Property cooling measures: Analysts expect fewer million-dollar HDB resale flats but prices of 4-room units, rents may rise

SINGAPORE — While newly announced measures to cool the public housing market are expected to reduce the number of million-dollar resale flat transactions, property analysts cautioned that prices for four-room flats may rise, along with rental units.

- The newly announced property cooling measures are likely to help reduce the number of million-dollar HDB resale flat transactions, said analysts

- Some property experts described the measures as the "first major" move of its type for public housing since at least 2013

- They caution about possible knock-on impact, such as an uptick in demand for four-room HDB flats and upward pressure on already high rental rates

SINGAPORE — While newly announced measures to cool the public housing market are expected to reduce the number of million-dollar resale flat transactions, property analysts cautioned that prices for four-room flats may rise, along with rental units.

The analysts also see possible implications for the private property market, with some suggesting that en-bloc prices may rise as sellers hold out for higher prices given the new restrictions on buying Housing and Development Board (HDB) flats.

Smaller private homes may also rise in price now given the restrictions on private property sellers buying HDB flats.

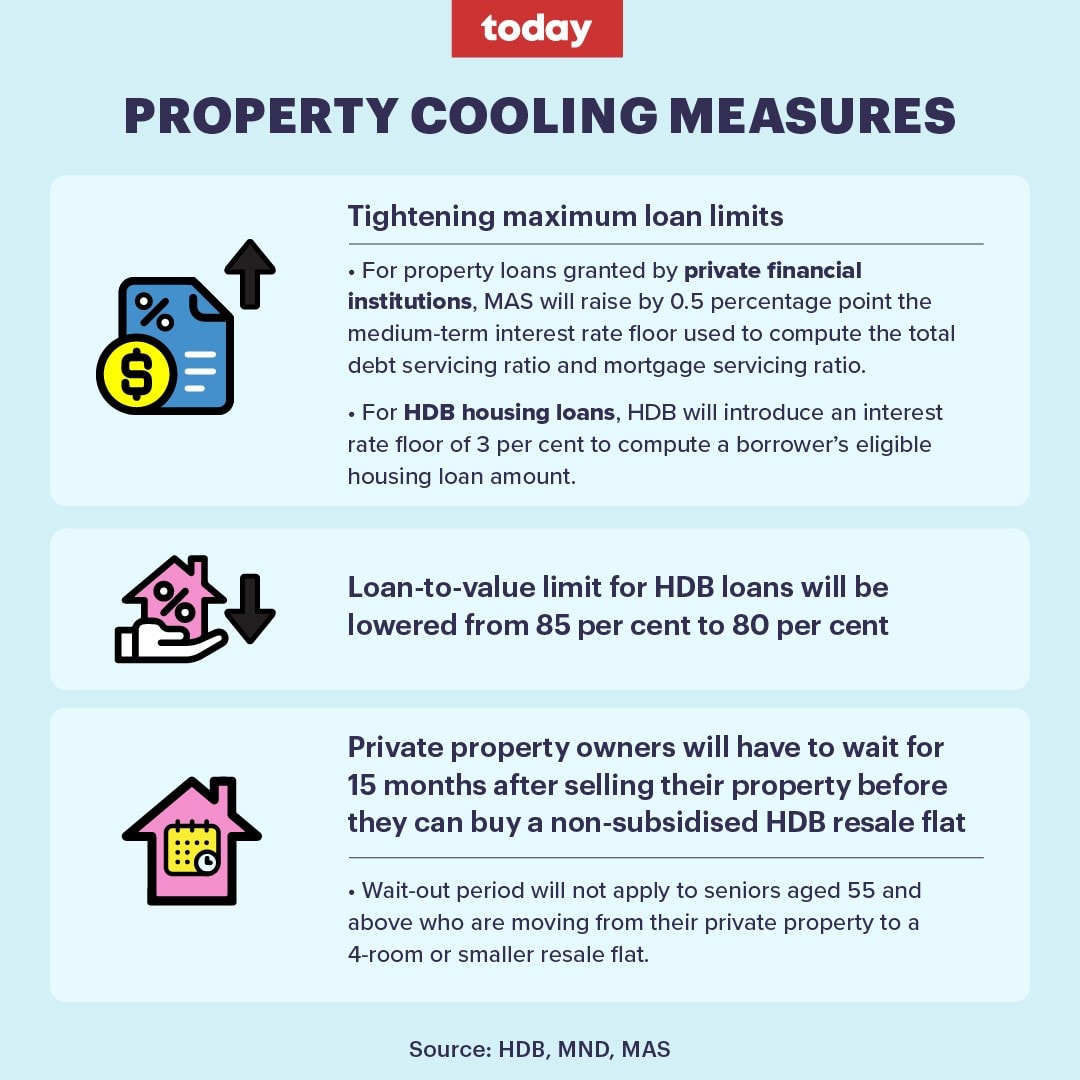

The Monetary Authority of Singapore, the Ministry of National Development and the HDB jointly announced late on Thursday (Sept 29) three measures to moderate demand for public housing.

They include a 15-month wait-out period for both current and former private residential property owners intending to buy a non-subsidised HDB resale flat, tightening of the maximum loan amount limits in light of rising market interest rates, and lowering the loan-to-value for HDB housing loans.

These moves follow rising numbers of HDB resale flats being sold for over S$1 million. More broadly, the HDB Resale Price Index jumped 5 per cent from last December to June this year.

Ms Christine Sun, senior vice president of research and analytics at property firm OrangeTee & Tie, said: “This is the first time that major cooling measures have been implemented in the public housing market, therefore we may expect a more significant knee-jerk reaction.”

Mr Lee Sze Teck, senior director for research at Huttons Asia, agreed that the announcement “is probably the first major cooling measure on the public housing market since 2013”, referring to the year the mortgage servicing ratio was introduced.

Before that, in December 2021, curbs were "implicitly implemented" when the HDB loan-to-value limit was reduced from 90 per cent to 85 per cent, said Mr Paul Wee, vice president at PropertyGuru Finance.

He added that the latest measures on the public housing market are significant as they are aimed at private property owners and ex-private property owners looking to buy HDB flats, a category that has "never been targeted" before.

"Measures are usually aimed at those in the primary market or those which fetch subsidies,” he said.

MILLION-DOLLAR FLATS SOLD 'EVERY OTHER DAY'

Analysts pointed to private property owners seeking to downgrade their home as the likely driving force behind recent instances of HDB flats being sold at eyebrow-raising prices.

Ms Sun noted that the price growth for five-room and executive flats has outpaced that of smaller units over the past year.

“Over the past month, about one to two (HDB resale) flats have been sold for a million dollars every other day,” she said.

“Over the past month, about one to two (HDB resale) flats have been sold for a million dollars every other day.Ms Christine Sun, senior vice president of research and analytics at property firm Orange Tee & Tie”

“These larger flats and million-dollar flats could be largely bought by private homeowners or downgraders who can afford to pay high prices for these flats, thus driving up their prices which will affect the overall price index for all resale flats.”

Mr Mohan Sandrasegeran, senior analyst for research and content creation at One Global Group, said these buyers had often been "unaffected by the excessive pricing and have ample liquidity”.

However, the introduction of the wait-out period of 15 months before they are able to buy an HDB unit may cause them to think twice about selling their house, he said.

DEMAND UPTICK FOR SMALLER HDB FLATS, RENTAL HOMES

One exception to the wait-out period is for owners aged 55 and up, who are not required to wait for 15 months if they choose to buy resale four-room HDB flats or smaller.

Knight Frank Singapore head of research Leonard Tay said that this may "trigger a rise in value" especially for four-room flats in mature estates.

“(These units have) good locations, walking distance to MRT stations and were built in earlier years when the size of HDB four-room units were larger at 100sqm to 110sqm,” he said.

"After all, a retiree couple intent on downgrading from private property after their children have moved on to start families of their own might be content on a simpler housing arrangement that is nearby to the amenities common in HDB estates."

Mr Nicholas Mak, head of research and consultancy at ERA, added that such flats meet the requirement of a “typical” household made up of parents, children and possibly a helper.“Four-room HDB flats are the smallest flats with three bedrooms. As a result of this new curb, four-room flats will become more popular.”

Mr Mak added that even among buyers with no private property, the tightening of the loan restrictions appeared likely to dampen demand and thus ease prices.

Meanwhile, private property owners who are willing to sit out the 15-month wait-out period may need to rent a unit for this period, which could drive rental rates higher.

“This would push more demand into the leasing market, putting more upward pressure on rental values, in both the private and HDB market, that have been increasing substantially throughout 2022,” said Mr Tay of Knight Frank.

Agreeing, Ms Tricia Song, head of research for Southeast Asia at CBRE, said: “Residential rents are at a record high now and, with this announcement, may continue to move up and remain elevated into 2023.”

IMPACT ON PRIVATE PROPERTY

Meanwhile, the analysts offer differing opinions on the measures' impact on the private residential property market.

Mr Wee of PropertyGuru Finance said not all private property downgraders who are aged over 55 would turn to smaller HDB flats.

“A possible implication is that these downgraders may turn to the private resale market for smaller units or shift to the rental market during the 15-month waiting period,” he said.

Mr Mak of ERA said the shift to smaller private units — or other private property units in general — could increase sales volume in the resale market.

On the other hand, other analysts felt that the likely hesitation by some private property owners to let go of their units in the immediate term, given the measures, may lead to a slowdown in the market.

“We anticipate that prospective buyers will likely take longer to commit to home purchases, translating to a slowdown in sales as the negotiation of prices and matching of buyers takes longer,” said Dr Tan Tee Khoon, country manager at PropertyGuru Singapore.

This is compounded by the calibration of borrowing rates, which would have an impact on property affordability, said analysts.

“A household with a monthly income of about S$12,200 would now only be eligible for up to S$1.41 million in a loan to support a S$1.88 million property purchase, versus S$2 million previously,” said Mr Lam Chern Woon, head of research and consulting at Edmund Tie, as an illustration.

Mr Lam was referring to the tighter loan rules which are taking account of the likely further increase in interest rates. The tighter rules are designed to ensure buyers can cover their mortgage if rates do indeed rise further.

The analysts believe that one area of the private property market that may be affected by the measures is the en-bloc market.

“En-bloc sellers may also have one less option of alternative accommodation and this could potentially drive up selling price expectations,” said Ms Song of CBRE. She was referring to the idea that en-bloc sellers might hold out for higher prices given that it will be harder to buy a cheaper home.

On the other hand, Mr Mak opined that the possible impact might be “minimal”.

“The profit from the en-bloc sale is so attractive that (the owners) will be willing to rent a temporary home during the 15-month waiting period,” he said.