MediShield Life review calls for higher premiums, expanded coverage to include treatments for attempted suicide, drug addiction and alcoholism

SINGAPORE — A set of recommendations has been put forth to improve MediShield Life coverage for Singaporeans, such as raising the policy-year claim limit from S$100,000 to S$150,000 and lowering the deductible for day surgeries for older patients.

While several enhancements to Medishield Life have been made over the years, the Ministry of Health said that this is the first major review since the scheme was launched.

- This is the first major review of MediShield Life since its launch in 2015

- The MediShield Life Council recommends expanding coverage for all

- This includes those seeking treatment from attempted suicide or drug and alcohol addiction

- It recommends raising premiums to keep MediShield Life sustainable

- It is seeking public feedback on the recommendations until Oct 20, 2020

SINGAPORE — A set of recommendations has been put forth to improve MediShield Life coverage for Singaporeans, such as raising the policy-year claim limit from S$100,000 to S$150,000 and lowering the deductible for day surgeries for older patients.

The MediShield Life Council, which oversees the administration of the basic hospitalisation insurance scheme under the Central Provident Fund (CPF) Board, is also suggesting expanding the scheme to cover patients seeking treatments arising from attempted suicide, intentional self-injury, drug addiction and alcoholism, who are now excluded.

MediShield Life is available to all citizens and permanent residents, helping them pay for large hospital bills and selected costly outpatient treatments, such as dialysis and chemotherapy for cancer.

With the expanded coverage, the council is calling for higher premiums to keep the scheme sustainable.

The Ministry of Health (MOH) also announced on Tuesday (Sept 29) that the Government will commit about S$2.2 billion for premium subsidies and support over the next three years to help Singapore residents with their MediShield Life premiums, including a one-off Covid-19 subsidy.

With these support measures in place, the net premium increases for all citizens will be kept to about 10 per cent in the first year.

The council is launching a public consultation to gather views on these proposals from Tuesday to Oct 20, with changes to the scheme expected to take effect early next year.

The council periodically reviews and updates the scheme’s benefits and premiums to keep pace with evolving medical practice, healthcare costs and actual claims experience.

Several enhancements to the scheme have been made over the years since it was launched in Nov 2015 but this is the scheme’s first major review.

PROPOSALS TO IMPROVE COVERAGE

Some of the council’s recommendations are as follows:

1. Remove the standard exclusions for treatments arising from attempted suicide, intentional self-injury, drug addiction and alcoholism.

The council said there is growing recognition that proper treatment is the appropriate approach when dealing with patients who self-harm

It added that addiction is a chronic medical disease that involves complex interactions among brain circuits, genetics, the environment and an individual’s life experiences

It therefore believes that prevention efforts and treatment approaches for addiction are generally as successful as those for other chronic diseases

2. Expand claim limits to cover nine in 10 subsidised hospital bills.

- Review claim limits more regularly to cope with inflation and medical advancements

3. Raise the policy year claim limit from S$100,000 to S$150,000.

4. For older patients doing day surgeries, lower the deductibles — the amount a patient pays once every policy year before MediShield Life payout starts.

A patient over the age of 80 would pay S$2,000 for a day surgery instead of the current S$3,000.

This would make it the same as the deductible for inpatient stays in hospital C wards, ensuring that patients are not discouraged from choosing a day surgery over an inpatient stay.

5. Higher claim limits for daily ward and treatment charges for the first two days of acute hospital stay.

Higher charges tend to be incurred during the first two days due to diagnostic tests and investigations

6. Raise the claim limits for normal and intensive care unit wards to S$800 and S$2,200 a day respectively and introduce an added claim limit of S$200 a day for the first two days for either ward. The limits are now at S$700 and S$1,200 daily respectively.

ADJUSTING PREMIUMS

The council is also recommending raising the premiums for MediShield Life, which has been kept constant since its launch, to ensure that the scheme continues to be sustainable.

It noted that premiums need to be adjusted periodically to support enhancements that provide better coverage and higher payouts, and to keep pace with healthcare cost inflation and actual claims experience.

MediShield Life payouts have increased by close to 40 per cent over the last four years, and the number of claimants has increased by almost 30 per cent, it added.

It is thus recommending that premiums be raised by between 11.5 per cent and 34.3 per cent, depending on the person’s age, before subsidies.

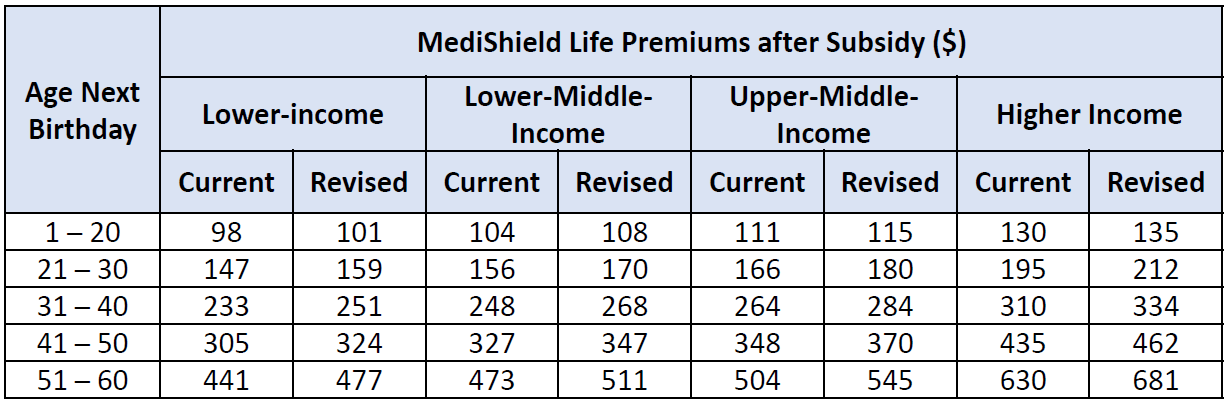

Premium subsidies applied are for Singapore citizens living in properties with an annual value of S$13,000 or less. Figures, shown here for Singaporeans aged 1 to 60, are rounded up to the nearest dollar. Source: Ministry of Health

For instance, the council proposed that for 2021, the premium for Singaporeans between the age of one and 20 be set at S$145 before subsidies, an increase from the current S$130.

For those between 31 and 40, they could pay S$390, up from the current S$310.

However, the council stressed that no one will lose MediShield Life coverage due to financial difficulties. Premium subsidies and support are extended to lower- and middle-income households as well as people under the Merdeka Generation and Pioneer Generation schemes. Premiums will continue to be fully payable through CPF MediSave.

The public consultation paper with details on the recommendations and the online feedback form can be found at MOH's website.