TODAY Youth Survey: Cost of living main source of mental health struggles, amid worries over healthcare and everyday expenses

SINGAPORE — While life is gradually resuming some sense of normalcy in the midst of the Covid-19 pandemic, a survey commissioned by TODAY has found that some young people are still struggling with mental health issues, with over a third of those polled admitting to being mentally fragile in the last three months.

- About a third of respondents polled in the TODAY Youth Survey 2022 said they were mentally unwell or only slightly well

- The cost of living in Singapore was the main source of concern for those who admitted to struggling mentally

- The survey also found that less than half felt that the Government was doing enough to help them through this period of rising inflation

- More than seven in 10 ranked dealing with inflation and economic growth as the top priority for the Government to tackle in the next three years

- Psychologists said young people may be struggling mentally with rising inflation because it affects their sense of autonomy

SINGAPORE — While life is gradually resuming some sense of normalcy in the midst of the Covid-19 pandemic, a survey commissioned by TODAY has found that some young people are still struggling with mental health issues, with over a third of those polled admitting to being mentally fragile in the last three months.

Even though Covid-related anxiety was no longer weighing them down, the cost of living in Singapore had become the main source of concern for those who admitted to struggling mentally.

These were among the findings from the TODAY Youth Survey 2022, an annual survey that seeks to give a voice to millennials and Gen Zers on societal issues and everyday topics close to their hearts.

This is the second edition of the survey. Last year's inaugural survey covered the topics of racism, religion, LGBTQ (lesbian, gay, bisexual, transgender and queer) attitudes, gender dynamics, the impact of Covid-19 on mental well-being and social ties, and career and material success.

This year's survey looked at mental health, inflation and cost of living, climate change and sustainability, as well as work-life balance, politics and attitudes on LGBTQ issues.

The demographically representative survey, which polled 1,000 respondents aged between 18 and 35, was carried out between Sept 5 and 16.

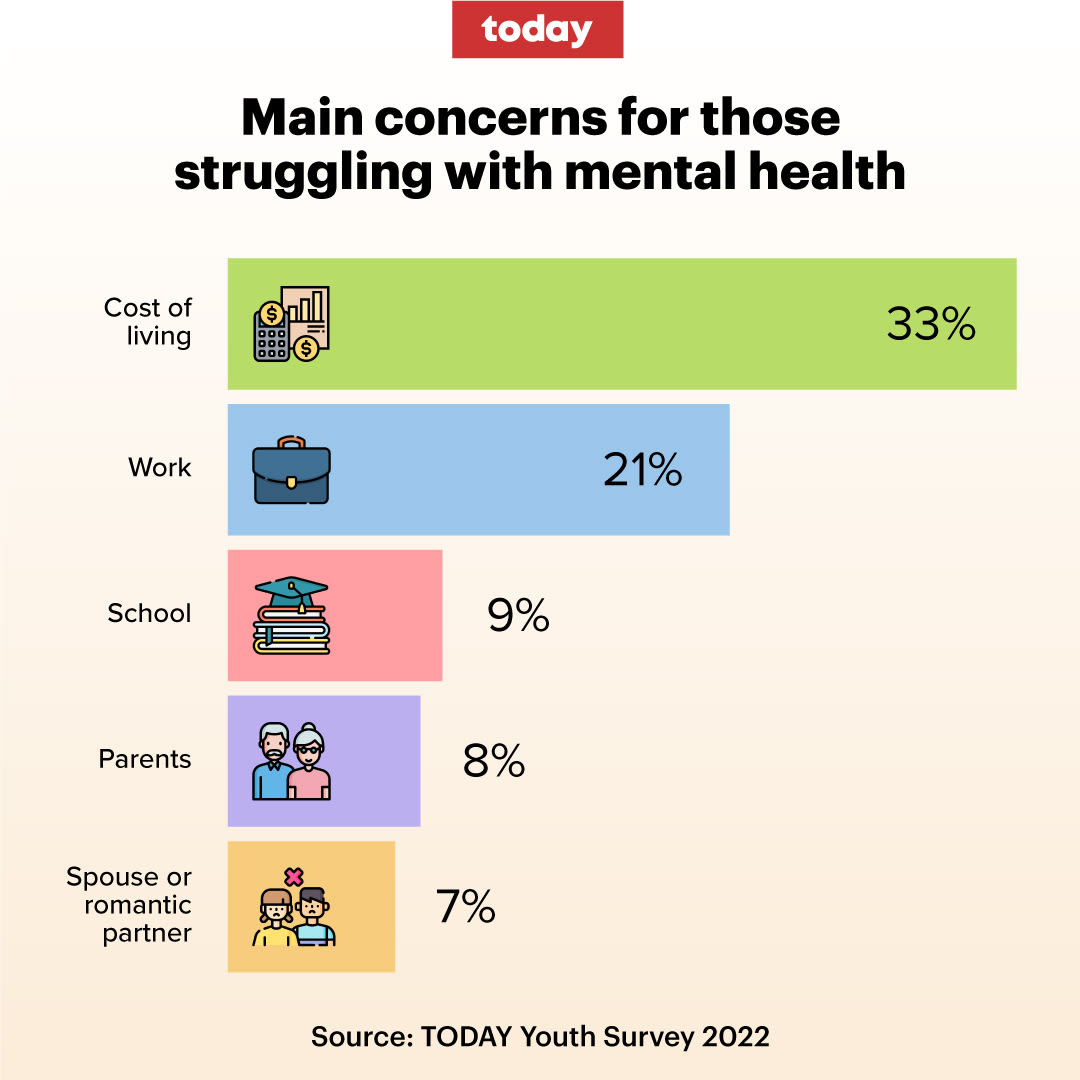

When asked, the respondents said that their top five main sources of mental health struggle were:

- Cost of living (52 per cent)

- Work (49 per cent)

- Parents (27 per cent)

- Spouse or romantic partner (20 per cent)

- School (18 per cent)

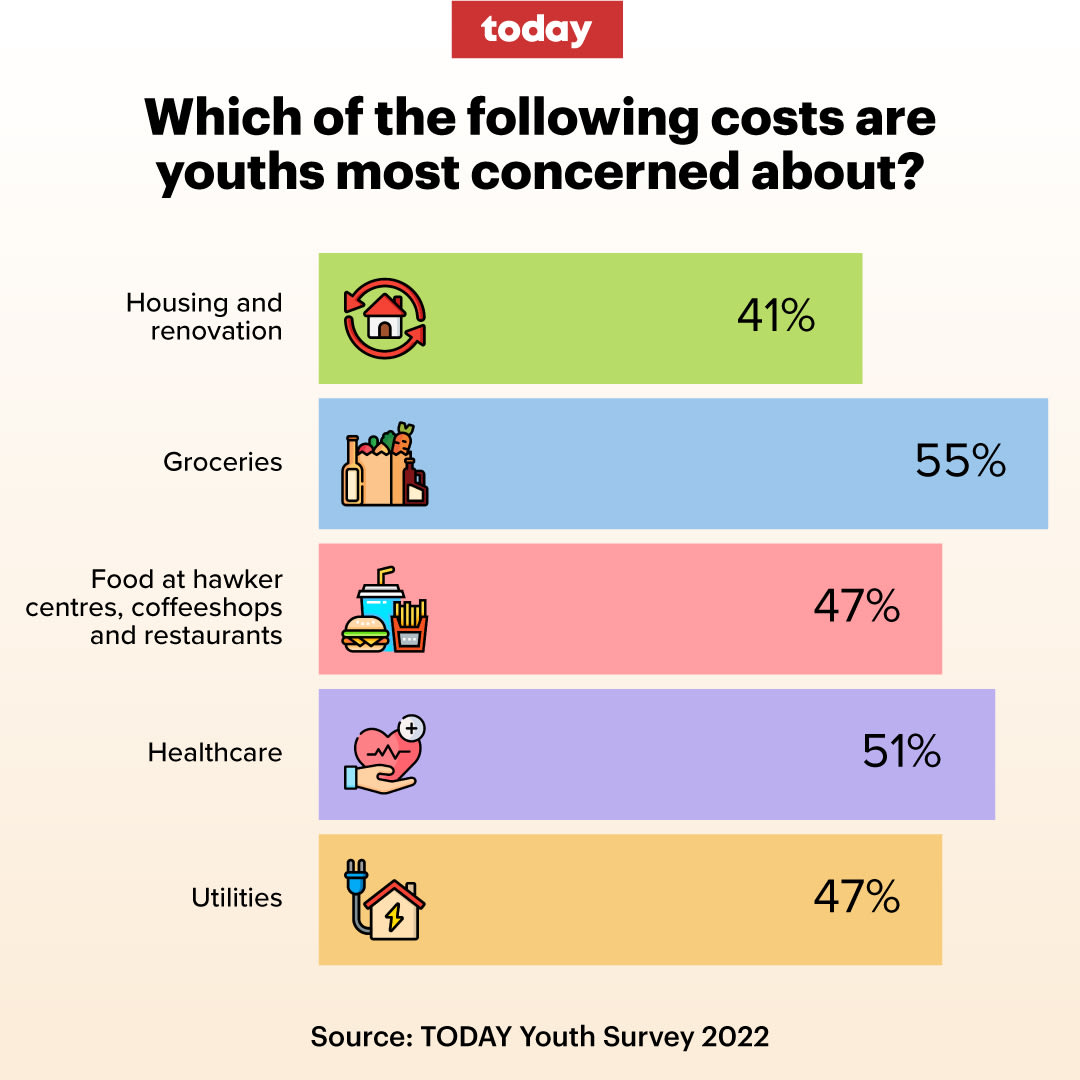

And when it came to the cost of living, the top five expenses the youth said they were most concerned about were related to:

- Groceries (55 per cent)

- Healthcare (51 per cent)

- Food at hawker centres, coffee shops and restaurants (47 per cent)

- Utilities (47 per cent)

- Housing and renovation (41 per cent)

Singapore's core inflation rose to 5.3 per cent in September, driven mainly by larger increases in the prices of food, services and retail and other goods, official data showed on Oct 25.

This was higher than the 5.1 per cent in August as the inflation figure inched towards a 14-year high.

The last time Singapore reported higher year-on-year core inflation growth was in November 2008, when it came in at 5.5 per cent.

In recent years, the Government has rolled out many big-money initiatives to help Singaporeans cope with persistent inflation. The latest of these was a S$1.5 billion package announced last month, such that about 2.5 million adults will receive up to S$500 in cash, among other measures.

Despite the Government's efforts, the survey found that less than half (47 per cent) of the respondents felt that it was doing enough to help them through this period of rising inflation.

Of the remainder, close to a quarter responded in the negative, while 29 per cent were indifferent.

Overall, more than seven in 10 young people (75 per cent) ranked dealing with inflation and economic growth as the top priority for the Government to tackle in the next three years.

This was followed by:

- Income inequality (55 per cent)

- Protecting jobs for residents (53 per cent)

- Climate change (48 per cent)

- Helping the less fortunate (38 per cent)

- Social cohesion (30 per cent)

The survey also found that 35 per cent of the respondents said that they were mentally unwell or only slightly well.

The general anxiety among the youth was in contrast to a finding of last year’s survey, which showed close to three in five young people were optimistic that life would be better this year.

Some of the youth interviewed, such as Mr Farhan Iqbal, a 24-year-old inventory technician, said that it was not just the cost of items at the supermarket that have gone up but the price of their favourite food as well.

“Every day, my dad tells me, ‘I dont know how to survive’ and I’m, like, I don't know either,” he said.

Ms Victoria Tymosiewicz, 22, said that although she is feeling happy generally, one of her stress points right now is related to the cost of living.

The gym trainer, who is Singaporean, said that her overall expenses have gone up and she is feeling the impact more intensely because she also has to take care of household expenditures for her family.

“This kind of stress, there is not much you can do about it… but cope by staying open-minded to change and learning to adjust."

LOSS OF AUTONOMY

Commenting on the survey findings, psychologists told TODAY that young people may be struggling mentally with rising inflation because it affects their sense of autonomy when it comes to living their lives.

Dr Praveen Nair, a psychologist and senior consultant at Raven Counselling and Consultancy, said that because inflation can reduce one’s spending power, it leads the youth to feel that they “cannot do what they want to do” in social, work or even educational settings.

And such a state “can spill into feelings of low self-worth and self-efficacy as well; all of which can adversely affect mental health”, Dr Nair said.

Then, there is also the impact on the romantic sphere to consider.

“A reduction in spending or purchasing power can drastically affect a young person’s capacity to engage in courtship rituals as per their idealisations,” he added.

Dr Joel Yang, a clinical psychologist at Mind What Matters, said that some young people also feel "trapped" because they work hard, yet they feel that their purchasing power is restricted and they are unable to express themselves more in terms of personality or lifestyle.

Based on the young adults whom his clinic counsels, Dr Yang said he was of the view that more from this generation have the desire to have their own personal space and are more willing to either lease or buy their own homes sooner, compared to the youth in the past.

“Young adults also feel more empowered to make bigger financial decisions earlier and are more compelled to have more freedom, which extends to financial freedom as well.”

Dr Nair also said that inflation could potentially lead to more family conflicts — another factor associated with poor mental health.

“There is a good possibility that a youth residing in a home may not be the breadwinner,” he said.

“The breadwinner may be facing the brunt of inflation and focusing their resources on addressing basic necessities. This may result in lower allowances or a reduced ability to provide a youth with something they may desire, particularly if the youth does not understand larger economic issues.”

Dr Geraldine Tan, director and principal psychologist of The Therapy Room, said that this generation of young people might also be feeling anxious because they are now out of their comfort zone, having grown up in a prosperous Singapore where much of their needs were met and they were used to a “cushy kind of lifestyle”.

“But when inflation hit, they are now looking at bread-and-butter issues… and they are focused on surviving.”

As to why the young might feel that the Government is not doing enough to fight inflation, Dr Tan said that this may be due to the human tendency to look for someone to blame.

“In any sort of crisis, the human brain tends to look for something to latch on to, and usually, it is to blame someone,” she added. “When situations go wrong, nobody will say, ‘Oh, everybody plays a part'.”

BE IN CONTROL OF YOUR RESPONSES

The TODAY Youth Survey respondents said that they were looking at various ways to cope with inflation.

The top actions taken by the youth were to:

- Cut back on unnecessary expenses (54 per cent)

- Buy cheaper versions of necessary items (47 per cent)

- Look for a side income (46 per cent)

- Cut back on leisure activities such as hobbies and travel (38 per cent)

- Look for a better-paying job (36 per cent)

In advising the youth on what they ought to do to rein in their anxiety — beyond speaking to a mental health professional — the psychologists said that it would be helpful to take a step back and relook one’s budget.

Dr Tan said that the alarming news headlines about the economy and inflation may raise anxiety among the young and cause them to think that they have to change their lifestyles, but if they drew up their budget and expenses, they may find that they are doing all right and do not really need to make any changes.

Dr Yang said that it is also important for the young to recognise that there are ways to express themselves that do not have to cost a lot of money.

Ultimately, Dr Nair said: “One can never be fully in control of one’s circumstances, but one can be in control of one’s responses.”

Look out for more reports on the TODAY Youth Survey 2022 on Nov 4. We will also be holding hybrid webinars on Nov 14 and 15 to discuss the survey findings. More details here.