will offer six months of relief to businesses and individuals who are unable to fulfil their contractual obligations due to the pandemic.

The Bill is an unprecedented move by the Government to step into disputes concerning certain categories of commercial contracts that are typically resolved by the courts.

Get news updates via Telegram: t.me/todayonlinesg

SINGAPORE — Couples who have had to postpone their weddings because of the Covid-19 outbreak will soon not have to worry about forfeiting their deposits. The Government intends to fast track a set of proposed laws that will offer six months of relief to businesses and individuals who are unable to fulfil their contractual obligations due to the pandemic.

This would include people at risk of losing their deposits for events such as weddings and business meetings that have had to be postponed. Construction firms facing liquidated damages for incomplete projects arising from supply and labour shortages and restaurants that cannot afford rent after seeing their footfall wiped out by the coronavirus will be protected too.

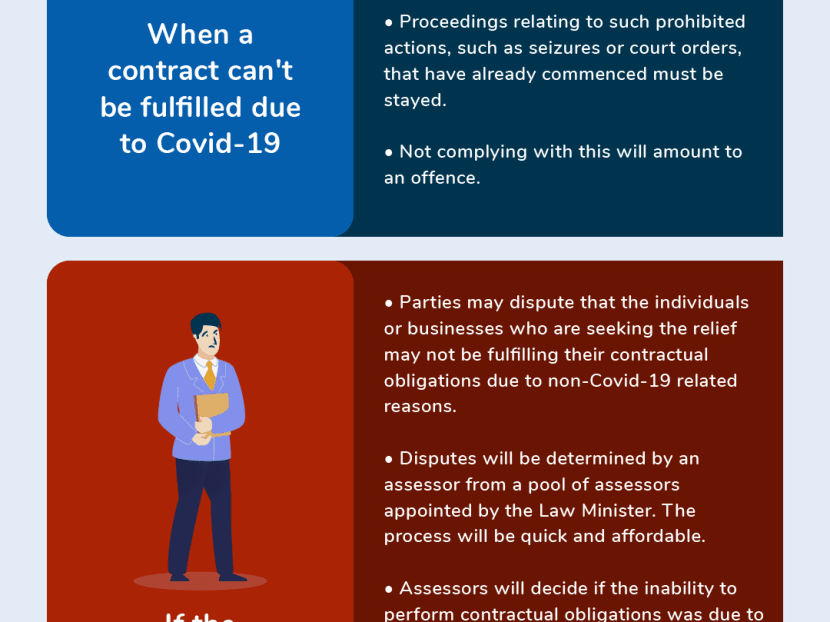

The Covid-19 (Temporary Measures) Bill proposes to temporarily make it an offence for an organisation or individual to take legal action against a party who is not fulfilling his contractual obligations, as long as that party gives notice that his inability to fulfil the contract has been due to the pandemic.

The legal actions that would be temporarily prohibited during this period would include terminating the leases of commercial tenants, confiscating equipment or preventing access to property that was paid for through secured loans, filing an application to declare the business bankrupt, enforcing court judgements and arbitration decisions, or calling on a performance bond from a construction contract.

For events, such as weddings and business meetings, and tourism-related contracts that could not be carried out due to Covid-19, an additional relief measure would compel parties to restore the deposits if these had been forfeited.

Penalties for non-compliance will be announced in due course, said the Law Ministry.

The Bill is an unprecedented move by the Government to step into disputes concerning certain categories of commercial contracts, an act not seen during past financial crises or the severe acute respiratory syndrome (Sars) outbreak in 2003.

It is scheduled to be introduced, debated and passed in a single sitting on April 7. If Parliament and the President approves, the proposed law is expected to come into force mid-April and expire a year later.

The Bill was put together in a matter of days by various ministries and agencies, with Attorney-General Lucien Wong supervising its drafting, said Law and Home Affairs Minister K Shanmugam.

Private sector representatives from banks, property development, law firms and other businesses were also consulted.

Mr Shanmugam said the Bill is to be seen in light of the S$48 billion Resilience Budget introduced last week and the new package of relief measures launched on Tuesday by the Monetary Authority of Singapore (MAS) and the finance industry for businesses and individuals.

“(Those measures) could be seen as a transfusion of blood… We are seeking to put legislation into Parliament that will help stanch the flow of blood, specifically categories of contracts where you have seen a lot of calls from retailers and tenants that they are bleeding because Covid-19 is not something that anyone could have predicted,” said Mr Shanmugam in a media briefing on the Bill on Tuesday.

Five categories of contracts are covered under the Bill:

Leases or licences for non-residential immovable property (e.g. leases for factory premises)

Construction contract or supply contract (e.g. contract for the supply of materials)

Contracts for the provision of goods and services for events (e.g. venue and catering contracts for weddings and business meetings)

Certain contracts for goods or services for visitors to Singapore, domestic tourists or outbound tourists, or promotion of tourism (e.g. cruises, hotel bookings)

Certain loan facilities granted by a bank or a finance company to small- and medium-sized enterprises (SMEs), defined as corporates with a turnover of not more than S$100 million.

This list includes hire-purchase loans taken out by private-hire car drivers for their vehicles. This means a finance company cannot repossess the car during the relief period if the driver is unable to pay the instalments for his loan due to reduced income from the Covid-19 pandemic.

Importantly, the proposed measures cover obligations that needed to be performed on or after Feb 1 — which the ministry said was the approximate date when the economic impact of Covid-19 started to be “significantly felt”.

The measures also exclude contracts entered into on or after March 25, a day after stricter safe distancing measures were implemented by the Government.

These measures would provide cash flow relief for firms and people who may have to pay damages, forfeit deposits, face lengthy litigation or possible insolvency and risk having their assets seized due to circumstances caused by the pandemic.

The six-month relief period may also be extended by Mr Shanmugam if needed.

DISPUTE RESOLUTION MECHANISM

Mr Edwin Tong, Senior Minister of State for Law and Health, said: “What this Bill seeks to do is to try to find a way to have an organised moratorium so that these obligations are deferred and suspended.”

This moratorium represents a suspension of contractual obligations, not an absolution or removal of any contractual obligations, he added.

For example, newly wed couples could still see their deposits forfeited if they decide to cancel the booking and go to another hotel.

If contracting parties are not convinced that the reasons are due to Covid-19, they may raise this to a pool of assessors appointed by Mr Shanmugam, who will decide on the outcome that will be on “just and equitable” grounds, the ministry said.

This dispute process will be made affordable, fast and simple, it added. Both parties will not be represented by lawyers and the assessors’ decisions are final and not appealable.

Until this decision is made, a venue provider will not be able to forfeit the couple’s deposit, said MinLaw.

Around 100 assessors from different sectors will be appointed to resolve disputes, including legal professionals, industry representatives and accountants, the ministry added.

This dispute mechanism is aimed at preventing unfair abuse of the relief measures.

In Germany, which has also rolled out temporary rental relief measures in a S$1.73 trillion rescue package last week, several well-heeled commercial tenants, such as apparel retailers Adidas and H&M, unilaterally announced that they will stop paying rent on stores due to the outbreak. This prompted outrage from the German government, which urged financially strong firms not to abuse relief measures meant for firms facing financial hardship.

RAISED THRESHOLDS FOR BANKRUPTCY AND INSOLVENCY

The Bill will also temporarily raise the monetary threshold and time limits for bankruptcy and insolvency, to help businesses and individuals tide through the difficult environment, said MinLaw.

For individuals, the monetary threshold for bankruptcy will be raised from S$15,000 to S$60,000. The threshold for business insolvency will be raised from S$10,000 to S$100,000.

The statutory period for individuals and businesses to respond to creditors’ demands will also be lengthened to six months, up from 21 days currently.

“Directors will be temporarily relieved from their obligations to prevent their companies trading while insolvent if the debts are incurred in the company’s ordinary course of business,” said the ministry.

However, the proposed measures will not excuse company directors who are criminally liable for debts that are incurred fraudulently, it added.