Explainer: Why is interest on Retirement Accounts not accrued once CPF Life payouts start, and how much will your family get when you die?

SINGAPORE — A recent parliamentary debate has thrust the Central Provident Fund (CPF) Life annuity scheme under the spotlight, with one Member of Parliament (MP) highlighting that when CPF members under the scheme die, the interest earned in their Retirement Account does not go to their beneficiaries.

This audio is AI-generated.

- A Member of Parliament said that the actual interest yield earned by the CPF Special Account and Retirement Account “could not be more different”

- This is because the interest earned under CPF Life is pooled for all members and does not necessarily go to one's beneficiaries when one dies

- Experts said that the premiums of all CPF Life policyholders, including interest, are pooled together

- Such a risk-pooling mechanism is a fundamental aspect of annuities, which guarantee a lifetime payout to members

SINGAPORE — A recent parliamentary debate has thrust the Central Provident Fund (CPF) Life annuity scheme under the spotlight, with one Member of Parliament (MP) highlighting that when CPF members under the scheme die, the interest earned in their Retirement Account does not go to their beneficiaries.

On Monday (Feb 26), Workers' Party MP Louis Chua from the Sengkang Group Representation Constituency referred to the CPF Board's website, which states that when CPF members die, the interest earned on the CPF Life premiums is not included in the amount that gets paid to beneficiaries after the death.

This is because the premiums are risk-pooled — a fundamental concept behind annuity schemes that enable members to get regular lifetime payouts, even if they live longer lives than expected.

Mr Chua then pointed out that although the stated interest rate of the Special Account and the Retirement Account is identical, the actual yield earned by the two accounts “could not be more different”.

The debate followed Deputy Prime Minister Lawrence Wong's announcement that the CPF Special Account will be closed when members turn 55.

Questions about CPF-related announcements in Budget 2024, including the raising of the Enhanced Retirement Sum to four times of the Basic Retirement Sum, and how such moves affect retirement adequacy, had dominated the parliamentary debate.

Several MPs also called for a review of the interest rates for the various CPF accounts.

Right now, the interest rate is 4.08 per cent per annum for the Special Account and Retirement Account, and 2.5 per cent for the Ordinary Account.

And on Wednesday, Minister for Manpower Tan See Leng said in Parliament that the closure of the Special Account is not aimed at "saving interest monies" for the Government.

Ahead of the debate on the Ministry of Manpower's budget, TODAY takes a closer look at where the interest yield under the CPF Retirement Account goes to under CPF Life, and how risk-pooling works.

HOW CPF LIFE WORKS

CPF Life, also known as the CPF Lifelong Income for the Elderly scheme, is a national longevity insurance annuity plan that provides CPF members with monthly payouts for as long as they live.

It is mandatory for Singapore citizens and permanent residents to save and set aside money for retirement under CPF.

In general, annuities are long-term financial schemes in which insurers provide premium-paying members with a steady stream of income over a long period of time, usually to support retirement.

In the context of CPF Life, the premium to be paid is taken from members' CPF Retirement Account at the age of 65.

Members will be automatically included in the CPF Life scheme if they are a Singapore citizen or permanent resident born in or after 1958, and have at least S$60,000 in retirement savings when monthly payouts begin.

What this also means is that from the ages of 55 to 65, members earn a high interest rate on the Retirement Account, which will then be used to purchase the annuity policy at the end of this period.

There are also various plans under CPF Life that members may choose, which affect the type of payouts based on the members' preferences.

Members can also choose to start their payouts from age 65 to 70, so those who want to defer payouts until 70 will continue to earn interest on their savings in the Retirement Account until then.

The CPF Life's premium and payout levels are dependent on the member's Retirement Account savings used to join the annuity, as well as the member's sex and age.

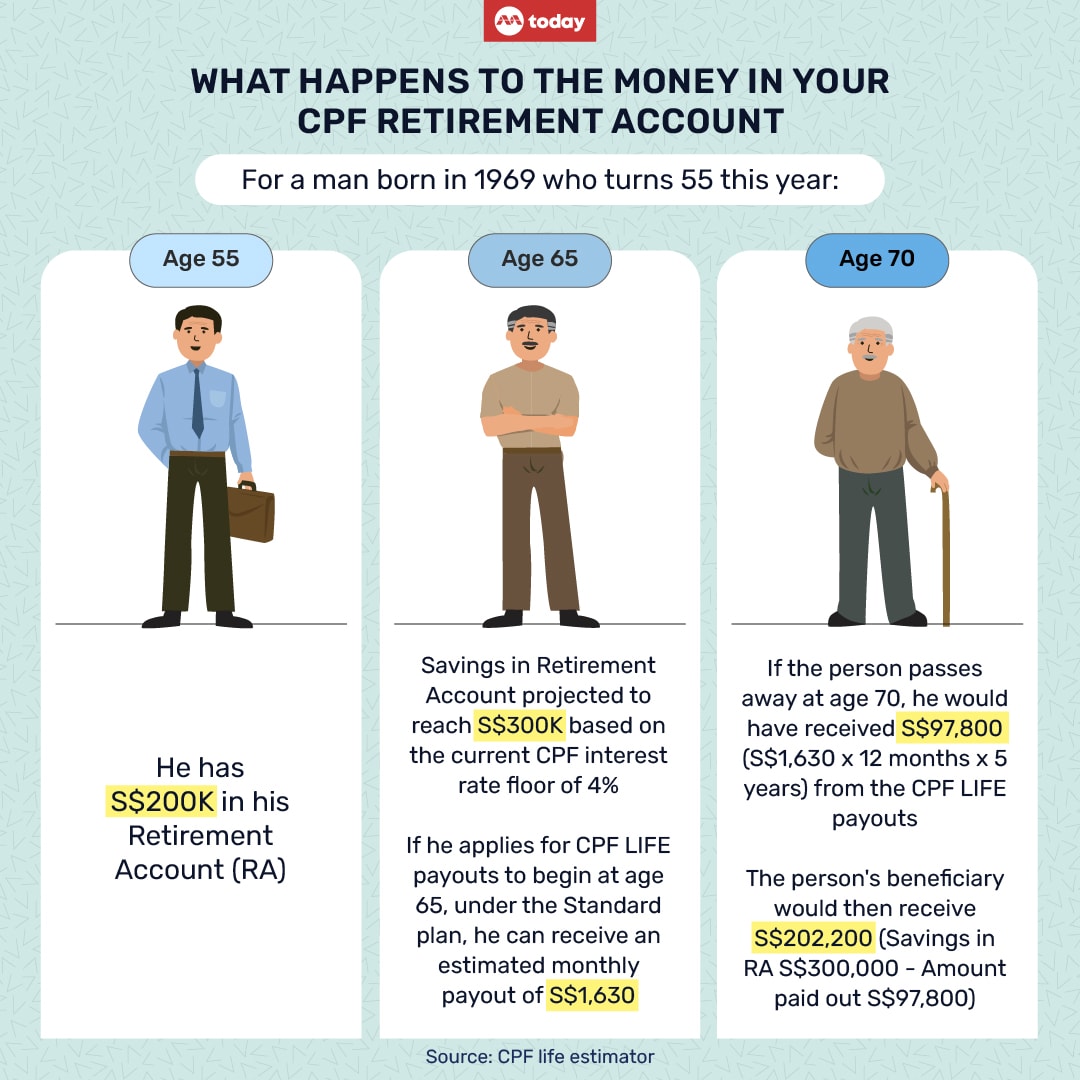

For example, if a CPF member has S$200,000 in his Retirement Account at age 55, he is projected to have around S$300,000 in his Retirement Account by the age of 65, including the compounded interest, based on the current 4 per cent interest rate floor for CPF.

Under CPF Life, if this man applies to receive payouts under the Standard Plan from 65 years old onwards and dies at age 75, he will receive an estimated S$1,630 a month or S$19,560 a year.

If he receives payouts under the same plan but deferred the start of his payouts until the age of 70, he will earn more interest from ages 65 to 70 in his Retirement Account and his premium would be S$370,000 by the time payouts begin. He will also receive a higher monthly payout of an estimated S$2,180 — or S$26,160 a year.

If the same member lives to 90 and started receiving payouts at the age of 70, he would have exhausted the original S$370,000 premium and would have received an estimated S$523,200 in total from the annuity, from the age of 70 to the end of his life.

WHAT ABOUT CPF LIFE'S BASIC PLAN?

For those who opt to join CPF Life Basic Plan, instead of the Standard and Escalating Plans, about 80 to 90 per cent of Retirement Account savings will be directly used to provide payouts until age 90.

The remaining 10 to 20 per cent of the Retirement Account will be deducted to pay for the CPF Life premium and is used to provide payouts from age 90 for the rest of the member's life.

As less is used for CPF Life premium, the monthly payout will be lower compared to the Standard Plan.

The Basic plan payouts will also decrease as balances decrease and earn less extra interest. According to the CPF website, the extra interest is earned on the first S$60,000 of CPF balances and is used to increase CPF Life payouts.

For those opting for Standard and Escalating Plans, all Retirement Account savings will be used for the CPF Life premium.

The Basic Plan is a legacy plan carried over from when CPF Life was first introduced in 2009. Compared with the Standard Plan, which gives higher and steady monthly payouts, Basic Plan payouts are lower and will get progressively lower when the combined CPF balances fall below S$60,000.

CPF members who have less that S$60,000 than in retirement savings when starting monthly payouts, and are born in 1958 or after, will not be automatically included in CPF Life annuity.

They will thus not be eligible for lifetime payouts and will only receive monthly payouts that will stop when their savings run out. This means they will have to find other sources of retirement income.

Summing it up in simple terms, Mr Christopher Gee, senior research fellow and deputy director at the Institute of Policy Studies, said that CPF Life is a "pot of money that we all put together" to cover members' retirement needs.

"There is a long-term commitment for all of us if we're members and we take up this CPF Life annuity... then we're covered for life," he added.

"And because there are that many CPF Life members with the annuity, it's a big pot and you can take that risk of money running out in the pot, because you have that many people."

Associate Professor Mandy Tham from Singapore Management University (SMU), whose research interests are in finance and wealth management, said that although the Special Account can be thought of as an investment account that earns returns from a floor interest rate, CPF Life is not an investment account but serves the purpose of ensuring our "minimum lifelong financial sustainability".

The CPF Board's website states as much: "CPF Life is an insurance product, not an investment product."

WHY INTEREST IS POOLED

Because CPF Life is an annuity policy, it works by pooling all premiums paid by members, including all accumulated interest earned.

This makes it possible for the scheme to offer lifetime payouts to members, even if a single member exceeds his or her expected longevity or that the sum of the payouts the person gets exceeds the premiums he or she has paid.

Its webpage also states that the projected interest earned on the premium is "factored into monthly payouts from the start".

Mr Timothy Ho, co-founder and managing editor of investing website Dollars and Sense, said that CPF Life remains a "competitive" product.

The Government ultimately provides the basis of assurances that the returns to CPF Life premiums are guaranteed, he added.

Agreeing, Associate Professor Walter Theseira, an economist from the Singapore University of Social Sciences, said that CPF Life is “low cost” by virtue of being based on the entire population.

Without the risk-pooling mechanism among CPF Life members, there would be no source for the funds to support those who live longer.

“In CPF Life, you are paying for the fact that you still get payouts after the life expectancy. If you lived beyond life expectancy, which plenty of people would, you get far more from CPF Life," Assoc Prof Theseira explained.

The converse is also true, in that any annuity product offer fewer benefits to those who live shorter lifespans.

This is part of the nature of annuities and why they are considered as a form of risk transfer.

HOW MUCH DO BENEFICIARIES GET WHEN CPF MEMBERS DIE?

If one dies before 65 years old, before they can be enrolled in CPF Life, one's beneficiaries will receive their Retirement Account balance, which would have accrued interest from 55 years old onwards based on the prevailing CPF interest rate.

This is different for members enrolled under CPF Life after 65.

Should they die, their beneficiaries will receive the CPF Life premium balance, which is the total CPF Life premium paid from the Retirement Account, minus the total payouts they received in their lifetime. Beneficiaries will also receive any remaining CPF savings.

For instance, using the earlier example, a male CPF member who subscribed to CPF Life's Standard Plan would have a premium of S$370,000 if he started receiving payouts at 70. This sum includes the added interest earned from ages 65 to 70 in his Retirement Account.

Should he die at age 75, after taking into account payouts received by him, his beneficiaries would receive the remaining S$239,200.

If the same member lives to 90 though, he would have exhausted the original S$370,000 premium, having collected around S$523,200 in total from the annuity. This means that his beneficiaries will not get anything when he dies.

On this point, Assoc Prof Tham from SMU said that CPF Life is designed to sustain one's lifestyle during their lifespan, but not to hedge against "mortality risk". In the latter case, such products would focus on the death payout for an individual's beneficiaries.

"(CPF Life) is not designed for bequest purposes.

"We are living longer and need a more adequate annuity plan. With a larger number of singles, bequest motives become weaker, lifelong retirement income needs become stronger," Assoc Prof Tham added.

In short, the goal of CPF Life is to guarantee the CPF member's financial sustainability for the remainder of his or her life, and not the next generation’s inheritance through bequest.