Look Ahead 2024: COE premiums set to moderate amid supply bump, but ride-hailing costs may rise

SINGAPORE — Certificate of Entitlement (COE) premiums may have set some record highs in 2023, but experts say the trend is not expected to continue this year due to an increase in supply.

After a turbulent and eventful 2023, TODAY takes a look at what's in store for the next 12 months. The final of our four-part Look Ahead series looks at Singapore's transport scene as people moving around the island face possible changes across public transport, ride-hailing and Certificate of Entitlement prices.

- Experts predict a decline in COE premiums due to increased supply resulting from higher deregistrations of cars sold in 2014 compared with 2013

- Ride-hailing costs are expected to rise this year due to factors such as fluctuations in energy costs and a shortage of manpower in the taxi and private-hire sector

- A government review of the point-to-point transport industry's structure is expected to conclude in the second quarter of 2024, which could result in a boost to service availability

- Changes in bus services and routes are also expected after the launch of Stage 4 of the Thomson-East Coast Line in early 2024, leading to rationalisation based on demand

- The adoption of electric vehicles (EVs) in Singapore is likely to remain slow in 2024 as more consumer confidence needs to be built

SINGAPORE — Certificate of Entitlement (COE) premiums may have set some record highs in 2023, but experts say the trend is not expected to continue this year due to an increase in supply.

This is because more cars were sold 10 years ago in 2014, compared with 2013, leading to more deregistrations this year. Unless renewed, COEs expire after 10 years.

Already, the first COE exercise of 2024 saw a sharp fall in premiums for cars.

On the other hand, in assessing the overall transport picture in Singapore, the experts noted that private car ride-hailing costs are set to go up owing to fluctuations in energy costs, operational costs and a lack of manpower.

However, things may look up for commuters after the second quarter of 2024 when the Government’s review of the point-to-point transport industry’s structure concludes, which aims to improve the availability of services.

Another key element in the big picture of transport services is public transport.

Commuters living in the east will possibly have to brace themselves for more rationalisation of bus services once Stage 4 of the Thomson-East Coast Line (TEL) launches this year.

As for the adoption of electric vehicles (EVs), experts do not think 2024 will see a significant spike in demand as there are still several teething issues to be ironed out to boost consumer confidence.

These issues include battery charging, vehicle costs, and the availability of better infrastructure globally and regionally.

LOWER COE PREMIUMS DUE TO HIGHER SUPPLY

Sky-high COE premiums were a hot-button issue in 2023, igniting debate as there was more demand than supply in various rounds of the twice a month bidding process.

However, transport analysts told TODAY that Singaporeans can expect a gradual increase in COE supply this year, especially towards the latter part of the year.

This is due to high deregistrations in the 10-year COE cycle, as more cars were sold 10 years ago in 2014 than in 2013, and the "cut-and-fill" move by the Government to bring forward COE quotas from peak periods.

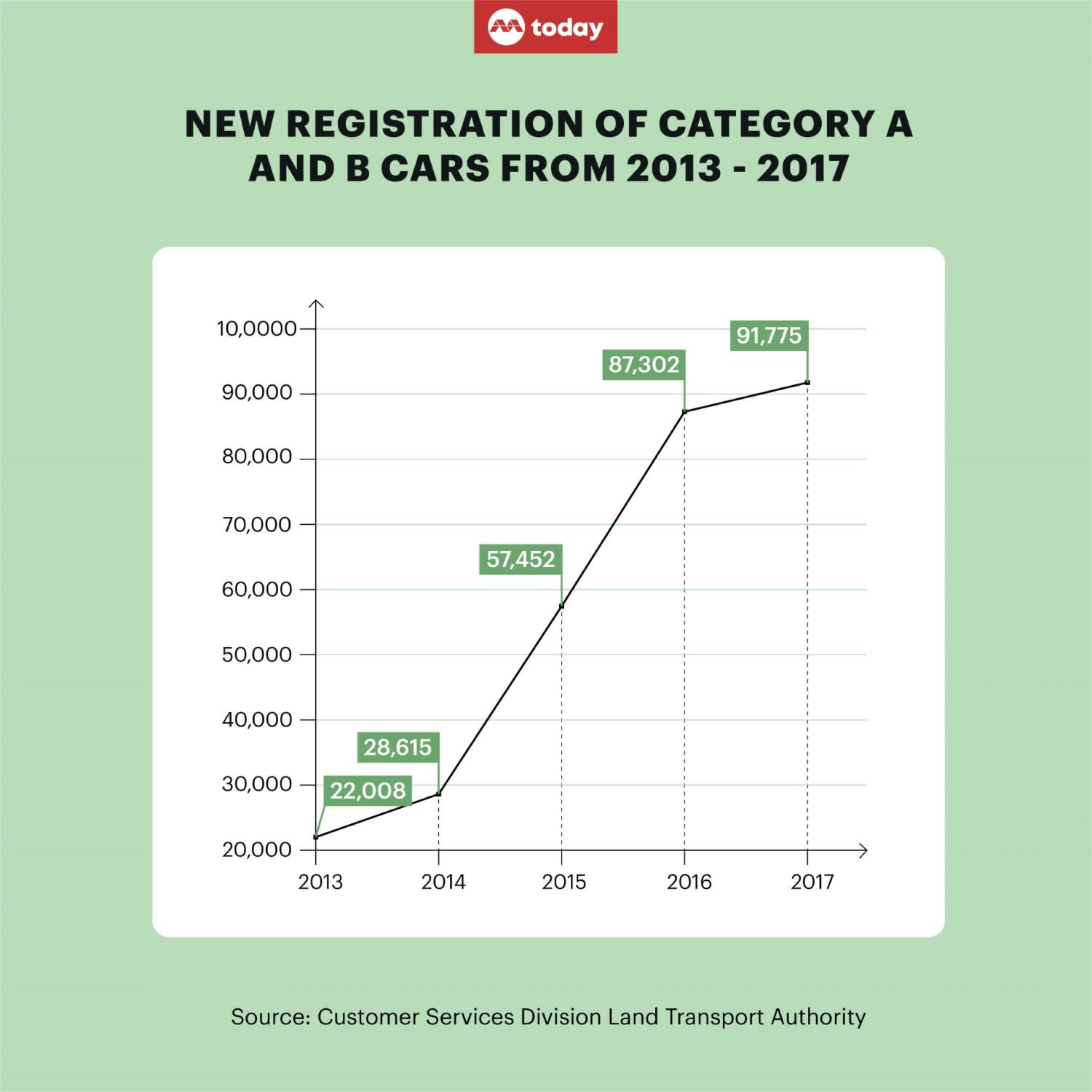

According to the Annual Vehicle Statistics 2022 on the Land Transport Authority website, a total of 55,588 new registrations by COEs were made in 2014 across all categories — a 21.5 per cent jump from 2013’s 45,761.

New registrations of Category A and Category B — for smaller and larger cars, respectively — totalled 28,615, a 30 per cent increase from the previous year’s total of 22,008.

Transport economist Associate Professor Walter Theseira said this will moderate COE prices, but also bring many existing car owners into the market again as they seek to replace cars.

“So instead of having a situation of very high COE prices that affect only a tiny number of potential buyers, we'll probably have moderately high COE prices that start to affect a larger number of buyers,” he said.

Prof Theseira added that this situation would cause some pain, to the extent that the premiums are likely to be higher than what drivers paid the last time they bought their cars in 2014 and onwards.

Last November, Acting Minister for Transport Chee Hong Tat said the "cut-and-fill" move would fill any current supply troughs by bringing forward supply from peak periods while maintaining the zero-vehicle growth policy.

Hence, motorists can expect a significant increase in COE supply from the second half of 2024 before reaching the peak supply years from 2026 to 2027.

Will Singapore witness a drop in car demand this year given the Government's policy and the expansion of the MRT network? Prof Theseira said no. In fact, it would be the opposite.

As car deregistrations will increase from late 2024 onwards, Prof Theseira said there would be much greater demand for buying new cars, especially from existing car owners looking for replacements.

“When combined with the larger COE supply due to deregistrations, I expect overall the effect on COE prices to be moderating downwards,” he said, adding that it has been the case for every higher COE supply cycle in the past.

However, for millennials, experts think that many may still hold off their plans to buy their first car, given the current economic outlook, especially if there is no urgent reason to make the purchase.

Transport engineering consultant Gopinath Menon said with the variety of transport options available today, many youths may want to avoid committing to the high cost of buying, maintaining and operating a car.

Likewise, Dr Raymond Ong from the National University of Singapore (NUS) said: “I expect car ownership desire will drop, as youths are more concerned about bread and butter issues, such as home ownership and career aspirations.”

RIDE-HAILING COSTS MAY RISE

With the slew of global uncertainties, experts told TODAY that it is also likely that users of ride-hailing services will face higher prices on platforms this year.

Mr Menon said while it is difficult to predict, steeper costs are possible given the increasing cost of living in 2024.

Dr Ong, associate head of research in the NUS department of civil and environmental engineering, is on the same page.

He said the lack of drivers in the taxi and private-hire sector constitutes a supply reduction, while demand for ride-hailing services remains strong.

“Demand for ride-hailing services looks unlikely to fall based on past trends. We do not expect demand to fall anytime soon,” he said.

While Dr Ong expects ride-hailing firms to aggressively hire more drivers to fill the gap, he is pessimistic about the outcome due to better career opportunities and salary packages in other sectors.

Some users remain prudent in their approach to using ride-hailing services.

Those who spoke to TODAY agreed that taxis and private-hire transport have become more expensive in recent years. As such, these commuters would allow themselves the “luxury” of hailing a ride only under specific circumstances.

Bank officer Audrey Lee, 29, said prices, especially during a surge, can be quite “ridiculous”.

She said she would hail a ride only once or twice a month when she has a late night out with friends, but sometimes it could take longer than usual for her to get a driver.

“I don’t think I will change my frequency of hailing rides this year. Not in this economy.”

Senior Parliamentary Secretary for Transport Baey Yam Keng told TODAY that the Government is reviewing the point-to-point (P2P) industry structure and regulatory framework to improve these services.

“As part of this review, LTA is reaching out to commuters, drivers, P2P operators, the National Taxi Association, the National Private Hire Vehicles Association and academics,” he said.

The review is slated to be completed by the second quarter of 2024.

BUS SERVICES RATIONALISATION AFTER TEL STAGE 4 OPENS

With the MRT's TEL Stage 4 slated to launch in early 2024, experts have said that commuters can expect changes in bus services and bus routes as more areas in the East Coast will have easy access to MRT stations.

With that, more rationalisation of bus services is on the cards. Mr Menon said the East Coast is well-served by buses, enabling residents to travel to almost every part of Singapore easily.

“When the (new MRT stations) come, maybe the not-so-popular bus services will be affected. The rationalisation may not take place exactly this year, but from next year onwards,” he said.

The rationalisation of bus services refers to the withdrawal, merger, or cutting down of operating frequency due to low commuter demand.

Judging by what happened recently with bus service 167, Mr Menon thinks some services in the East Coast may have their frequencies cut down instead of being stopped entirely.

Last November, the Land Transport Authority (LTA) reversed its decision to withdraw bus service 167. Instead of complete removal, the service now operates at 30-minute intervals throughout the day.

The initial decision, which triggered an outcry among commuters, was made due to a decline in ridership.

ADOPTION OF ELECTRIC VEHICLES TO REMAIN SLOW FOR NOW

Last September, it was announced that the Electric Vehicle (EV) Early Adoption Incentive, launched in 2021, has been extended by two years to Dec 31, 2025, with lower rebates offered this year.

However, experts see that Singaporeans will likely remain slow in fully embracing EVs in 2024.

Mr Saktiandi Supaat, who is chairperson of the Government Parliamentary Committee for Transport, said Singaporeans are cautious about shifting to EVs because of several factors: EV prices, travel range, battery lifespan and availability of charging stations.

He said EV models, such as those made by Tesla, Hyundai and China’s BYD, are usually considered expensive by the average buyer.

“Range is also a concern for EV users, especially those who go to Malaysia because they are worried that the battery will run out when travelling across different states,” said Mr Saktiandi.

“I think Singaporeans will probably wait for better infrastructure to be available globally or regionally before switching from an internal combustion engine to an EV.”

Similarly, Dr Ong said there is a need to adopt a wait-and-see approach for now, as consumers have a tendency to balance EV rebate amounts with COE prices before deciding whether it is worth switching to an EV.