HDB reveals for the first time breakdown of development costs of BTO flats, reiterates it 'doesn't apply profit margin on costs'

SINGAPORE — For the first time, the Housing and Development Board (HDB) has revealed a breakdown of the development costs for Build-to-Order (BTO) flats, as a national discussion continues about the affordability of public housing.

A view of Built-to-Order flats being constructed.

- MND and HDB have disclosed development costs for recently completed flats for the first time

- The prices of new BTO flats are pegged to buyers’ affordability, not to development costs, they said

- The prices of BTO flats are determined by comparing the prices of surrounding resale flats and applying substantial housing subsidy

- The process is not profit-driven and HDB incurs a loss every year due to housing subsidies, it said

SINGAPORE — For the first time, the Housing and Development Board (HDB) has revealed a breakdown of the development costs for Build-to-Order (BTO) flats, as a national discussion continues about the affordability of public housing.

In a joint statement on Wednesday (Dec 7) with the Ministry for National Development (MND), it also gave a full explanation as to how it determines the prices of BTO flats and the subsidies for each project.

It stressed that the way it determines BTO flat prices is totally separate and independent from the development costs of housing projects, as it is not profit-driven.

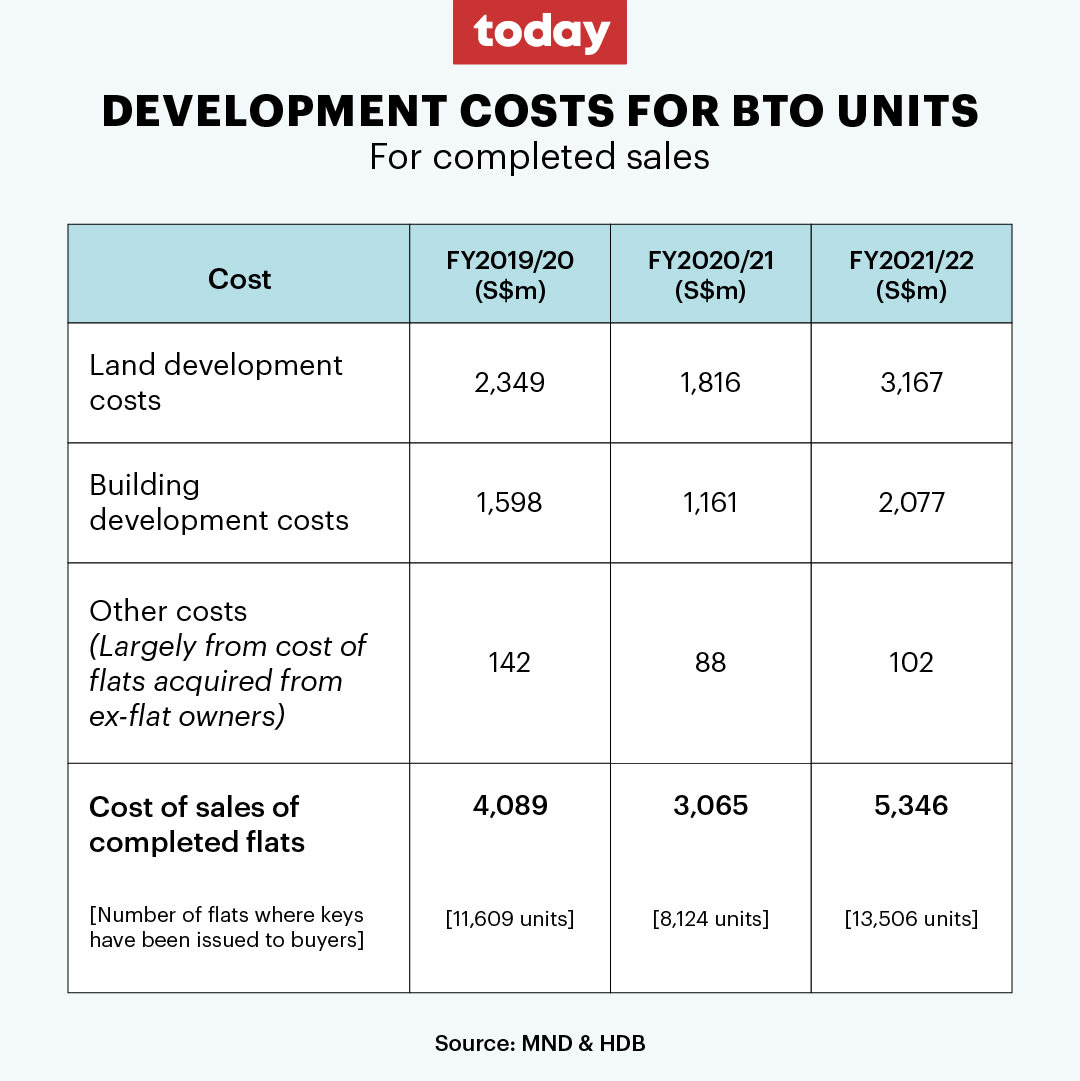

HDB and MND disclosed that the development costs for 13,506 BTO units, which were completed and handed over to home buyers in the 2021-2022 financial year, were:

- S$3.17 billion in land costs

- S$2.08 billion in building costs

- S$102 million for other costs (costs incurred from former HDB flat owners who had to sell their flats due to infringement, or other reasons)

- S$5.35 billion for the total cost of the sales of completed flats

HDB and MND added: "Unlike the private sector, which is profit-driven, HDB prices new flats with affordability in mind. We therefore do not apply a profit margin on costs."

To determine housing affordability, the ministry and HDB look at the buyers’ household incomes and the selling prices of the flats on offer, they said.

The disclosure of these figures come after Leader of the Opposition Pritam Singh and Ms Indranee Rajah, Second Minister for Finance and National Development, sparred in Parliament last month over the costs of developing new flats and HDB subsidies.

Mr Singh had suggested making public the breakdown of development costs of all new public flats and the subsidies that have been applied to them to track the amount of subsidies offered, to which Ms Indranee disagreed, saying that it was not “meaningful” to do so.

The issue has come under the spotlight as BTO flat prices have been on the rise. In August, a five-room BTO flat at Central Weave@Ang Mo Kio was launched at a record high selling price of S$877,000.

The higher prices, along with longer waiting times for BTO flats, have added to the worries of young first-time buyers who face increasingly stiff competition to successfully ballot for BTO flats, particularly in mature estates.

HOW BTO FLATS ARE PRICED, SUBSIDIES DETERMINED

HDB sets the prices of new flats by first establishing the flat’s market value, which is determined by comparing with the transacted price of comparable resale flats nearby, MND and HDB said in their statement.

The prices of these resale flats are influenced by prevailing market conditions and their individual attributes such as location, which floor of the block they are, orientation and accessibility to facilities and amenities.

Then, HDB will provide subsidies to offset the difference in price between the assessed market value of the BTO flat and its final selling price.

The amount of subsidy that is applied is determined according to BTO flat buyers’ affordability, which are pegged to two factors:

- Resident household incomes

- Mortgage servicing ratio, which refers to the percentage of the borrower’s gross monthly income that goes to repaying home loan instalments

As market values of flats fluctuate, the housing subsidies for each BTO project varies.

BTO projects under the Prime Location Public Housing model also enjoy extra subsidies since flats at prime locations typically have high market value due to their proximity to prime locations such as the city centre and to amenities.

FLATS STILL AFFORDABLE

HDB said that 90 per cent of owners who collected keys to their new flats in non-mature estates and 80 per cent of those who collected keys to new flats in mature estates from January to June 2022 had a mortgage servicing ratio of 25 per cent or less.

This means that these buyers used 25 per cent or less of their monthly income to pay their HDB loan instalments and could pay their loans using their monthly Central Provident Funds (CPF) contributions, forking out little to no cash.

On top of the housing subsidies, HDB also provides housing grants of up to S$80,000, which are tiered by household incomes, for eligible first-time flat buyers.

“By increasing the subsidy applied in a rising property market, HDB has kept BTO flat prices relatively stable, even when construction costs had increased by almost 30 per cent in the past two years,” MND and HDB said.

DEVELOPMENT COSTS OF HDB FLATS

HDB also released the breakdown of development costs for flat sales since 2019.

In the 2020-2021 financial year, the development costs for 8,124 units were:

- Land costs – S$1.82 billion

- Building costs – S$1.16 billion

- Other costs (costs incurred from ex-HDB flat owners who had to sell their flats due to infringement, or other reasons) – S$88 million

- Total cost of sales of completed flats – S$3.07 billion

In the 2019-2020 financial year, the development costs for 11,609 units were:

- Land costs – S$2.35 billion

- Building costs – S$1.6 billion

- Other costs (costs incurred from ex-HDB flat owners who had to sell their flats due to infringement, or other reasons) – S$142 million

- Total cost of sales of completed flats – S$4.09 billion

HDB said that the increase in the deficit it incurred in the latest financial year is an indicator of the increased amount of subsidies that have been applied to new BTO flat projects.

The housing authority incurs a loss every year due to the housing subsidies in its Home Ownership Programme, it added:

- Financial year 2021-2022 – deficit of about S$3,850 million

- Financial year 2020-2021 – deficit of about S$1,953 million

- Financial year 2019-2020 – deficit of about S$2,232 million

The deficit is mainly incurred from the gross loan on flat sales completed, disbursement of CPF housing grants to eligible resale flat buyers, and expected loss for flats that began development in the financial year 2021-2022, HDB and MND said.