Economists downgrade Singapore's GDP forecast following circuit breaker extension

SINGAPORE — As the economy comes almost to a standstill for one more month until June 1 due to the extension of control measures to curb the spread of Covid-19, economists have downgraded their growth forecasts for Singapore yet again. And they expect it to go into an even deeper recession.

Earlier hopes that there may be a pickup in economic activity for Singapore in the second half of this year has all but disappeared, economists said.

SINGAPORE — As the economy comes almost to a standstill for one more month until June 1 due to the extension of control measures to curb the spread of Covid-19, economists have downgraded their growth forecasts for Singapore yet again. And they expect it to go into an even deeper recession.

In a published report on Wednesday (April 22), United Overseas Bank (UOB) economist Barnabas Gan lowered Singapore’s 2020 growth forecast from -2.5 per cent previously to -4 per cent.

Other economists interviewed by TODAY made similar downgrades.

A day before, Prime Minister Lee Hsien Loong announced in a nationwide live telecast that the Government is adding four more weeks to the circuit breaker to reduce the movement of people until better results show that transmission rates are going down. The period was supposed to end by May 4.

More businesses providing essential services have to shut down temporarily, so that the proportion of workers commuting daily can be cut from 20 per cent to about 15 per cent.

Ms Selena Ling, head of treasury research and strategy at OCBC bank, downgraded her forecast from -3 per cent to -6 per cent, with a possible downside risk of even a -10 per cent growth.

Unable to give official figures yet, Mr Irvin Seah of DBS bank and Dr Chua Hak Bin of Maybank Kim Eng said that the four more weeks of circuit breaker would mean the risk for greater contraction is there.

However, in an earlier report by Dr Chua and Miss Lee Ju Ye, another economist from Maybank Kim Eng, they said that the circuit breaker would cause the gross domestic product (GDP) to contract by 6 per cent, while a one-month extension would cause it to contract further to 8 per cent.

Dr Chua told TODAY on Wednesday that this extra month will cost Singapore’s economy S$10 billion.

While Mr Seah had earlier forecast a 2.8 per cent baseline contraction of the economy for this year, he said before that the first four weeks of the circuit breaker could potentially tip the full-year forecast towards a 4 per cent contraction.

Now with the extension, there is a risk that the recession will be deeper than the lower limit of the authorities’ official forecast range of -4 per cent.

Official forecasts from the Ministry of Trade and Industry estimated that the Singapore economy would contract by between 1 and 4 per cent for 2020.

All these projections mean that Singapore is charting a course towards possibly the worst recession on record.

The economists said that the work stoppages during the extension would particularly hit the construction, food-and-beverage (F&B) and manufacturing sectors.

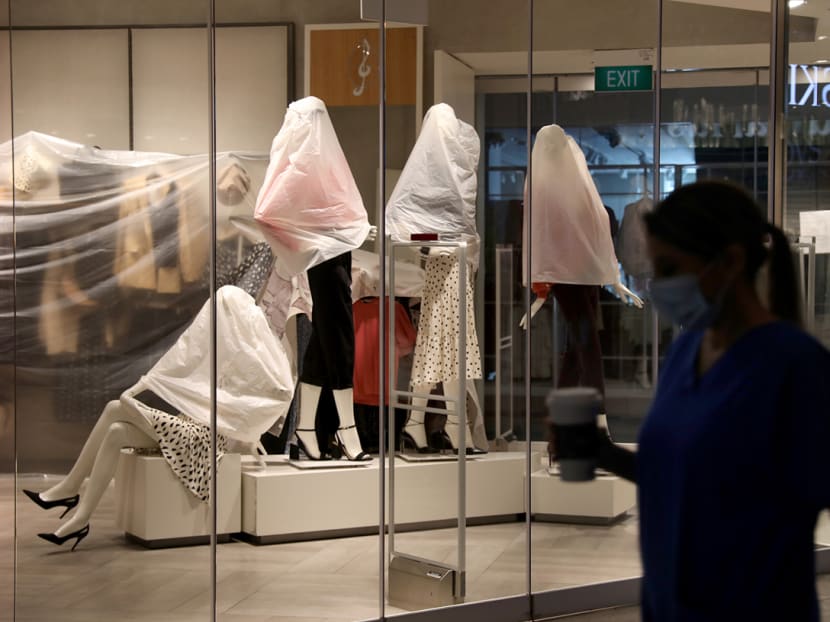

Mr Gan of UOB said that it would mean another month of lost revenues and delays to projects for the construction sector. In addition, 70 per cent of Singapore’s retail sales cluster will have their storefronts closed.

Apart from the F&B sector that would be affected by the tightening measures, Mr Seah of DBS said that many industries beyond F&B will not be able to operate at their full capacity for one more month.

With the months of January and December usually slower due to festivities around Christmas and the new year, Ms Ling said that there are usually 10 productive months in a working year.

Now with two of the 10 months coming under the circuit breaker, productive activity is being reduced to two-thirds of the whole year, she explained.

“The shock level is going to be quite high.”

JOB MARKET

Dr Chua earlier projected that the first four weeks of the circuit breaker might lead to the retrenchment of between 150,000 and 200,000 workers for the whole of 2020.

When asked whether the extension would lead to more retrenchments, he declined to put a figure to it, except to say that it would be more likely for the number of retrenchments to be large.

Ms Ling of OCBC said that there are already signs of the labour market weakening rapidly.

“What will happen after your Jobs Support Scheme runs out?” Ms Ling questioned, referring to a scheme by the Government to subsidise 75 per cent of all Singaporeans’ wages during the two months of the circuit breaker.

“Maybe businesses are just postponing the day of reckoning by two months. If you don’t get a demand recovery in June and beyond, businesses may have to make tough decisions,” she added.

SLOW RECOVERY

Earlier hopes that there may be a pickup in economic activity in the second half of this year has all but disappeared, economists said.

That is because the authorities have made it clear that any unwinding of the circuit breaker measures would be gradual and cautious.

So they project recovery to be in the form of a U-shape, with a very long trough.

Previously expecting negative growth to hit Singapore for the four quarters of 2020, Mr Seah of DBS said that he now expects the contraction to continue in the first quarter of next year.

Looking at other countries’ lockdowns as case studies, Ms Ling said that many have chosen to extend their lockdown, and those which opted to ease measures, such as New Zealand and Germany, are saying that they are going to lift it gradually.

“Even if countries lift their lockdowns, it doesn’t mean safe distancing measures go away, it doesn’t mean containment measures are lifted overnight,” she added.