Expect ‘competitive prices’ in S’pore as Gojek woos customers, says ride-hailing firm

SINGAPORE — Commuters can rejoice next year when Gojek rides into Singapore, as the ride-hailing firm told TODAY that it will be dishing out “competitive prices” to woo customers onto its platform.

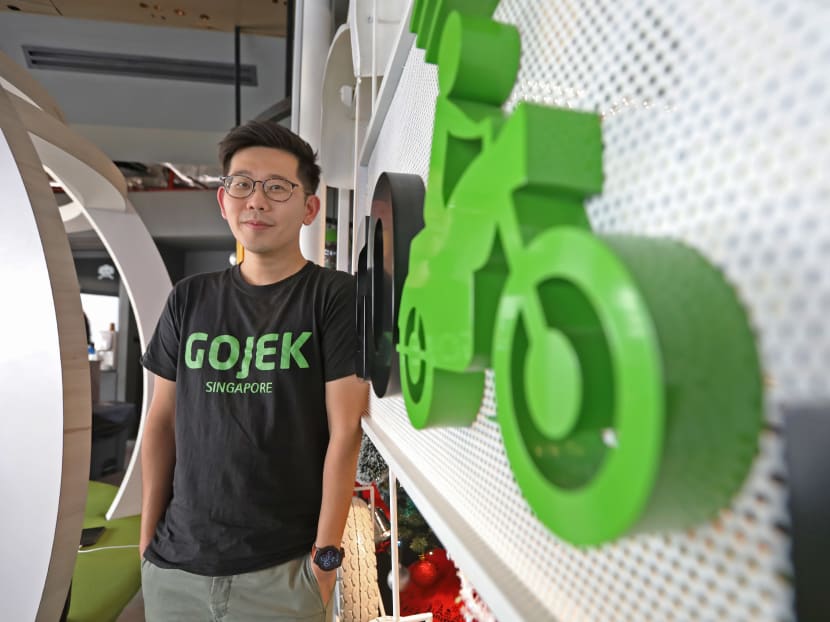

Gojek Singapore's head of operations Chua Min Han says they will focus on acquiring customers and will be "very competitive" on pricing.

SINGAPORE — Commuters can rejoice next year when Gojek rides into Singapore, as the ride-hailing firm told TODAY that it will be dishing out “competitive prices” to woo customers onto its platform.

“Our strategy for launch is to make sure we are constantly acquiring customers through the right mechanisms… and that could be through promo codes (and) vouchers,” said Gojek Singapore's head of operations Chua Min Han in an interview with TODAY.

“We will continue to be very big on acquiring customers, and we will be very competitive on pricing.”

Mr Chua’s claims come more than a week after rival firm Grab signalled publicly that it would not engage in a price war with Gojek, which is based in Indonesia. In an earlier interview, Head of Grab Singapore Lim Kell Jay said that handing out promotions is unsustainable and Grab is working instead to bring “longer-term value” to commuters.

Sign up for TODAY's newsletter service on any of these platforms. Click here:

While experts concur that a price war is untenable in the long run, they said that Grab would be pressured to respond if it sees its market share evaporating rapidly. For now, Grab has yet to feel the pinch due to Gojek’s measured pace of entry here, they added.

Grab’s response would also hinge on how committed Gojek is in investing money in the Singapore market, said the analysts.

Mr Chua said that Gojek is taking a “long-term view” when it comes to Singapore as it gathers feedback in the lead-up to its launch. In a move that will see Gojek muscling further onto Grab’s turf, the former — whose services in Indonesia include food delivery, massage and payments — has indicated its interest in expanding into the food and parcel delivery business here.

Read also

Gojek has also kick-started “talks” to offer shared rides and trips on larger vehicles, but Mr Chua did not disclose further details, saying the firm is still studying demand for such services.

For now, Gojek is focused on gathering user feedback to provide a viable alternative to commuters here, added Mr Chua, who had previously worked at Uber.

‘PENT-UP DEMAND’

The newest ride-hailing entrant began beta trials at the end of last month with “thousands” of users, with its Go-Car service available across more than half of the island, including the Central Business District, Jurong East, Changi, Punggol, Ang Mo Kio and Sentosa.

Gojek is expected to go head on with Grab early next year when its service is set to be expanded to all Singapore users and coverage eventually goes islandwide.

When asked if Gojek is confident of being able to mount a significant challenge to Grab, Mr Chua said that Gojek’s entry into Singapore is “not so much about whether we want to take on anybody”.

“It’s about us coming in to solve problems and meet demands,” he added.

“One thing we are seeing in Singapore is a pent-up demand for more choices. It’s not just about whether you are a super app, it’s really about whether we are solving a real problem.”

Gojek’s priority is to give consumers a “good choice” in the long run by making sure prices are “very competitive”, said Mr Chua.

Transport economist Walter Theseira said that Grab’s public statements and Gojek’s “measured pace of entry” are attempts by both parties to signal to the other that they are not keen on “recreating the kind of unsustainable competition” between Grab and Uber when both firms handed out “flashy but expensive and unsustainable promotions”.

Pointing out that Grab has felt “very little pain” from Gojek due to the latter’s measured entry, Dr Theseira, who is from the Singapore University of Social Sciences (SUSS), added: “If Grab sees its market share or drivers evaporating rapidly, they will be under some pressure to act to stabilise.”

Grab would likely introduce subscription programmes that give consumers more value or hand out discounts to get them to use its other services, he added.

HOW LONG WILL LOWER PRICES LAST?

During its beta launch, Gojek said that it would not implement dynamic pricing — where fares surge during peak hours — in the first few weeks.

When asked if Gojek will keep its no dynamic pricing model indefinitely, Mr Chua said he will not “rule out any possibilities”.

“(Surge pricing) is a means to balance demand and supply… but we want to spend more time in acquiring customers and how we can value add further by passing on savings to them in the long run,” he added.

However, experts do not expect the firm to hold out for long.

“In this market, you have to work on very thin margins so there’s a limit to how much you can lower prices,” said Associate Professor Lawrence Loh from the NUS Business School.

“If fares are going to be low, then there may not be enough drivers picking up passengers.”

TWO ‘G’ MARKET?

For now, there could be “a relatively peaceful co-existence” between Grab and Gojek, said Dr Park Byung Joon, an urban transport expert from the SUSS.

Dr Park said that the competition watchdog’s ruling in September that the Grab-Uber deal was “anti-competitive”, as well as its subsequent measures, have paved a smooth path for Gojek’s entry into Singapore.

These measures, which include hefty fines and the removal of Grab’s exclusive arrangements with taxi operators, may be lifted if a rival attains at least 30 per cent of the rides matched across ride-hailing services for half a year.

This is a “great opportunity” for Gojek as Grab could step back to allow its rival to gain market share in order for the measures to be lifted, said Dr Park.

“But once Gojek reaches 30 per cent (of the market share) and the measures are removed, then the real competition will begin,” he added.

Transport analyst Terence Fan from the Singapore Management University said that it remains to be seen if Gojek can adequately meet demand.

“Gojek may try to have competitive prices to attract people, but it might take some time before people can reliably get a vehicle on their platform,” he said.

Gojek has remained tight-lipped about the number of drivers it has onboard or recruited, only stating that some 20,000 drivers had expressed interest in signing up for its beta launch.

Mr Chua said Gojek is looking to partner with more companies to reduce rental and fuel costs for drivers. Currently, Gojek has partnered six rental companies under its rental marketplace, Go-Fleet. He added that cost savings from the partnerships can then be passed on to consumers, and that reducing operating costs for drivers is one of its “biggest” priorities.

BETTER DRIVER INCENTIVES

Providing an update on the insights gleaned from its beta trial, Mr Chua said Gojek tweaked its incentive structure for drivers based on feedback.

Gojek is now rewarding drivers on a daily point-based system instead of hourly incentives, and there are top-ups when drivers hit minimum weekly earnings targets. This would give drivers more flexibility to attain incentives over a week, said Mr Chua.

Currently, drivers who complete five trips a day will earn an incentive of S$35, with rewards multiplying as more trips are completed.

Each completed trip is worth one point, with peak hour trips worth 1.5 points. Drivers who accumulate 30 points will be rewarded with a S$310 daily incentive. Those who hit further targets will also get weekly earning top-ups to supplement their earnings from fares and the daily points system.

However, drivers must maintain at least an 85 per cent performance rating to be eligible for the payouts.

Mr Chua said that Gojek will be conducting more focus groups and community events to engage drivers and collect feedback from passengers.